Citibank 2011 Annual Report Download - page 261

Download and view the complete annual report

Please find page 261 of the 2011 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

239

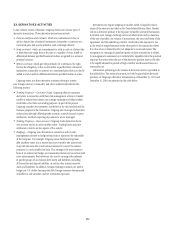

The Company makes markets in and trades a range of credit derivatives,

both on behalf of clients as well as for its own account. Through these

contracts, the Company either purchases or writes protection on either a

single name or a portfolio of reference credits. The Company uses credit

derivatives to help mitigate credit risk in its Corporate and Consumer loan

portfolios and other cash positions, to take proprietary trading positions, and

to facilitate client transactions.

The range of credit derivatives sold includes credit default swaps, total

return swaps, credit options and credit-linked notes.

A credit default swap is a contract in which, for a fee, a protection seller

agrees to reimburse a protection buyer for any losses that occur due to

a credit event on a reference entity. If there is no credit default event or

settlement trigger, as defined by the specific derivative contract, then the

protection seller makes no payments to the protection buyer and receives only

the contractually specified fee. However, if a credit event occurs as defined in

the specific derivative contract sold, the protection seller will be required to

make a payment to the protection buyer.

A total return swap transfers the total economic performance of a

reference asset, which includes all associated cash flows, as well as capital

appreciation or depreciation. The protection buyer receives a floating rate

of interest and any depreciation on the reference asset from the protection

seller and, in return, the protection seller receives the cash flows associated

with the reference asset plus any appreciation. Thus, according to the total

return swap agreement, the protection seller will be obligated to make a

payment any time the floating interest rate payment and any depreciation

of the reference asset exceed the cash flows associated with the underlying

asset. A total return swap may terminate upon a default of the reference asset

subject to the provisions of the related total return swap agreement between

the protection seller and the protection buyer.

A credit option is a credit derivative that allows investors to trade or hedge

changes in the credit quality of the reference asset. For example, in a credit

spread option, the option writer assumes the obligation to purchase or sell the

reference asset at a specified “strike” spread level. The option purchaser buys

the right to sell the reference asset to, or purchase it from, the option writer at

the strike spread level. The payments on credit spread options depend either

on a particular credit spread or the price of the underlying credit-sensitive

asset. The options usually terminate if the underlying assets default.

A credit-linked note is a form of credit derivative structured as a debt

security with an embedded credit default swap. The purchaser of the note

writes credit protection to the issuer, and receives a return which will be

negatively affected by credit events on the underlying reference credit. If

the reference entity defaults, the purchaser of the credit-linked note may

assume the long position in the debt security and any future cash flows

from it, but will lose the amount paid to the issuer of the credit-linked note.

Thus the maximum amount of the exposure is the carrying amount of the

credit-linked note. As of December 31, 2011 and December 31, 2010, the

amount of credit-linked notes held by the Company in trading inventory

was immaterial.

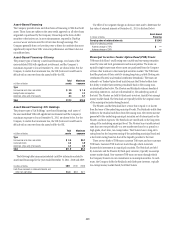

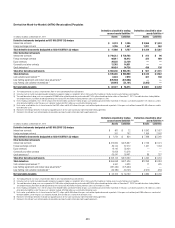

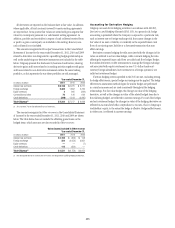

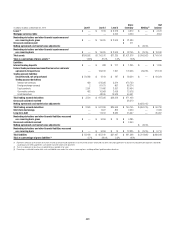

The following tables summarize the key characteristics of the Company’s

credit derivative portfolio as protection seller as of December 31, 2011 and

December 31, 2010:

In millions of dollars as of

December 31, 2011

Maximum potential

amount of

future payments

Fair

value

payable (1)(2)

By industry/counterparty

"ANK $ 929,608 $ 45,920

"ROKERDEALER 321,293 19,026

.ONFINANCIAL 1,048 98

)NSURANCEæANDæOTHERæFINANCIALæINSTITUTIONS 142,579 7,447

Total by industry/counterparty $1,394,528 $ 72,491

By instrument

#REDITæDEFAULTæSWAPSæANDæOPTIONS $1,393,082 $ 72,358

4OTALæRETURNæSWAPSæANDæOTHER 1,446 133

Total by instrument $1,394,528 $ 72,491

By rating

)NVESTMENTæGRADE $ 611,447 $ 16,913

.ONINVESTMENTæGRADE 226,939 28,034

.OTæRATED 556,142 27,544

Total by rating $1,394,528 $ 72,491

By maturity

7ITHINææYEAR $ 266,723 $ 3,705

&ROMææTOææYEARS 947,211 46,596

!FTERææYEARS 180,594 22,190

Total by maturity $1,394,528 $ 72,491

æ )NæADDITIONæFAIRæVALUEæAMOUNTSæPAYABLEæUNDERæCREDITæDERIVATIVESæPURCHASEDæWEREææMILLION

æ )NæADDITIONæFAIRæVALUEæAMOUNTSæRECEIVABLEæUNDERæCREDITæDERIVATIVESæSOLDæWEREææMILLION

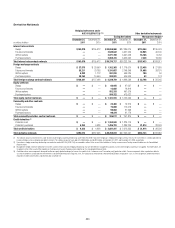

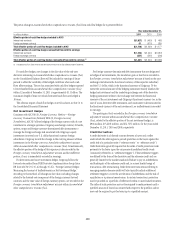

In millions of dollars as of

December 31, 2010

Maximum potential

amount of

future payments

Fair

value

payable (1)(2)

By industry/counterparty

"ANK

"ROKERDEALER

.ONFINANCIAL

)NSURANCEæANDæOTHERæFINANCIALæINSTITUTIONSæ

Total by industry/counterparty

By instrument

#REDITæDEFAULTæSWAPSæANDæOPTIONS

4OTALæRETURNæSWAPSæANDæOTHER

Total by instrument

By rating

)NVESTMENTæGRADE

.ONINVESTMENTæGRADE

.OTæRATED

Total by rating

By maturity

7ITHINææYEAR

&ROMææTOææYEARS

!FTERææYEARS

Total by maturity

æ )NæADDITIONæFAIRæVALUEæAMOUNTSæPAYABLEæUNDERæCREDITæDERIVATIVESæPURCHASEDæWEREææMILLION

æ )NæADDITIONæFAIRæVALUEæAMOUNTSæRECEIVABLEæUNDERæCREDITæDERIVATIVESæSOLDæWEREææMILLION