Citibank 2011 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2011 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.112

Differences Between Country and Cross-Border Risk

As described in more detail in the sections above, there are significant

differences between the reporting of country risk and cross-border risk. A

general summary of the more significant differences is as follows:

Country risk is the risk that an event within a country will impair the

value of Citi’s franchise or adversely affect the ability of obligors within

the country to honor their obligations to Citi. Country risk reporting in

Citi’s internal risk management systems is based on the identification

of the country where the client relationship, taken as a whole, is most

directly exposed to the economic, financial, sociopolitical or legal risks.

Generally, country risk includes the benefit of margin received as well as

offsetting exposures and hedge positions. As such, country risk, which is

reported based on Citi’s internal risk management standards, measures

net exposure to a credit or market risk event.

Cross-border risk, as defined by the FFIEC, focuses on the potential

exposure if foreign governments take actions, such as enacting exchange

controls, that prevent the conversion of local currency to non-local

currency or restrict the remittance of funds outside the country. Unlike

country risk, FFIEC cross-border risk measures exposure to the immediate

obligors or counterparties domiciled in the given country or, if applicable,

by the location of collateral or guarantors of the legally binding

guarantees, generally without the benefit of margin received or hedge

positions, and recognizes offsetting exposures only for certain products.

The differences between the presentation of country risk and cross-border

risk can be substantial, including the identification of the country of risk,

as described above. In addition, some of the more significant differences by

product are described below:

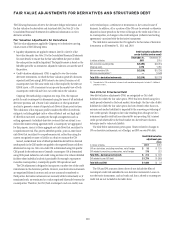

For country risk, net derivative receivables are generally reported based

on fair value, netting receivables and payables under the same legally

binding netting agreement, and recognizing the benefit of margin

received and any hedge positions in place. For cross-border risk, these

items are also reported based on fair value and allow for netting of

receivables and payables if a legally binding netting agreement is in place,

but only with the same specific counterparty, and do not recognize the

benefit of margin received or hedges in place.

For country risk, secured financing transactions, such as repurchase

agreements and reverse repurchase agreements, as well as securities

loaned and borrowed, are reported based on the net credit exposure

arising from the transaction, which is typically small or zero given the

over-collateralized structure of these transactions. For cross-border risk,

reverse repurchase agreements and securities borrowed are reported based

on notional amounts and do not include the value of any collateral

received (repurchase agreements and securities loaned are not included in

cross-border risk reporting).

For country risk, loans are reported net of hedges and collateral pledged

under bankruptcy-remote structures. For cross-border risk, loans are

reported without taking hedges into account.

For country risk, securities in AFS and trading portfolios are reported on a

net basis, netting long positions against short positions. For cross-border

risk, securities in AFS and trading portfolios are not netted.

For country risk, credit default swaps (CDSs) are reported based on

the net notional amount of CDSs purchased and sold, assuming zero

recovery from the underlying entity, and adjusted for any mark-to-market

receivable or payable position. For cross-border risk, CDSs are included

based on the gross notional amount sold, and do not include any

offsetting purchased CDSs on the same underlying entity.

Venezuelan Operations

In 2003, the Venezuelan government enacted currency restrictions that

have restricted Citigroup’s ability to obtain U.S. dollars in Venezuela at the

official foreign currency rate. In May 2010, the government enacted new

laws that have closed the parallel foreign exchange market and established

a new foreign exchange market. Citigroup does not have access to U.S.

dollars in this new market. Citigroup uses the official rate to re-measure the

foreign currency transactions in the financial statements of its Venezuelan

operations, which have U.S. dollar functional currencies, into U.S. dollars.

At December 31, 2011 and 2010, Citigroup had net monetary assets in

its Venezuelan operations denominated in bolivars of approximately

$241 million and $200 million, respectively.