Citibank 2011 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2011 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.91

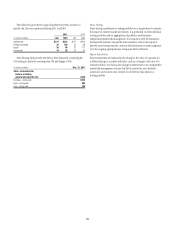

Securities and Banking-Sponsored Legacy Private-Label

Residential Mortgage Securitizations—Representations and

Warranties

Overview

Citi is also exposed to representation and warranty claims through residential

mortgage securitizations that had been sponsored by Citi’s S&B business.

However, S&B-sponsored legacy securitizations have represented a much

smaller portion of Citi’s business than Citi’s Consumer residential mortgage

business discussed above.

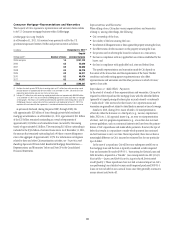

As previously disclosed, during the period 2005 through 2008, S&B had

sponsored approximately $66.5 billion in legacy private-label mortgage-

backed securitization transactions that were backed by loan collateral

composed of approximately $15.5 billion prime, $12.4 billion Alt-A and

$38.6 billion subprime residential mortgage loans. As of December 31,

2011, approximately $23.4 billion of this amount remains outstanding

as a result of repayments of approximately $34.5 billion and cumulative

losses (incurred by the issuing trusts) of approximately $8.7 billion (of

which approximately $6.6 billion related to subprime loans). Of the amount

remaining outstanding, approximately $6.1 billion is backed by prime

residential mortgage collateral at origination, approximately $4.9 billion by

Alt-A and approximately $12.3 billion by subprime. As of December 31, 2011,

the $23.4 billion remaining outstanding had a 90 days or more delinquency

rate of approximately 27.2%.

The mortgages included in these securitizations were purchased from

parties outside of Citi; fewer than 2% of the mortgages underlying the

transactions outstanding as of December 31, 2011 were originated by Citi.

In addition, fewer than 10% of the mortgages are serviced by Citi. (The

mortgages serviced by Citi are included in the $396 billion of residential

mortgage loans referenced under “Consumer Mortgage—Representations

and Warranties” above.)

Representation and Warranties

In connection with these securitization transactions, representations and

warranties (representations) relating to the mortgages included in each trust

issuing the securities were made either by Citi, by third-party sellers (Selling

Entities, which were also often the originators of the loans), or both. These

representations were generally made or assigned to the issuing trust and

related to, among other things, the following:

the absence of fraud on the part of the borrower, the seller or any

appraiser, broker or other party involved in the origination of the

mortgage (which was sometimes wholly or partially limited to the

knowledge of the representation provider);

whether the mortgage property was occupied by the borrower as his or her

principal residence;

the mortgage’s compliance with applicable federal, state and local laws;

whether the mortgage was originated in conformity with the originator’s

underwriting guidelines; and

detailed data concerning the mortgages that were included on the

mortgage loan schedule.

The specific representations relating to the mortgages in each

securitization varied, however, depending on various factors such as the

Selling Entity, rating agency requirements and whether the mortgages were

considered prime, Alt-A or subprime in credit quality.

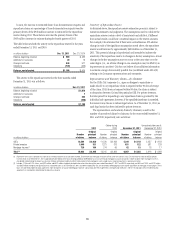

In the event of a breach of its representations, Citi may be required either

to repurchase the mortgage with the identified defects (generally at unpaid

principal balance plus accrued interest) or indemnify the investors for their

losses through make-whole payments. For securitizations in which Citi

made representations, Citi generally also received from the Selling Entities

similar representations, with the exception of certain limited representations

required by, among others, the rating agencies. In cases where Citi made

representations and also received the same representations from the Selling

Entity for a particular loan, if Citi receives a claim based on breach of

those representations in respect of the loan, it may have a contractual right

to pursue a similar (back-to-back) claim against the Selling Entity (see

discussion below). If only the Selling Entity made representations with

respect to a particular loan, then only the Selling Entity should be responsible

for a claim based on breach of the representations.

For the majority of the securitizations where Citi made representations

and received similar representations from Selling Entities, Citi currently

believes that with respect to the securitizations backed by prime and Alt-A

collateral, if it received a repurchase claim for those loans, it would have

back-to-back claims against the Selling Entities that the Selling Entities

would likely be in a position to honor. However, for the significant majority

of the subprime collateral where Citi has back-to-back claims against

Selling Entities, Citi believes that those Selling Entities would be unlikely to

honor back-to-back claims because they are in bankruptcy, liquidation, or

financial distress. In those situations, in the event that claims for breaches

of representations were made against Citi, the Selling Entities’ financial

condition might preclude Citi from obtaining back-to-back recoveries

from them.

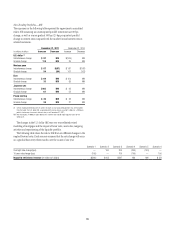

To date, Citi has received actual claims for breaches of representations

relating to only a small percentage of the mortgages included in these

securitization transactions, although the pace of claims remains volatile and

has recently increased. Citi has also experienced an increase in the level of

inquiries, assertions and requests for loan files, among other matters, relating

to the above securitization transactions from trustees of securitization trusts

and others. Trustee activities have been prompted in part by lawsuits and

other actions by investors. Given the continued increased focus on mortgage-

related matters, as well as the increasing level of litigation and regulatory

activity relating to mortgage loans and mortgage-backed securities, the

level of inquiries and assertions regarding these securitizations may further

increase. These inquiries and assertions could lead to actual claims for

breaches of representations, or to litigation relating to such breaches or other

matters. For information on litigation, claims and regulatory proceedings

regarding these and other S&B mortgage-related activities, see Note 29 to the

Consolidated Financial Statements.