Citibank 2011 Annual Report Download - page 168

Download and view the complete annual report

Please find page 168 of the 2011 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.146

Deferred taxes are recorded for the future consequences of events that

have been recognized for financial statements or tax returns, based upon

enacted tax laws and rates. Deferred tax assets are recognized subject to

management’s judgment that realization is more likely than not. FASB

Interpretation No. 48, “Accounting for Uncertainty in Income Taxes” (FIN

48) (now incorporated into ASC 740, Income Taxes), sets out a consistent

framework to determine the appropriate level of tax reserves to maintain

for uncertain tax positions. This interpretation uses a two-step approach

wherein a tax benefit is recognized if a position is more likely than not to

be sustained. The amount of the benefit is then measured to be the highest

tax benefit that is greater than 50% likely to be realized. FIN 48 also sets out

disclosure requirements to enhance transparency of an entity’s tax reserves.

See Note 10 to the Consolidated Financial Statements for a further

description of the Company’s provision and related income tax assets

and liabilities.

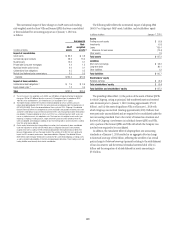

Commissions, Underwriting and Principal Transactions

Commissions revenues are recognized in income generally when earned.

Underwriting revenues are recognized in income typically at the closing of

the transaction. Principal transactions revenues are recognized in income on

a trade-date basis. See Note 6 to the Consolidated Financial Statements for a

description of the Company’s revenue recognition policies for commissions

and fees.

Earnings per Share

Earnings per share (EPS) is computed after deducting preferred stock

dividends. The Company has granted restricted and deferred share awards

with dividend rights that are considered to be participating securities, which

are akin to a second class of common stock. Accordingly, a portion of

Citigroup’s earnings is allocated to those participating securities in the EPS

calculation.

Basic earnings per share is computed by dividing income available to

common stockholders after the allocation of dividends and undistributed

earnings to the participating securities by the weighted average number

of common shares outstanding for the period. Diluted earnings per

share reflects the potential dilution that could occur if securities or other

contracts to issue common stock were exercised. It is computed after giving

consideration to the weighted average dilutive effect of the Company’s stock

options and warrants, convertible securities, T-DECs, and the shares that

could have been issued under the Company’s Management Committee Long-

Term Incentive Plan and after the allocation of earnings to the participating

securities.

All per share amounts and Citigroup shares outstanding for all periods

reflect Citigroup’s 1-for-10 reverse stock split, which was effective May 6, 2011.

Use of Estimates

Management must make estimates and assumptions that affect the

Consolidated Financial Statements and the related footnote disclosures. Such

estimates are used in connection with certain fair value measurements. See

Note 25 to the Consolidated Financial Statements for further discussions on

estimates used in the determination of fair value. The Company also uses

estimates in determining consolidation decisions for special-purpose entities

as discussed in Note 22. Moreover, estimates are significant in determining

the amounts of other-than-temporary impairments, impairments of goodwill

and other intangible assets, provisions for probable losses that may arise

from credit-related exposures and probable and estimable losses related to

litigation and regulatory proceedings, and tax reserves. While management

makes its best judgment, actual amounts or results could differ from those

estimates. Current market conditions increase the risk and complexity of the

judgments in these estimates.

Cash Flows

Cash equivalents are defined as those amounts included in cash and due

from banks. Cash flows from risk management activities are classified in the

same category as the related assets and liabilities.

Related Party Transactions

The Company has related party transactions with certain of its subsidiaries

and affiliates. These transactions, which are primarily short-term in nature,

include cash accounts, collateralized financing transactions, margin

accounts, derivative trading, charges for operational support and the

borrowing and lending of funds, and are entered into in the ordinary course

of business.