Citibank 2011 Annual Report Download - page 181

Download and view the complete annual report

Please find page 181 of the 2011 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.159

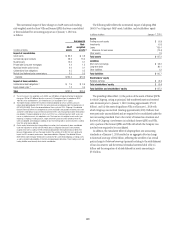

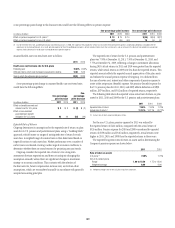

Stock Award Programs

Citigroup issues (and/or has issued) shares of its common stock in the

form of restricted stock awards, deferred stock awards, and stock payments

pursuant to the 2009 Stock Incentive Plan (and predecessor plans) to its

officers, employees and non-employee directors.

For all stock award programs, during the applicable vesting period, the

shares awarded are not issued to participants (in the case of a deferred stock

award) or cannot be sold or transferred by the participants (in the case

of a restricted stock award), until after the vesting conditions have been

satisfied. Recipients of deferred stock awards do not have any stockholder

rights until shares are delivered to them, but they generally are entitled to

receive dividend-equivalent payments during the vesting period. Recipients

of restricted stock awards are entitled to a limited voting right and to

receive dividend or dividend-equivalent payments during the vesting period.

(Dividend equivalents are paid through payroll and recorded as an offset

to retained earnings on those shares expected to vest.) Once a stock award

vests, the shares may become freely transferable, but in the case of certain

executives, may be subject to transfer restrictions by their terms or a stock

ownership commitment.

The total expense to be recognized for the stock awards described below

represents the fair value of Citigroup common stock at the date of grant.

The expense is recognized as a charge to income ratably over the vesting

period, except for those awards granted to retirement-eligible employees, and

salary stock and other immediately vested awards. For awards of deferred

stock expected to be made to retirement-eligible employees, the charge to

income is accelerated based on the dates the retirement rules are or will be

met. If the retirement rules will have been met on or prior to the expected

award date, the entire estimated expense is recognized in the year prior to

grant in the same manner as cash incentive compensation is accrued, rather

than amortized over the applicable vesting period of the award. Salary stock

and other immediately vested awards generally were granted in lieu of cash

compensation and are also recognized in the year prior to the grant in the

same manner as cash compensation is accrued. Certain stock awards with

performance conditions or certain clawback provisions may be subject to

variable accounting, pursuant to which the associated charges fluctuate with

changes in Citigroup’s stock price over the applicable vesting periods. The

total amount that will be recognized as expense cannot be determined in full

until the awards vest.

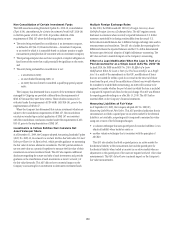

Annual Award Programs. Citigroup’s primary stock award program

is the Capital Accumulation Program (CAP). Generally, CAP awards of

restricted or deferred stock constitute a percentage of annual incentive

compensation and vest ratably over three- or four-year periods, beginning on

or about the first anniversary of the award date.

Continuous employment within Citigroup is generally required to

vest in CAP and other stock award programs. Typical exceptions include

vesting for participants whose employment is terminated involuntarily

during the vesting period for a reason other than “gross misconduct,” who

meet specified age and service requirements before leaving employment

(retirement-eligible participants), or who die or become disabled during the

vesting period. Post-employment vesting by retirement-eligible participants is

generally conditioned upon their refraining from competition with Citigroup

during the remaining vesting period.

In a change from prior years, incentive awards in January 2012 to

individual employees who have influence over the Company’s material risks

(covered employees) were delivered as a mix of immediate cash bonuses,

deferred stock awards under CAP and deferred cash awards. (Previously,

annual incentives were traditionally awarded as a combination of cash

bonus and CAP.) For covered employees, the minimum percentage of

incentive pay required to be deferred was raised from 25% to 40%, with a

maximum deferral of 60% for the most highly paid employees. For incentive

awards made to covered employees in January 2012 (in respect of 2011

performance), only 50% of the deferred portion was delivered as a CAP award;

the other 50% was delivered in the form of a deferred cash award. The 2012

deferred cash award is subject to a performance-based vesting condition

that results in cancellation of unvested amounts on a formulaic basis if a

participant’s business has losses in any year of the vesting period. The 2012

deferred cash award also earns notional interest at an annual rate of 3.55%,

compounded annually.

CAP awards made in January 2012 and January 2011 to “identified

staff” in the European Union (EU) have several features that differ from

the generally applicable CAP provisions described above. “Identified staff”

are those Citigroup employees whose compensation is subject to various

banking regulations on sound incentive compensation policies in the EU.

CAP awards to these employees are scheduled to vest over three years of

service, but vested shares are subject to a six-month sale restriction, and

awards are subject to cancellation, in the sole discretion of the Committee,

if (a) there is reasonable evidence a participant engaged in misconduct or

committed material error in connection with his or her employment, or (b)

the Company or the employee’s business unit suffers a material downturn

in its financial performance or a material failure of risk management (the

EU clawback). For these CAP awards, the EU clawback is in addition to the

clawback provision described below. CAP awards containing the EU clawback

provision are subject to variable accounting.