Citibank 2011 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2011 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

81

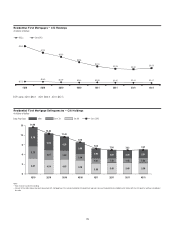

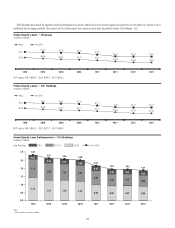

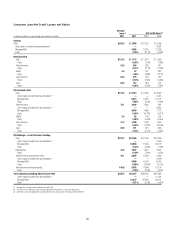

FICO and LTV Trend Information—

North America

Consumer Mortgages

0

20

40

60

80

100

4Q113Q112Q111Q114Q10

12.6 12.4 11.9 10.7 11.1

20.9 19.2 18.6 18.7 17.8

13.9 15.1 13.8 12.2 13.2

36.6 36.2 37.4 39.6 39.6

Residential First Mortgages

In billions of dollars

FICO < 660, LTV > 100% FICO < 660, LTV ≤ 100%

FICO ≥ 660, LTV > 100% FICO ≥ 660, LTV ≤ 100%

2ESIDENTIALæ-ORTGAGEæ$0$æ 1 1 1 1 1

&)#/æ≥ææ,46æ≤æ

&)#/æ≥ææ,46ææ

&)#/æææ,46æ≤æ

&)#/æææ,46ææ

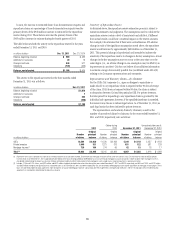

0

20

40

60

4Q113Q112Q111Q114Q10

6.1 5.8 5.8 5.3 5.4

5.5 5.1 5.3 5.3 4.5

14.3 14.6 13.6 12.5 12.8

21.2 19.8 19.1 19.4 18.4

Home Equity Loans

In billions of dollars

FICO < 660, LTV > 100% FICO < 660, LTV ≤ 100%

FICO ≥ 660, LTV > 100% FICO ≥ 660, LTV ≤ 100%

(OMEæ%QUITYæ$0$æ 1 1 1 1 1

&)#/æ≥ææ,46æ≤æ

&)#/æ≥ææ,46ææ

&)#/æææ,46æ≤æ

&)#/æææ,46ææ

.OTESæ

nææ$ATAæAPPEARINGæINæTHEæTABLESæABOVEæHAVEæBEENæSOURCEDæFROMæ#ITISæRISKæSYSTEMSæANDæASæSUCHæMAYæNOTæ

RECONCILEæWITHæDISCLOSURESæELSEWHEREæGENERALLYæDUEæTOæDIFFERENCESæINæMETHODOLOGYæORæVARIATIONSæINæTHEæ

MANNERæINæWHICHæINFORMATIONæISæCAPTUREDæ#ITIæHASæNOTEDæSUCHæVARIATIONSæINæINSTANCESæWHEREæITæBELIEVESæ

THEYæCOULDæBEæMATERIALæTOæRECONCILEæTOæTHEæINFORMATIONæPRESENTEDæELSEWHERE

nææ4ABLESæEXCLUDEæLOANSæINæ#ANADAæANDæ0UERTOæ2ICOæLOANSæGUARANTEEDæBYæ53æGOVERNMENTæAGENCIESæ

RESIDENTIALæFIRSTæMORTGAGESæTABLEæONLYæLOANSæRECORDEDæATæFAIRæVALUEæRESIDENTIALæFIRSTæMORTGAGESæTABLEæONLYæ

ANDæLOANSæSUBJECTæTOæ,43#S

nææ"ALANCESæEXCLUDEæDEFERREDæFEESCOSTSæ

nææ4ABLESæEXCLUDEæBALANCESæFORæWHICHæ&)#/æORæ,46æDATAæISæUNAVAILABLEæ&ORæRESIDENTIALæFIRSTæMORTGAGESæ

BALANCESæFORæWHICHæSUCHæDATAæISæUNAVAILABLEæINCLUDESæææBILLIONæFORæ1ææBILLIONæFORæ1æANDæ

æBILLIONæINæEACHæOFæ1æ1æANDæ1æ&ORæHOMEæEQUITYæLOANSæBALANCESæFORæWHICHæSUCHæDATAæISæ

UNAVAILABLEæINCLUDESææBILLIONæINæ1ææBILLIONæINæ1ææBILLIONæINæ1ææBILLIONæINæ1æ

ANDææBILLIONæINæ1

As evidenced by the table above, the overall proportion of 90+ days past

due residential first mortgages with refreshed FICO scores of less than 660

decreased year over year. Citi believes that the deterioration in these 90+ days

past due delinquency ratios from third to fourth quarter 2011 reflects the

decline in Citi’s asset sales of delinquent first mortgages, the lengthening of

the foreclosure process and the continued economic uncertainty, as discussed

in the sections above.

Although home equity loans are typically in junior lien positions and

residential first mortgages are typically in a first lien position, residential

first mortgages historically have experienced higher delinquency rates as

compared to home equity loans. Citi believes this difference is primarily

due to the fact that residential first mortgages are written down to collateral

value less cost to sell at 180 days past due and remain in the delinquency

population until full disposition through sale, repayment or foreclosure,

whereas home equity loans are generally fully charged off at 180 days past

due and thus removed from the delinquency calculation. In addition, due

to the longer timelines to foreclose on a residential first mortgage (see

“Foreclosures” above), these loans tend to remain in the delinquency

statistics for a longer period and, consequently, the 90 days or more

delinquencies of these mortgages remain higher.

Despite this historically higher level of delinquencies for residential

first mortgages, however, home equity loan delinquencies have generally

decreased at a slower rate than residential first mortgage delinquencies.

Citi believes this difference is due primarily to the lack of a market to sell

delinquent home equity loans and the relatively smaller number of home

equity loan modifications which, to date, have been the primary drivers

of Citi’s first mortgage delinquency improvement (see “North America

Consumer Mortgage Quarterly Credit Trends—Delinquencies and Net Credit

Losses—Residential First Mortgages” above).