Citibank 2011 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2011 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.86

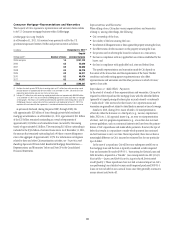

Consumer Loan Modification Programs

Citi has instituted a variety of loan modification programs to assist its borrowers

with financial difficulties. Under these programs, the largest of which are

predominately long-term modification programs targeted at residential first

mortgage borrowers, the original loan terms are modified. Substantially all

of these programs incorporate some form of interest rate reduction; other

concessions may include reductions or waivers of accrued interest or fees, loan

tenor extensions and/or the deferral or forgiveness of principal.

Loans modified under long-term modification programs (as well as

short-term modifications originated since January 1, 2011) that provide

concessions to borrowers in financial difficulty are reported as troubled debt

restructurings (TDRs). Accordingly, loans modified under the programs

described below, including modifications under short-term programs since

January 1, 2011, are TDRs. These TDRs are concentrated in the U.S. See

Note 16 to the Consolidated Financial Statements for a discussion of TDRs

and Note 1 to the Consolidated Financial Statements for a discussion of the

allowance for loan losses for these loans.

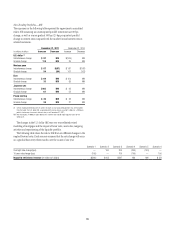

A summary of Citi’s more significant U.S. modification programs follows:

Residential First Mortgages

HAMP. The HAMP is a long-term modification program designed to reduce

monthly residential first mortgage payments to a 31% housing debt ratio

(monthly mortgage payment, including property taxes, insurance and

homeowner dues, divided by monthly gross income) by lowering the interest

rate, extending the term of the loan and deferring or forgiving (either on an

absolute or contingent basis) principal of certain eligible borrowers who have

defaulted on their mortgages or who are at risk of imminent default due to

economic hardship. The interest rate reduction for residential first mortgages

under HAMP is in effect for five years and the rate then increases up to 1% per

year until the interest rate cap (the lower of the original rate or the Freddie

Mac Weekly Primary Mortgage Market Survey rate for a 30-year fixed rate

conforming loan as of the date of the modification) is reached. In order to be

entitled to a HAMP loan modification, borrowers must provide the required

documentation and complete a trial period (generally three months) by

making the agreed payments.

Historically, Citi accounted for modifications under HAMP as TDRs when the

borrower successfully completed the trial period and the loan was permanently

modified. Effective in the fourth quarter of 2011, trial modifications are

reported as TDRs at the beginning of the trial period. Accordingly, all loans in

HAMP trials as of the end of 2011 are reported as TDRs.

Citi Supplemental. The Citi Supplemental (CSM) program is a

long-term modification program designed to assist residential first mortgage

borrowers ineligible for HAMP or who become ineligible through the HAMP

trial period process. If the borrower already has less than a 31% housing debt

ratio, the modification offered is an interest rate reduction (up to 2.5% with a

floor rate of 4%), which is in effect for two years, and the rate then increases

up to 1% per year until the interest rate is at the pre-modified contractual

rate. If the borrower’s housing debt ratio is greater than 31%, steps similar to

those under HAMP, including potential interest rate reductions, will be taken

to achieve a 31% housing debt ratio. The modified interest rate is in effect

for two years, and then increases up to 1% per year until the interest rate is

at the pre-modified contractual rate. Three trial payments are required prior

to modification, which can be made during the trial period. As in the case

of HAMP as discussed above, all loans in CSM trials as of the end of 2011 are

reported as TDRs.

FHA/VA. Loans guaranteed by the FHA or VA are modified through the

modification process required by those respective agencies and are long-term

modification programs. Borrowers must be delinquent, and concessions

include interest rate reductions, principal forgiveness, extending maturity

dates, and forgiving accrued interest and late fees. The interest rate reduction

is in effect for the remaining loan term. Losses on FHA loans are borne by

the sponsoring agency, provided that the insurance terms have not been

rescinded as a result of an origination defect. The VA establishes a loan-level

loss cap, beyond which Citi is liable for loss. Historically, Citi’s losses on FHA

and VA loans have been negligible.

Responsible Lending. Citi’s Responsible Lending program is a

long-term modification program designed to assist current residential first

mortgage borrowers unable to refinance their loan due to negative equity in

their home and/or other borrower characteristics. These loans are not eligible

for modification under HAMP or CSM. This program is designed to provide

payment relief based on a floor interest rate by product type. All adjustable

rate and interest only loans are converted to fixed rate, amortizing loans for

the remaining mortgage term.

CFNA Permanent Mortgage Adjustment of Terms. This

long-term modification program is targeted to CitiFinancial’s (part of

Citi Holdings – LCL) consumer finance residential mortgage borrowers

with a permanent hardship. Payment reduction is provided through

the re-amortization of the remaining loan balance, typically at a lower

interest rate. Modified loan tenors may not exceed a period of 480 months.

Generally, the rescheduled payment cannot be less than 50% of the original

payment amount unless the adjustment of terms is a result of participation

in the CitiFinancial Home Affordability Modification Program (CHAMP)

(terminated August 2010), or as a result of settlement, court order, judgment

or bankruptcy. Borrowers must make a qualifying payment at the reduced

payment amount in order to qualify for the modification. In addition,

borrowers must provide income and employment verification, and monthly

obligations are validated through an updated credit report.