Citibank 2011 Annual Report Download - page 187

Download and view the complete annual report

Please find page 187 of the 2011 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

165

9. RETIREMENT BENEFITS

Pension and Postretirement Plans

The Company has several non-contributory defined benefit pension plans

covering certain U.S. employees and has various defined benefit pension

and termination indemnity plans covering employees outside the United

States. The U.S. qualified defined benefit plan was frozen effective January 1,

2008, for most employees. Accordingly, no additional compensation-based

contributions were credited to the cash balance portion of the plan for

existing plan participants after 2007. However, certain employees covered

under the prior final pay plan formula continue to accrue benefits. The

Company also offers postretirement health care and life insurance benefits to

certain eligible U.S. retired employees, as well as to certain eligible employees

outside the United States.

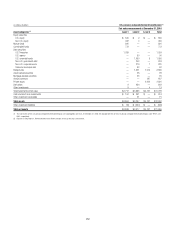

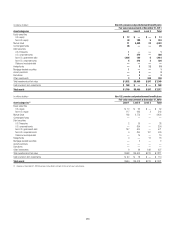

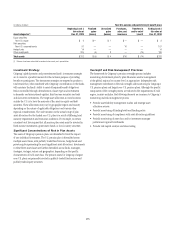

The following table summarizes the components of net (benefit) expense

recognized in the Consolidated Statement of Income for the Company’s U.S.

qualified and nonqualified pension plans, postretirement plans and plans

outside the United States. The Company uses a December 31 measurement

date for its U.S. and non-U.S. plans.

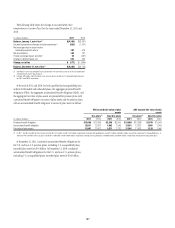

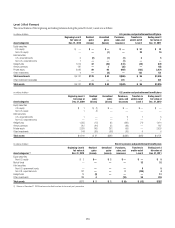

Contributions

Citigroup’s funding policy for U.S. and non-U.S. pension plans is generally to

fund to minimum funding requirements in accordance with applicable local

laws and regulations. The Company may increase its contributions above

the minimum required contribution, if appropriate. For the U.S. pension

plans, at December 31, 2011 and 2010, there were no minimum required

cash contributions. During 2010, a discretionary cash contribution of

$995 million was made to the plan. For the U.S. non-qualified pension plans,

the Company contributed $51 million in benefits paid directly during 2011,

$51 million during 2010 and $55 million during 2009. No contributions

are expected for the U.S. qualified pension plan for 2012 and $53 million of

direct payments are expected for the U.S. non-qualified plans for 2012.

For the non-U.S. pension plans, the Company reported $389 million in

employer contributions during 2011, which includes $47 million in benefits

paid directly by the Company. For the non-U.S. pension plans, discretionary

cash contributions for 2012 are anticipated to be approximately $211

million. In addition, the Company expects to contribute $43 million of

benefits to be paid directly by the Company for its non-U.S. pension plans.

For the U.S. postretirement benefit plans, there are no expected or required

contributions for 2012 other than $55 million of benefit payments expected

to be paid directly by the Company.

For the non-U.S. postretirement benefit plans, the Company reported $75

million in employer contributions during 2011, which includes $5 million

in benefits paid directly by the Company during the year. For the non-U.S.

postretirement benefit plans, expected cash contributions for 2012 are $83

million including $4 million of benefits to be paid directly by the Company.

These estimates are subject to change, since contribution decisions are

affected by various factors, such as market performance and regulatory

requirements. In addition, management has the ability to change funding policy.

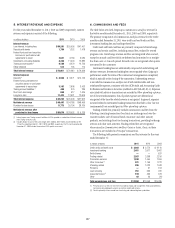

Net (Benefit) Expense

æPension plans Postretirement benefit plans

æU.S. plans Non-U.S. plans U.S. plans Non-U.S. plans

In millions of dollars 2011 2011 2011 2011

Qualified Plans

"ENEFITSæEARNEDæDURINGæTHEæYEAR $13 $ 203 $— $28

)NTERESTæCOSTæONæBENEFITæOBLIGATION 612 382 53 118

%XPECTEDæRETURNæONæPLANæASSETS (890) (422) (6) (117)

!MORTIZATIONæOFæUNRECOGNIZED

.ETæTRANSITIONæOBLIGATION — (1) — —

0RIORæSERVICEæCOSTæBENEFIT (1) 4(3) —

.ETæACTUARIALæLOSS 64 72 3 24

#URTAILMENTæGAINæLOSSæ — 4 — —

3ETTLEMENTæGAINæLOSS —10 — —

3PECIALæTERMINATIONæBENEFITSæ —27 — —

.ETæQUALIFIEDæBENEFITæEXPENSE $(202) $ 279 $47 $53

.ONQUALIFIEDæPLANSæEXPENSE $42 $— $— $—

Total net (benefit) expense $(160) $ 279 $47 $53

æ 4HEææCURTAILMENTæGAINæINæTHEæNON53æPENSIONæPLANSæINCLUDESæANææMILLIONæGAINæREFLECTINGæTHEæSALEæOFæ#ITIGROUPSæ.IKKOæOPERATIONSæ3EEæ.OTEææTOæTHEæ#ONSOLIDATEDæ&INANCIALæ3TATEMENTSæFORæFURTHERæDISCUSSIONæOFæ

THEæSALEæOFæ.IKKOæOPERATIONS