Citibank 2011 Annual Report Download - page 158

Download and view the complete annual report

Please find page 158 of the 2011 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

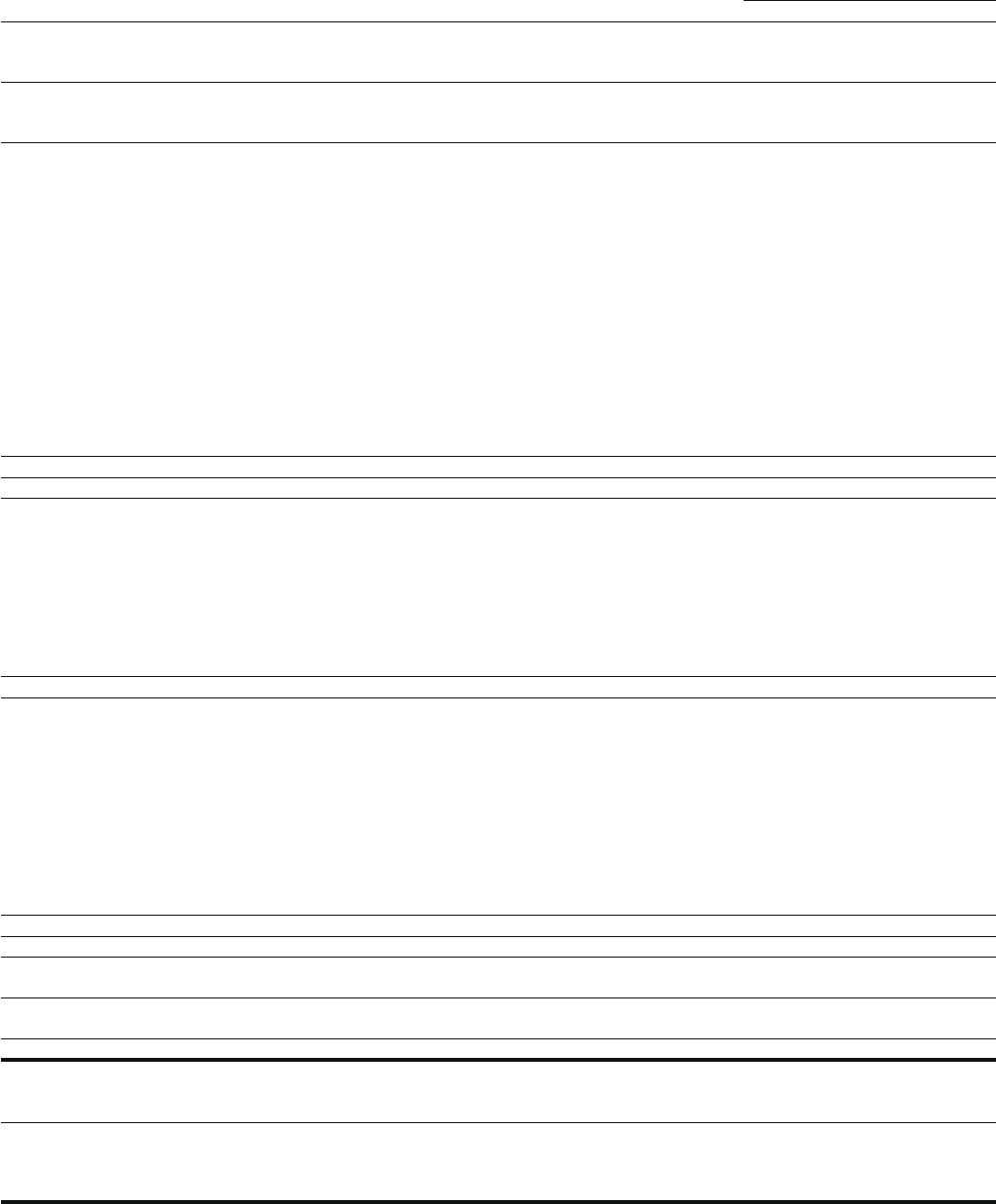

136

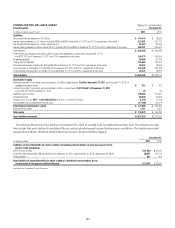

CONSOLIDATED STATEMENT OF CASH FLOWS Citigroup Inc. and Subsidiaries

Year ended December 31,

In millions of dollars 2011

Cash flows from operating activities of continuing operations

Net income (loss) before attribution of noncontrolling interests $ 11,215

Net income attributable to noncontrolling interests 148

Citigroup’s net income (loss) $ 11,067

Income (loss) from discontinued operations, net of taxes 17

Gain (loss) on sale, net of taxes 95

Income (loss) from continuing operations—excluding noncontrolling interests $ 10,955

