Citibank 2011 Annual Report Download - page 160

Download and view the complete annual report

Please find page 160 of the 2011 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.138

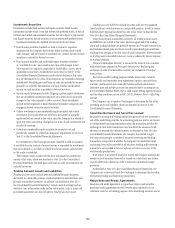

Investment Securities

Investments include fixed income and equity securities. Fixed income

instruments include bonds, notes and redeemable preferred stocks, as well as

certain loan-backed and structured securities that are subject to prepayment

risk. Equity securities include common and nonredeemable preferred stock.

Investment securities are classified and accounted for as follows:

Fixed income securities classified as “held-to-maturity” represent

securities that the Company has both the ability and the intent to hold

until maturity, and are carried at amortized cost. Interest income on such

securities is included in Interest revenue.

Fixed income securities and marketable equity securities classified

as “available-for-sale” are carried at fair value with changes in fair

value reported in a separate component of Stockholders’ equity, net of

applicable income taxes. As described in more detail in Note 15 to the

Consolidated Financial Statements, credit-related declines in fair value

that are determined to be other–than-temporary are recorded in earnings

immediately. Realized gains and losses on sales are included in income

primarily on a specific identification cost basis. Interest and dividend

income on such securities is included in Interest revenue.

Venture capital investments held by Citigroup’s private equity subsidiaries

that are considered investment companies are carried at fair value with

changes in fair value reported in Other revenue. These subsidiaries

include entities registered as Small Business Investment Companies and

engage exclusively in venture capital activities.

Certain investments in non-marketable equity securities and certain

investments that would otherwise have been accounted for using the

equity method are carried at fair value, since the Company has elected to

apply fair value accounting. Changes in fair value of such investments are

recorded in earnings.

Certain non-marketable equity securities are carried at cost and

periodically assessed for other-than-temporary impairment, as set out in

Note 15 to the Consolidated Financial Statements.

For investments in fixed income securities classified as held-to-maturity

or available-for-sale, accrual of interest income is suspended for investments

that are in default or on which it is likely that future interest payments will

not be made as scheduled.

The Company uses a number of valuation techniques for investments

carried at fair value, which are described in Note 25 to the Consolidated

Financial Statements. Realized gains and losses on sales of investments are

included in income.

Trading Account Assets and Liabilities

Trading account assets include debt and marketable equity securities,

derivatives in a receivable position, residual interests in securitizations and

physical commodities inventory. In addition (as described in Note 26 to

the Consolidated Financial Statements), certain assets that Citigroup has

elected to carry at fair value under the fair value option, such as loans and

purchased guarantees, are also included in Trading account assets.

Trading account liabilities include securities sold, not yet purchased

(short positions), and derivatives in a net payable position, as well as certain

liabilities that Citigroup has elected to carry at fair value (as described in

Note 26 to the Consolidated Financial Statements).

Other than physical commodities inventory, all trading account assets

and liabilities are carried at fair value. Revenues generated from trading

assets and trading liabilities are generally reported in Principal transactions

and include realized gains and losses as well as unrealized gains and losses

resulting from changes in the fair value of such instruments. Interest income

on trading assets is recorded in Interest revenue reduced by interest expense

on trading liabilities.

Physical commodities inventory is carried at the lower of cost or market

with related losses reported in Principal transactions. Realized gains

and losses on sales of commodities inventory are included in Principal

transactions.

Derivatives used for trading purposes include interest rate, currency,

equity, credit, and commodity swap agreements, options, caps and floors,

warrants, and financial and commodity futures and forward contracts.

Derivative asset and liability positions are presented net by counterparty on

the Consolidated Balance Sheet when a valid master netting agreement exists

and the other conditions set out in ASC 210-20, Balance Sheet—Offsetting

are met.

The Company uses a number of techniques to determine the fair value

of trading assets and liabilities, which are described in Note 25 to the

Consolidated Financial Statements.

Securities Borrowed and Securities Loaned

Securities borrowing and lending transactions generally do not constitute a

sale of the underlying securities for accounting purposes, and so are treated

as collateralized financing transactions when the transaction involves the

exchange of cash. Such transactions are recorded at the amount of cash

advanced or received plus accrued interest. As described in Note 26 to the

Consolidated Financial Statements, the Company has elected to apply

fair value accounting to a number of securities borrowing and lending

transactions. Irrespective of whether the Company has elected fair value

accounting, fees paid or received for all securities lending and borrowing

transactions are recorded in Interest expense or Interest revenue at the

contractually specified rate.

With respect to securities borrowed or loaned, the Company monitors the

market value of securities borrowed or loaned on a daily basis and obtains

or posts additional collateral in order to maintain contractual margin

protection.

As described in Note 25 to the Consolidated Financial Statements, the

Company uses a discounted cash flow technique to determine the fair value

of securities lending and borrowing transactions.

Repurchase and Resale Agreements

Securities sold under agreements to repurchase (repos) and securities

purchased under agreements to resell (reverse repos) generally do not

constitute a sale for accounting purposes of the underlying securities and so