Citibank 2011 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2011 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

50

Secured Financing Transactions

Secured financing is primarily conducted through Citi’s broker-dealer

subsidiaries to facilitate customer matched-book activity and to efficiently

fund a portion of the trading inventory. As of December 31, 2011, secured

financing was $198 billion and averaged approximately $220 billion during

the year. Secured financing at December 31, 2011 increased year over year by

approximately $9 billion from $190 billion at December 31, 2010.

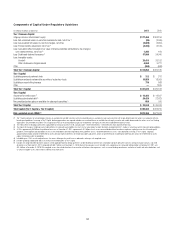

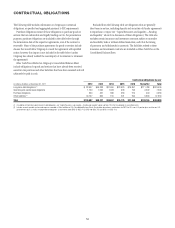

Commercial Paper

At December 31, 2011 and December 31, 2010, commercial paper

outstanding for Citigroup’s non-bank entities and significant bank entities,

respectively, was as follows:

In millions of dollars Dec. 31, 2011 $ECææ

.ONBANKæ $ 6,414

"ANK 14,872 æ

Total $21,286 æ

Other Short-Term Borrowings

At December 31, 2011, Citi’s other short-term borrowings were $33 billion,

compared with $54 billion at December 31, 2010. The average balances for

the quarters were generally consistent with the quarter-end balances for

each period.

See Note 19 to the Consolidated Financial Statements for further

information on Citigroup’s outstanding long-term debt and short-term

borrowings.

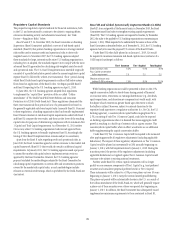

Liquidity Risk Management

Liquidity risk is the risk of a financial institution’s inability to meet its

obligations in a timely manner. Management of liquidity risk at Citi is

the responsibility of the Citigroup Treasurer with oversight from senior

management through Citi’s Finance and Asset and Liability Committee

(FinALCO). For additional information on FinALCO and Citi’s liquidity

management, see “Capital Resources – Overview” above.

Citigroup operates under a centralized treasury model where the overall

balance sheet is managed by Citigroup Treasury through Global Franchise

Treasurers and Regional Treasurers. Day-to-day liquidity and funding are

managed by treasurers at the country and business level and are monitored

by Citigroup Treasury and independent risk management.

Liquidity Measures and Stress Testing

Citi uses multiple measures in monitoring its liquidity, including liquidity

ratios, stress testing and liquidity limits, each as described below.

Liquidity Measures

In broad terms, the structural liquidity ratio, defined as the sum of deposits,

long-term debt and stockholders’ equity as a percentage of total assets,

measures whether Citi’s asset base is funded by sufficiently long-dated

liabilities. Citi’s structural liquidity ratio was 73% at December 31, 2011 and

73% at December 31, 2010.

Internally, Citi also utilizes cash capital to measure and monitor its ability

to fund the structurally illiquid portion of the balance sheet, on a specific

product-by-product basis. While cash capital is a methodology generally

used by financial institutions to provide a maturity structure matching

assets and liabilities, there is a lack of standardization in this area and

specific product-by-product assumptions vary by firm. Cash capital measures

the amount of long-term funding—core deposits, long-term debt and

equity—available to fund illiquid assets. Illiquid assets generally include

loans (net of securitization adjustments), securities haircuts and other assets

(i.e., goodwill, intangibles and fixed assets). As of December 31, 2011, based

on Citi’s internal measures, both the non-bank and the aggregate bank

subsidiaries had excess cash capital.

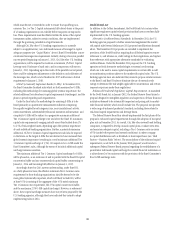

As part of Basel III, the Basel Committee proposed two new liquidity

measurements (for an additional discussion of Basel III, see “Capital

Resources—Regulatory Capital Standards” above). Specifically, as

proposed, the Liquidity Coverage Ratio (LCR) is designed to ensure banking

organizations maintain an adequate level of unencumbered cash and

high quality unencumbered assets that can be converted into cash to meet

liquidity needs. The LCR must be at least 100%, and is proposed to be

effective beginning January 1, 2015. While the U.S. regulators have not yet

provided final rules or guidance with respect to the LCR, based on its current

understanding of the LCR requirements, Citi believes it is in compliance with

the LCR as of December 31, 2011.

In addition to the LCR, the Basel Committee proposed a Net Stable

Funding Ratio (NSFR) designed to promote the medium- and long-term

funding of assets and activities over a one-year time horizon. It is Citi’s

understanding, however, that this proposed metric is under review by the

Basel Committee and may be further revised.

Moreover, in January 2012, the Federal Reserve Board proposed rules to

implement the enhanced prudential standards for systemically important

financial institutions, as required by the Dodd-Frank Act. The proposed

rules include new requirements for liquidity management and corporate

governance related thereto. Citi continues to review these proposed rules and

any potential impact they may have on its liquidity management practices.