Adjustments to reconcile net income (loss) to net cash provided by (used in) operating activities of

continuing operations

!MORTIZATIONæOFæDEFERREDæPOLICYæACQUISITIONæCOSTSæANDæPRESENTæVALUEæOFæFUTUREæPROFITS $ 250

!DDITIONSREDUCTIONSæTOæDEFERREDæPOLICYæACQUISITIONæCOSTS (54)

$EPRECIATIONæANDæAMORTIZATION 2,872

$EFERREDæTAXæBENEFIT (74)

0ROVISIONæFORæCREDITæLOSSES 11,824

#HANGEæINæTRADINGæACCOUNTæASSETS 25,538

#HANGEæINæTRADINGæACCOUNTæLIABILITIES (2,972)

#HANGEæINæFEDERALæFUNDSæSOLDæANDæSECURITIESæBORROWEDæORæPURCHASEDæUNDERæAGREEMENTSæTOæRESELL (29,132)

#HANGEæINæFEDERALæFUNDSæPURCHASEDæANDæSECURITIESæLOANEDæORæSOLDæUNDERæAGREEMENTSæTOæREPURCHASE 8,815

#HANGEæINæBROKERAGEæRECEIVABLESæNETæOFæBROKERAGEæPAYABLES 8,383

2EALIZEDæGAINSæFROMæSALESæOFæINVESTMENTS (1,997)

#HANGEæINæLOANSæHELDFORSALE 1,021

/THERæNET 9,312

Total adjustments $ 33,786

Net cash provided by (used in) operating activities of continuing operations $ 44,741

Cash flows from investing activities of continuing operations

#HANGEæINæDEPOSITSæWITHæBANKS $ 6,653

#HANGEæINæLOANS (11,559)

0ROCEEDSæFROMæSALESæANDæSECURITIZATIONSæOFæLOANS 10,022

0URCHASESæOFæINVESTMENTS (314,250)

0ROCEEDSæFROMæSALESæOFæINVESTMENTS 182,566

0ROCEEDSæFROMæMATURITIESæOFæINVESTMENTS 139,959

#APITALæEXPENDITURESæONæPREMISESæANDæEQUIPMENTæANDæCAPITALIZEDæSOFTWARE (3,448)

0ROCEEDSæFROMæSALESæOFæPREMISESæANDæEQUIPMENTæSUBSIDIARIESæANDæAFFILIATESæANDæREPOSSESSEDæASSETS 1,323

Net cash provided by (used in) investing activities of continuing operations $ 11,266

Cash flows from financing activities of continuing operations

$IVIDENDSæPAID $ (107)

)SSUANCEæOFæCOMMONæSTOCK —

)SSUANCESæOFæ4$%#S!0)# —

)SSUANCEæOFæ!$)!æ5PPERæ$ECSæEQUITYæUNITSæPURCHASEæCONTRACT 3,750

4REASURYæSTOCKæACQUIRED (1)

3TOCKæTENDEREDæFORæPAYMENTæOFæWITHHOLDINGæTAXES (230)

)SSUANCEæOFæLONGTERMæDEBT 30,242

0AYMENTSæANDæREDEMPTIONSæOFæLONGTERMæDEBT (89,091)

#HANGEæINæDEPOSITS 23,858

#HANGEæINæSHORTTERMæBORROWINGS (25,067)

Net cash (used in) provided by financing activities of continuing operations $ (56,646)

%FFECTæOFæEXCHANGEæRATEæCHANGESæONæCASHæANDæCASHæEQUIVALENTS $ (1,301)

Discontinued operations

Net cash provided by (used in) discontinued operations $ 2,669

Change in cash and due from banks $ 729

Cash and due from banks at beginning of period 27,972

Cash and due from banks at end of period $ 28,701

Supplemental disclosure of cash flow information for continuing operations

#ASHæPAIDRECEIVEDæDURINGæTHEæYEARæFORæINCOMEæTAXES $ 2,705

#ASHæPAIDæDURINGæTHEæYEARæFORæINTEREST $ 21,230

Non-cash investing activities

4RANSFERSæTOæ/2%/æANDæOTHERæREPOSSESSEDæASSETS $ 1,284

4RANSFERSæTOæTRADINGæACCOUNTæASSETSæFROMæINVESTMENTSæAVAILABLEFORSALEæ —

4RANSFERSæTOæTRADINGæACCOUNTæASSETSæFROMæINVESTMENTSæHELDTOMATURITY $ 12,700

3EEæ.OTESæTOæTHEæ#ONSOLIDATEDæ&INANCIALæ3TATEMENTS