Citibank 2011 Annual Report Download - page 284

Download and view the complete annual report

Please find page 284 of the 2011 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

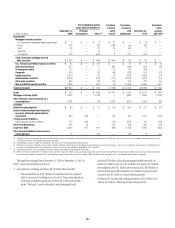

262

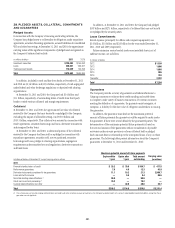

Maximum potential amount of future payments

In billions of dollars at December 31,

except carrying value in millions

Expire within

1 year

Expire after

1 year

Total amount

outstanding

Carrying value

(in millions)

2010

&INANCIALæSTANDBYæLETTERSæOFæCREDIT

0ERFORMANCEæGUARANTEES

$ERIVATIVEæINSTRUMENTSæCONSIDEREDæTOæBEæGUARANTEES

,OANSæSOLDæWITHæRECOURSE

3ECURITIESæLENDINGæINDEMNIFICATIONSæ

#REDITæCARDæMERCHANTæPROCESSINGæ

#USTODYæINDEMNIFICATIONSæANDæOTHER

Total

æ 4HEæCARRYINGæVALUESæOFæSECURITIESæLENDINGæINDEMNIFICATIONSæANDæCREDITæCARDæMERCHANTæPROCESSINGæAREæNOTæMATERIALæASæTHEæ#OMPANYæHASæDETERMINEDæTHATæTHEæAMOUNTæANDæPROBABILITYæOFæPOTENTIALæLIABILITIESæARISINGæFROMæTHESEæ

GUARANTEESæAREæNOTæSIGNIFICANT

Financial standby letters of credit

Citigroup issues standby letters of credit which substitute its own credit

for that of the borrower. If a letter of credit is drawn down, the borrower is

obligated to repay Citigroup. Standby letters of credit protect a third party

from defaults on contractual obligations. Financial standby letters of credit

include guarantees of payment of insurance premiums and reinsurance risks

that support industrial revenue bond underwriting and settlement of payment

obligations to clearing houses, and also support options and purchases of

securities or are in lieu of escrow deposit accounts. Financial standbys also

backstop loans, credit facilities, promissory notes and trade acceptances.

Performance guarantees

Performance guarantees and letters of credit are issued to guarantee a

customer’s tender bid on a construction or systems-installation project or to

guarantee completion of such projects in accordance with contract terms.

They are also issued to support a customer’s obligation to supply specified

products, commodities, or maintenance or warranty services to a third party.

Derivative instruments considered to be guarantees

Derivatives are financial instruments whose cash flows are based on a

notional amount and an underlying, where there is little or no initial

investment, and whose terms require or permit net settlement. Derivatives

may be used for a variety of reasons, including risk management, or to

enhance returns. Financial institutions often act as intermediaries for their

clients, helping clients reduce their risks. However, derivatives may also be

used to take a risk position.

The derivative instruments considered to be guarantees, which are

presented in the tables above, include only those instruments that require Citi

to make payments to the counterparty based on changes in an underlying

instrument that is related to an asset, a liability, or an equity security held by

the guaranteed party. More specifically, derivative instruments considered to

be guarantees include certain over-the-counter written put options where the

counterparty is not a bank, hedge fund or broker-dealer (such counterparties

are considered to be dealers in these markets and may, therefore, not hold the

underlying instruments). However, credit derivatives sold by the Company are

excluded from this presentation, as they are disclosed separately in Note 23

to the Consolidated Financial Statements. In addition, non-credit derivative

contracts that are cash settled and for which the Company is unable to assert

that it is probable the counterparty held the underlying instrument at the

inception of the contract also are excluded from the disclosure above.

In instances where the Company’s maximum potential future payment is

unlimited, the notional amount of the contract is disclosed.

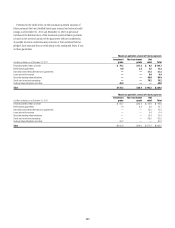

Loans sold with recourse

Loans sold with recourse represent the Company’s obligations to reimburse

the buyers for loan losses under certain circumstances. Recourse refers to the

clause in a sales agreement under which a lender will fully reimburse the

buyer/investor for any losses resulting from the purchased loans. This may be

accomplished by the seller’s taking back any loans that become delinquent.

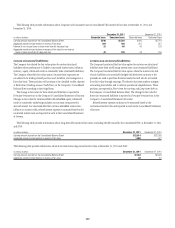

In addition to the amounts shown in the table above, the repurchase reserve

for Consumer mortgages representations and warranties was $1,188 million

and $969 million at December 31, 2011 and December 31, 2010, respectively,

and these amounts are included in Other liabilities on the Consolidated

Balance Sheet.

The repurchase reserve estimation process is subject to numerous

estimates and judgments. The assumptions used to calculate the repurchase

reserve contain a level of uncertainty and risk that, if different from actual

results, could have a material impact on the reserve amounts. The key

assumptions are:

loan documentation requests;

repurchase claims as a percentage of loan documentation requests;

claims appeal success rate; and

estimated loss per repurchase or make-whole.

Citi estimates that if there were a simultaneous 10% adverse change in

each of the significant assumptions, the repurchase reserve would increase

by approximately $620 million as of December 31, 2011. This potential

change is hypothetical and intended to indicate the sensitivity of the

repurchase reserve to changes in the key assumptions. Actual changes in

the key assumptions may not occur at the same time or to the same degree

(i.e., an adverse change in one assumption may be offset by an improvement

in another). Citi does not believe it has sufficient information to estimate a

range of reasonably possible loss (as defined under ASC 450) relating to its

Consumer representations and warranties.