Citibank 2011 Annual Report Download - page 275

Download and view the complete annual report

Please find page 275 of the 2011 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.253

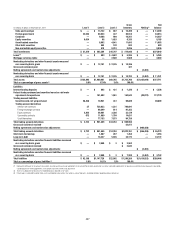

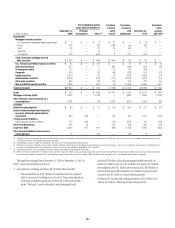

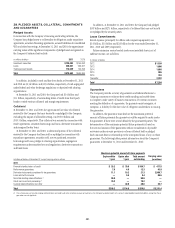

Purchases of asset-backed securities of $5.0 billion and sales of –

$5.9 billion, reflecting trading in CLO and CDO positions.

Transfers of $2.3 billion from Level 2 to Level 3 – , consisting mainly of

transfers of corporate debt securities of $1.5 billion due primarily to

less price transparency for these securities.

Settlements of $5.0 billion – , which included $1.2 billion related

to the scheduled termination of a structured transaction, with

a corresponding decrease in Long-term debt, and $1 billion of

redemptions of auction rate securities.

A net increase in interest rate contracts of $1.5 billion, including transfers

of $1.5 billion from Level 2 to Level 3.

A net decrease in credit derivatives of $0.6 billion. The net decrease was

comprised of gains of $0.5 billion recorded in Principal transactions,

relating mainly to total return swaps referencing returns on corporate

loans, offset by losses on the referenced loans which are classified as Level 2.

Settlements of $1.3 billion related primarily to the settlement of certain

contracts under which the Company had purchased credit protection on

commercial mortgage-backed securities from a single counterparty.

A net decrease in Level 3 Investments of $0.5 billion. There was a net

increase in non-marketable equity securities of $1.4 billion. Purchases of

non-marketable equity securities of $4.9 billion included Citi’s acquisition

of the share capital of Maltby Acquisitions Limited, the holding company

that controls EMI Group Ltd. Purchases also included subscriptions in

Citi-advised private equity and hedge funds. Sales of $1.8 billion and

settlements of $1.7 billion related primarily to sales and redemptions by

the Company of investments in private equity and hedge funds.

A net increase in Loans of $1.5 billion, including transfers from Level 2 to

Level 3 of $0.4 billion, due to a lack of observable prices. Issuances of $2.0 billion

included new margin loans advanced by the Company.

A net decrease in Mortgage servicing rights of $2.0 billion, due to a

reduction in interest rates.

A net decrease in Level 3 Long-term debt of $2.4 billion, which included

settlements of $2.1 billion, $1.2 billion of which related to the scheduled

termination of a structured transaction, with a corresponding decrease in

corporate debt trading securities.

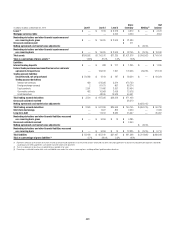

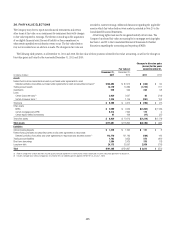

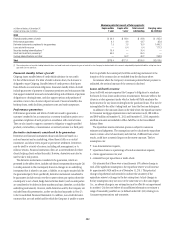

The significant changes from December 31, 2009 to December 31, 2010 in

Level 3 assets and liabilities are due to:

An increase in Federal funds sold and securities borrowed or purchased

under agreements to resell of $3.8 billion, driven primarily by transfers of

certain collateralized long-dated callable reverse repos (structured reverse

repos) of $3.0 billion from Level 2 to Level 3. The Company has noted that

there is more transparency and observability for repo curves (used in the

determination of the fair value of structured reverse repos) with a tenor of five

years or less; thus, structured reverse repos that are expected to mature beyond

the five-year point are generally classified as Level 3. The primary factor driving

the change in expected maturities in structured reverse repo transactions is the

embedded call option feature that enables the investor (the Company) to elect

to terminate the trade early. During 2010, the decrease in interest rates caused

the estimated maturity dates of certain structured reverse repos to lengthen to

more than five years, resulting in the transfer from Level 2 to Level 3.

A net decrease in trading securities of $20.8 billion that was driven by:

A net decrease of $10.2 billion in trading mortgage-backed securities –,

driven mainly by liquidations of subprime securities of $7.5 billion

and commercial mortgage-backed securities of $1.8 billion;

A net increase of $3. – 8 billion in asset-backed securities, including

transfers to Level 3 of $5.0 billion. Substantially all of these Level 3

transfers related to the reclassification of certain securities to trading

securities under the fair value option upon adoption of ASU 2010-11

on July 1, 2010, as described in Note 1 to the Consolidated Financial

Statements (for purposes of the Level 3 roll-forward table above, Level 3

investments that were reclassified to trading upon adoption of ASU 2010-

11 have been classified as transfers to Level 3 trading securities); and

A decrease of $11.9 billion in Other debt securities, due primarily –

to the impact of the consolidation of the credit card securitization

trusts by the Company upon adoption of SFAS 166/167 on January 1,

2010. Upon consolidation of the trusts, the Company recorded the

underlying credit card receivables on its Consolidated Balance Sheet

as Loans accounted for at amortized cost. At January 1, 2010, the

Company’s investments in the trusts and other inter-company

balances were eliminated. At January 1, 2010, the Company’s

investment in these newly consolidated VIEs, which is eliminated

for accounting purposes, included certificates issued by these trusts

of $11.1 billion that were classified as Level 3 at December 31, 2009.

The impact of the elimination of these certificates has been reflected

as net settlements in the Level 3 roll-forward table above.

A net decrease in Derivatives of $4.0 billion, including net trading losses

of $1.5 billion, net settlements of $1.9 billion and net transfers out of

Level 3 to Level 2 of $0.6 billion.

A net decrease in Level 3 Investments of $4.1 billion, including net sales

of asset-backed securities of $2.6 billion and sales of non-marketable

equity securities of $1.1 billion.

A net increase in Loans of $3 billion, due largely to the Company’s

consolidation of certain VIEs upon the adoption of SFAS 167 on

January 1, 2010, for which the fair value option was elected. The impact

from consolidation of these VIEs on Level 3 loans has been reflected as

purchases in the Level 3 roll-forward above.

A decrease in Mortgage servicing rights of $2 billion due primarily to

losses of $1.1 billion, resulting from a reduction in interest rates.

A decrease in Long-term debt of $1.3 billion, driven mainly by $1.3

billion of net terminations of structured notes.