Citibank 2011 Annual Report Download - page 213

Download and view the complete annual report

Please find page 213 of the 2011 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

191

December 31, 2011 and February 23, 2012, foreign currency translation

and related hedges on this equity method investment totaled an additional

cumulative pretax loss of approximately $0.9 billion.

Regarding Citi’s equity method investment in MSSB, Citi has evaluated

this investment for OTTI based on the qualitative and quantitative

measures discussed herein (see also Note 25 to the Consolidated Financial

Statements). As of December 31, 2011, Citi’s carrying value of this equity

method investment was approximately $10 billion. Based on the midpoint

of the current range of estimated values, analysis indicates that a temporary

impairment may exist; however, based on this analysis, the potential

temporary impairment was not material.

For debt securities that are not deemed to be credit impaired, management

assesses whether it intends to sell or whether it is more-likely-than-not that

it would be required to sell the investment before the expected recovery of

the amortized cost basis. In most cases, management has asserted that it

has no intent to sell and that it believes it is not likely to be required to sell

the investment before recovery of its amortized cost basis. Where such an

assertion cannot be made, the security’s decline in fair value is deemed to be

other than temporary and is recorded in earnings.

For debt securities, a critical component of the evaluation for OTTI is

the identification of credit impaired securities, where management does not

expect to receive cash flows sufficient to recover the entire amortized cost

basis of the security. For securities purchased and classified as AFS with the

expectation of receiving full principal and interest cash flows as of the date of

purchase, this analysis considers the likelihood of receiving all contractual

principal and interest. For securities reclassified out of the trading category in

the fourth quarter of 2008, the analysis considers the likelihood of receiving

the expected principal and interest cash flows anticipated as of the date of

reclassification in the fourth quarter of 2008. The extent of the Company’s

analysis regarding credit quality and the stress on assumptions used in the

analysis have been refined for securities where the current fair value or other

characteristics of the security warrant. The paragraphs below describe the

Company’s process for identifying credit-related impairments in security types

with the most significant unrealized losses as of December 31, 2011.

Mortgage-backed securities

For U.S. mortgage-backed securities (and in particular for Alt-A and other

mortgage-backed securities that have significant unrealized losses as a

percentage of amortized cost), credit impairment is assessed using a cash

flow model that estimates the cash flows on the underlying mortgages, using

the security-specific collateral and transaction structure. The model estimates

cash flows from the underlying mortgage loans and distributes those cash

flows to various tranches of securities, considering the transaction structure

and any subordination and credit enhancements that exist in that structure.

The cash flow model incorporates actual cash flows on the mortgage-backed

securities through the current period and then projects the remaining cash

flows using a number of assumptions, including default rates, prepayment

rates and recovery rates (on foreclosed properties).

Management develops specific assumptions using as much market data

as possible and includes internal estimates as well as estimates published

by rating agencies and other third-party sources. Default rates are projected

by considering current underlying mortgage loan performance, generally

assuming the default of (1) 10% of current loans, (2) 25% of 30–59 day

delinquent loans, (3) 70% of 60–90 day delinquent loans and (4) 100%

of 91+ day delinquent loans. These estimates are extrapolated along a

default timing curve to estimate the total lifetime pool default rate. Other

assumptions used contemplate the actual collateral attributes, including

geographic concentrations, rating agency loss projections, rating actions and

current market prices.

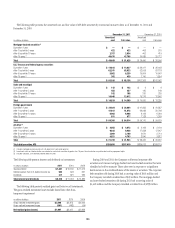

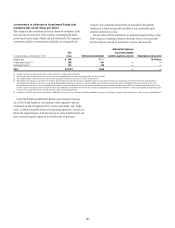

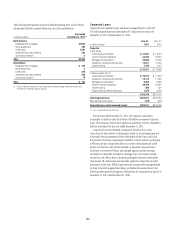

The key assumptions for mortgage-backed securities as of December 31,

2011 are in the table below:

December 31, 2011

0REPAYMENTæRATEæ 1%–8% CRR

,OSSæSEVERITYæ 45%–95%

æ #ONDITIONALæ2EPAYMENTæ2ATEæ#22æREPRESENTSæTHEæANNUALIZEDæEXPECTEDæRATEæOFæVOLUNTARYæPREPAYMENTæ

OFæPRINCIPALæFORæMORTGAGEBACKEDæSECURITIESæOVERæAæCERTAINæPERIODæOFæTIME

æ ,OSSæSEVERITYæRATESæAREæESTIMATEDæCONSIDERINGæCOLLATERALæCHARACTERISTICSæANDæGENERALLYæRANGEæFROMæ

næFORæPRIMEæBONDSænæFORæ!LT!æBONDSæANDænæFORæSUBPRIMEæBONDS

The valuation as of December 31, 2011 assumes that U.S. housing prices

will decrease 4% in 2012, decrease 1% in 2013, remain flat in 2014 and

increase 3% per year from 2015 onwards, while unemployment is 8.9%

for 2012.

In addition, cash flow projections are developed using more stressful

parameters. Management assesses the results of those stress tests (including

the severity of any cash shortfall indicated and the likelihood of the stress

scenarios actually occurring based on the underlying pool’s characteristics

and performance) to assess whether management expects to recover the

amortized cost basis of the security. If cash flow projections indicate that the

Company does not expect to recover its amortized cost basis, the Company

recognizes the estimated credit loss in earnings.

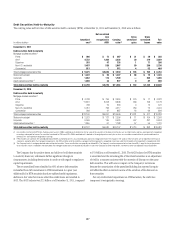

State and municipal securities

Citigroup’s AFS state and municipal bonds consist mainly of bonds that are

financed through Tender Option Bond programs or were previously financed

in this program. The process for identifying credit impairments for these

bonds is largely based on third-party credit ratings. Individual bond positions

are required to meet minimum ratings requirements, which vary based on

the sector of the bond issuer.

Citigroup monitors the bond issuer and insurer ratings on a daily basis.

The average portfolio rating, ignoring any insurance, is Aa3/AA-. In the event

of a downgrade of the bond below Aa3/AA-, the subject bond is specifically

reviewed for potential shortfall in contractual principal and interest. The

remainder of Citigroup’s AFS and HTM state and municipal bonds are

specifically reviewed for credit impairment based on instrument-specific

estimates of cash flows, probability of default and loss given default.

For impaired AFS state and municipal bonds that Citi plans to sell, or

would likely be required to sell and there is no expectation that the fair

value will recover prior to the expected sale date, the full impairment is

recognized in earnings.