Citibank 2011 Annual Report Download - page 202

Download and view the complete annual report

Please find page 202 of the 2011 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.180

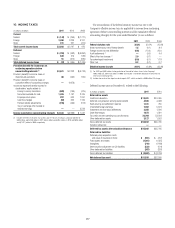

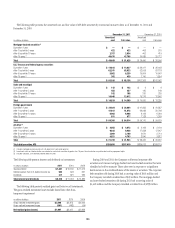

Although realization is not assured, the Company believes that the

realization of the recognized net DTA of $51.5 billion at December 31, 2011

is more likely than not based upon expectations as to future taxable income

in the jurisdictions in which the DTAs arise and available tax planning

strategies, as defined in ASC 740, Income Taxes (formerly SFAS 109), that

would be implemented, if necessary, to prevent a carryforward from expiring.

In general, Citi would need to generate approximately $111 billion of

taxable income during the respective carryforward periods to fully realize its

U.S. federal, state and local DTAs. Citi’s net DTAs will decline primarily as

additional domestic GAAP taxable income is generated.

As of December 31, 2011, Citi was no longer in a three-year cumulative

loss position for purposes of evaluating its DTAs. While this removes a

significant piece of negative evidence in evaluating the need for a valuation

allowance, Citi will continue to weigh the evidence supporting its DTAs. Citi

has concluded that there are two pieces of positive evidence which support the

full realizability of its DTAs. First, Citi forecasts sufficient taxable income in

the carryforward period, exclusive of tax planning strategies. Second, Citi has

sufficient tax planning strategies, including potential sales of assets, in which

it could realize the excess of appreciated value over the tax basis of its assets.

The amount of the DTAs considered realizable, however, is necessarily subject

to Citi’s estimates of future taxable income in the jurisdictions in which it

operates during the respective carryforward periods, which is in turn subject

to overall market and global economic conditions.

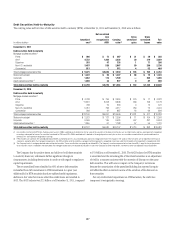

The U.S. federal consolidated tax return NOL carryforward component

of the DTAs of $3.8 billion at December 31, 2010 was utilized in 2011. Based

upon the foregoing discussion, as well as tax planning opportunities and

other factors discussed below, Citi believes the U.S. federal and New York state

and city NOL carryforward period of 20 years provides enough time to fully

utilize the DTAs pertaining to the existing NOL carryforwards and any NOL

that would be created by the reversal of the future net deductions that have

not yet been taken on a tax return.

Because the U.S. federal consolidated tax return NOL carryforward has

been utilized, Citi can begin to utilize its foreign tax credit (FTC) and general

business credit (GBC) carryforwards. The U.S. FTC carryforward period is

10 years. Utilization of foreign tax credits in any year is restricted to 35%

of foreign source taxable income in that year. However, overall domestic

losses that the Company has incurred of approximately $56 billion as of

December 31, 2011 are allowed to be reclassified as foreign source income to

the extent of 50% of domestic source income produced in subsequent years

and such resulting foreign source income would in fact be sufficient to cover

the foreign tax credits being carried forward. As such, Citi believes the foreign

source taxable income limitation will not be an impediment to the foreign

tax credit carryforward usage as long as Citi can generate sufficient domestic

taxable income within the 10-year carryforward period.

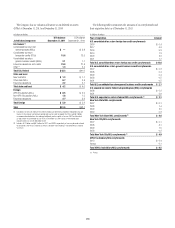

Regarding the estimate of future taxable income, Citi has projected its

pretax earnings, predominantly based upon the “core” businesses that Citi

intends to conduct going forward. These “core” businesses have produced

steady and strong earnings in the past. Citi believes that it will generate

sufficient pretax earnings within the 10-year carryforward period referenced

above to be able to fully utilize the foreign tax credit carryforward, in

addition to any foreign tax credits produced in such period.

As mentioned above, Citi has also examined tax planning strategies

available to it in accordance with ASC 740 that would be employed, if

necessary, to prevent a carryforward from expiring and to accelerate the

usage of its carryforwards. These strategies include repatriating low taxed

foreign source earnings for which an assertion that the earnings have

been indefinitely reinvested has not been made, accelerating U.S. taxable

income into or deferring U.S. tax deductions out of the latter years of the

carryforward period (e.g., selling appreciated intangible assets and electing

straight-line depreciation), accelerating deductible temporary differences

outside the U.S., holding onto available-for-sale debt securities with losses

until they mature and selling certain assets that produce tax exempt income,

while purchasing assets that produce fully taxable income. In addition,

the sale or restructuring of certain businesses can produce significant U.S.

taxable income within the relevant carryforward periods.

As previously disclosed, Citi’s ability to utilize its DTAs to offset future

taxable income may be significantly limited if Citi experiences an

“ownership change,” as defined in Section 382 of the Internal Revenue Code

of 1986, as amended (the Code). Generally, an ownership change will occur

if there is a cumulative change in Citi’s ownership by “5% shareholders” (as

defined in the Code) that exceeds 50 percentage points over a rolling three-

year period. Any limitation on Citi’s ability to utilize its DTAs arising from an

ownership change under Section 382 will depend on the value of Citi’s stock

at the time of the ownership change.