Citibank 2011 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2011 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.119

Where Citi has determined that certain investment vehicles are subject to

the consolidation requirements of SFAS 167, the consolidation conclusions

reached upon initial application of SFAS 167 are consistent with the

consolidation conclusions reached under the requirements of ASC 810-10,

prior to the implementation of SFAS 167.

For additional information, see Notes 1 and 22 to the Consolidated

Financial Statements.

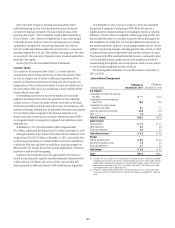

Goodwill

Citigroup has recorded Goodwill of $25.4 billion (1.4% of assets) and $26.2

billion (1.4% of assets) on its Consolidated Balance Sheet at December 31,

2011 and December 31, 2010, respectively. No goodwill impairment was

recorded during 2009, 2010 and 2011.

Goodwill is allocated to Citi’s reporting units at the date the goodwill is

initially recorded. Once goodwill has been allocated to the reporting units,

it generally no longer retains its identification with a particular acquisition,

but instead becomes identified with the reporting unit as a whole. As a result,

the full fair value of each reporting unit is available to support the value of

goodwill allocated to the unit. As of December 31, 2011, Citigroup operated

in three core business segments, as discussed above. Goodwill impairment

testing is performed at the reporting unit level, one level below the business

segment.

The reporting unit structure in 2011 was consistent with the reporting

units identified in the second quarter of 2009 as a result of the change in

Citi’s organizational structure. During 2011, goodwill was allocated to

disposals and tested for impairment under these reporting units. The nine

reporting units were North America Regional Consumer Banking, EMEA

Regional Consumer Banking, Asia Regional Consumer Banking,

Latin America Regional Consumer Banking, Securities and Banking,

Transaction Services, Brokerage and Asset Management, Local

Consumer Lending—Cards and Local Consumer Lending—Other.

Under ASC 350, Intangibles—Goodwill and Other, the goodwill

impairment analysis is done in two steps. The first step requires a comparison

of the fair value of the individual reporting unit to its carrying value,

including goodwill. If the fair value of the reporting unit is in excess of the

carrying value, the related goodwill is considered not to be impaired and

no further analysis is necessary. If the carrying value of the reporting unit

exceeds the fair value, there is an indication of potential impairment and a

second step of testing is performed to measure the amount of impairment, if

any, for that reporting unit.

When required, the second step of testing involves calculating the implied

fair value of goodwill for each of the affected reporting units. The implied

fair value of goodwill is determined in the same manner as the amount of

goodwill recognized in a business combination, which is the excess of the

fair value of the reporting unit determined in step one over the fair value

of the net assets and identifiable intangibles as if the reporting unit were

being acquired. If the amount of the goodwill allocated to the reporting unit

exceeds the implied fair value of the goodwill in the pro forma purchase price

allocation, an impairment charge is recorded for the excess. A recognized

impairment charge cannot exceed the amount of goodwill allocated to a

reporting unit and cannot subsequently be reversed even if the fair value of

the reporting unit recovers.

Goodwill impairment testing involves management judgment, requiring

an assessment of whether the carrying value of the reporting unit can be

supported by the fair value of the individual reporting unit using widely

accepted valuation techniques, such as the market approach (earnings

multiples and/or transaction multiples) and/or the income approach

(discounted cash flow (DCF) method). In applying these methodologies, Citi

utilizes a number of factors, including actual operating results, future

business plans, economic projections, and market data. Management may

engage an independent valuation specialist to assist in Citi’s valuation

process.

Citigroup engaged the services of an independent valuation specialist in

2010 and 2011 to assist in Citi’s valuation for most of the reporting units

employing both the market approach and DCF method. Citi believes that

the DCF method, using management projections for the selected reporting

units and an appropriate risk-adjusted discount rate, is most reflective of a

market participant’s view of fair values given current market conditions. For

the reporting units where both methods were utilized in 2010 and 2011, the

resulting fair values were relatively consistent and appropriate weighting was

given to outputs from both methods.

The DCF method used at the time of each impairment test used discount

rates that Citi believes adequately reflected the risk and uncertainty in the

financial markets generally and specifically in the internally generated cash

flow projections. The DCF method employs a capital asset pricing model in

estimating the discount rate. Citi continues to value the remaining reporting

units where it believes the risk of impairment to be low, using primarily the

market approach.

Citi prepares a formal three-year strategic plan for its businesses on an

annual basis. These projections incorporate certain external economic

projections developed at the point in time the strategic plan is developed. For

the purpose of performing any impairment test, the three-year forecast is

updated by Citi to reflect current economic conditions as of the testing date.

Citi used updated long-range financial forecasts as a basis for its annual

goodwill impairment test performed as of July 1, 2011.

The results of the July 1, 2011 test validated that the fair values exceeded

the carrying values for the reporting units that had goodwill at the testing

date. Citi is also required to test goodwill for impairment whenever events

or circumstances make it more likely than not that impairment may have

occurred, such as a significant adverse change in the business climate, a

decision to sell or dispose of all or a significant portion of a reporting unit,

or a significant decline in Citi’s stock price. No interim goodwill impairment

tests were performed during 2011.