Citibank 2011 Annual Report Download - page 164

Download and view the complete annual report

Please find page 164 of the 2011 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.142

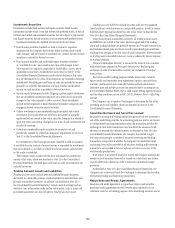

portfolios, where internal credit-risk ratings are assigned (primarily

Institutional Clients Group and Global Consumer Banking) or modified

Consumer loans, where concessions were granted due to the borrowers’

financial difficulties.

The above-mentioned representatives covering these respective business

areas present recommended reserve balances for their funded and unfunded

lending portfolios along with supporting quantitative and qualitative data.

The quantitative data include:

Estimated probable losses for non-performing, non-homogeneous

exposures within a business line’s classifiably managed portfolio

and impaired smaller-balance homogeneous loans whose terms

have been modified due to the borrowers’ financial difficulties, and

it was determined that a concession was granted to the borrower.

Consideration may be given to the following, as appropriate, when

determining this estimate: (i) the present value of expected future cash

flows discounted at the loan’s original effective rate; (ii) the borrower’s

overall financial condition, resources and payment record; and (iii) the

prospects for support from financially responsible guarantors or the

realizable value of any collateral. In the determination of the allowance

for loan losses for TDRs, management considers a combination of

historical re-default rates, the current economic environment and the

nature of the modification program when forecasting expected cash flows.

When impairment is measured based on the present value of expected

future cash flows, the entire change in present value is recorded in the

Provision for loan losses.

Statistically calculated losses inherent in the classifiably managed

portfolio for performing and de minimis non-performing exposures.

The calculation is based upon: (i) Citigroup’s internal system of credit-

risk ratings, which are analogous to the risk ratings of the major rating

agencies; and (ii) historical default and loss data, including rating agency

information regarding default rates from 1983 to 2010 and internal data

dating to the early 1970s on severity of losses in the event of default.

Additional adjustments include: (i) statistically calculated estimates to

cover the historical fluctuation of the default rates over the credit cycle,

the historical variability of loss severity among defaulted loans, and

the degree to which there are large obligor concentrations in the global

portfolio; and (ii) adjustments made for specific known items, such as

current environmental factors and credit trends.

In addition, representatives from each of the risk management and

finance staffs that cover business areas with delinquency-managed portfolios

containing smaller-balance homogeneous loans present their recommended

reserve balances based upon leading credit indicators, including loan

delinquencies and changes in portfolio size as well as economic trends,

including housing prices, unemployment and GDP. This methodology is

applied separately for each individual product within each geographic region

in which these portfolios exist.

This evaluation process is subject to numerous estimates and judgments.

The frequency of default, risk ratings, loss recovery rates, the size and

diversity of individual large credits, and the ability of borrowers with foreign

currency obligations to obtain the foreign currency necessary for orderly debt

servicing, among other things, are all taken into account during this review.

Changes in these estimates could have a direct impact on the credit costs in

any period and could result in a change in the allowance. Changes to the

Allowance for loan losses are recorded in the Provision for loan losses.

Allowance for Unfunded Lending Commitments

A similar approach to the allowance for loan losses is used for calculating

a reserve for the expected losses related to unfunded loan commitments

and standby letters of credit. This reserve is classified on the balance

sheet in Other liabilities. Changes to the allowance for unfunded

lending commitments are recorded in the Provision for unfunded

lending commitments.

Mortgage Servicing Rights

Mortgage servicing rights (MSRs) are recognized as intangible assets when

purchased or when the Company sells or securitizes loans acquired through

purchase or origination and retains the right to service the loans. Mortgage

servicing rights are accounted for at fair value, with changes in value

recorded in Other Revenue in the Company’s Consolidated Statement of

Income.

Additional information on the Company’s MSRs can be found in Note 22

to the Consolidated Financial Statements.

Consumer Mortgage—Representations and Warranties

The majority of Citi’s exposure to representation and warranty claims relates

to its U.S. Consumer mortgage business within CitiMortgage.

When selling a loan, Citi makes various representations and warranties

relating to, among other things, the following:

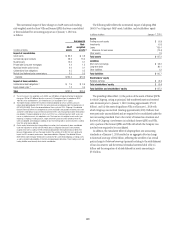

Citi’s ownership of the loan;

the validity of the lien securing the loan;

the absence of delinquent taxes or liens against the property securing

the loan;

the effectiveness of title insurance on the property securing the loan;

the process used in selecting the loans for inclusion in a transaction;

the loan’s compliance with any applicable loan criteria established by the

buyer; and

the loan’s compliance with applicable local, state and federal laws.

The specific representations and warranties made by Citi depend on the

nature of the transaction and the requirements of the buyer. Market

conditions and credit rating agency requirements may also affect

representations and warranties and the other provisions to which Citi may

agree in loan sales.