Citibank 2011 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2011 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

48

Further, Citi’s summary of aggregate liquidity resources above does not

include additional potential liquidity in the form of Citigroup’s borrowing

capacity at the U.S. Federal Reserve Bank discount window and from the

various Federal Home Loan Banks (FHLB), which is maintained by pledged

collateral to all such banks. Citi also maintains additional liquidity available

in the form of diversified high grade non-government securities.

In general, Citigroup can freely fund legal entities within its bank

vehicles. In addition, Citigroup’s bank subsidiaries, including Citibank,

N.A., can lend to the Citigroup parent and broker-dealer entities in

accordance with Section 23A of the Federal Reserve Act. As of December 31,

2011, the amount available for lending to these non-bank entities under

Section 23A was approximately $20.4 billion, provided the funds are

collateralized appropriately.

Deposits

Citi continued to focus on maintaining a geographically diverse retail and

corporate deposits base that stood at $866 billion at December 31, 2011, as

compared with $845 billion at December 31, 2010. The $21 billion increase

in deposits year-over-year was largely due to higher deposit volumes in

Global Consumer Banking and Transaction Services. These increases were

partially offset by a decrease in deposits in Citi Holdings year-over-year, while

deposits in Securities and Banking were relatively flat. Compared to the

prior quarter, deposits increased in Global Consumer Banking, Securities

and Banking and Transaction Services. Citi grew deposits year-over-year

in all regions as customers continued a “flight to quality” given the market

environment, including increases in Europe and North America in the

fourth quarter of 2011. As of December 31, 2011, approximately 60% of Citi’s

deposits were located outside of the United States.

Deposits can be interest-bearing or non-interest-bearing. Citi had

$866 billion of deposits at December 31, 2011; of those, $177 billion were

non-interest-bearing, compared to $133 billion at December 31, 2010. The

remainder, or $689 billion, was interest-bearing, compared to $712 billion at

December 31, 2010.

While Citi’s deposits have grown year over year, Citi’s overall cost of funds

on deposits decreased, reflecting the low rate environment as well as Citi’s

ability to lower price points that widens its margins given the high levels

of customer liquidity while still remaining competitive. Citi’s average rate

on total deposits was 0.96% at December 31, 2011, compared with 0.99% at

December 31, 2010. Excluding the impact of the higher FDIC assessment

effective beginning in the second quarter of 2011 and deposit insurance,

the average rate on Citi’s total deposits was 0.80% at December 31, 2011,

compared with 0.86% at December 31, 2010. As interest rates rise, however,

Citi expects to see pressure on these rates.

In addition, the composition of Citi’s deposits shifted significantly year-

over-year. Specifically, time deposits, where rates are fixed for the term of the

deposit and have generally lower margins, became a smaller proportion of

the deposit base, whereas operating accounts became a larger proportion

of deposits. As defined by Citigroup, operating accounts consist of accounts

such as checking and savings accounts for individuals, as well as cash

management accounts for corporations, and, in Citi’s experience, provide

wider margins and exhibit retentive behavior. During 2011, operating

account deposits grew across most of Citi’s deposit-taking businesses,

including retail, the private bank and Transaction Services. Operating

accounts represented 75% of Citicorp’s deposit base as of December 31, 2011,

compared to 70% as of December 31, 2010 and 63% at December 31, 2009.

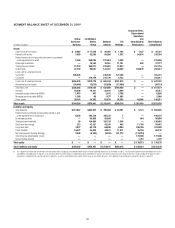

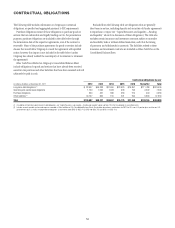

Long-Term Debt

Long-term debt (generally defined as original maturities of one year or

more) is an important funding source, primarily for the non-bank entities,

because of its multi-year maturity structure. The weighted average maturities

of structural long-term debt (as defined in note 1 to the long-term debt

issuances and maturities table below), issued by Citigroup, CFI, CGMHI

and Citibank, N.A., excluding trust preferred securities, was approximately

7.1 years at December 31, 2011, compared to approximately 6.2 years as of

December 31, 2010. At December 31, 2011 and December 31, 2010, overall

long-term debt outstanding for Citigroup was as follows:

In billions of dollars Dec. 31, 2011 $ECæææ

.ONBANKæ $247.0 æ

"ANKæ 76.5 æ

Total (2)(3) $323.5 æ

æ #OLLATERALIZEDæADVANCESæFROMæTHEæ&(,"æWEREæAPPROXIMATELYææBILLIONæANDææBILLIONæ

RESPECTIVELYæATæ$ECEMBERæææANDæ$ECEMBERæææ4HESEæADVANCESæAREæREFLECTEDæINæTHEæ

TABLEæABOVEæ

æ )NCLUDESæLONGTERMæDEBTæRELATEDæTOæCONSOLIDATEDæVARIABLEæINTERESTæENTITIESæ6)%SæOFæAPPROXIMATELYæ

æBILLIONæANDææBILLIONæRESPECTIVELYæATæ$ECEMBERæææANDæ$ECEMBERæææ

4HEæMAJORITYæOFæTHESEæ6)%SæRELATEæTOæTHEæ#ITIBANKæ#REDITæ#ARDæ-ASTERæ4RUSTæANDæTHEæ#ITIBANKæ/-.)æ

-ASTERæ4RUSTæ

æ /FæTHISæAMOUNTæAPPROXIMATELYææBILLIONæMATURINGæINææISæGUARANTEEDæBYæTHEæ&$)#æUNDERæTHEæ

4EMPORARYæ,IQUIDITYæ'UARANTEEæ0ROGRAMæ4,'0

As set forth in the table above, Citi’s overall long-term debt has decreased

by approximately $58 billion year-over-year. In the non-bank, the year-over-

year decrease was primarily due to TLGP run-off. In the bank entities, the

decrease also included TLGP run-off, FHLB reductions, and the maturing

of credit card securitization debt, particularly as Citi has grown its overall

deposit base. Citi currently expects a continued decline in its overall long-

term debt over 2012, particularly within its bank entities. Given its liquidity

resources as of December 31, 2011, Citi may consider opportunities to

repurchase its long-term debt, pursuant to open market purchases, tender

offers or other means.