Citibank 2011 Annual Report Download - page 203

Download and view the complete annual report

Please find page 203 of the 2011 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

181

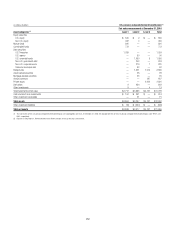

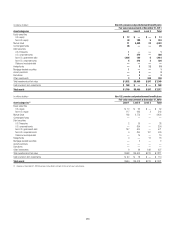

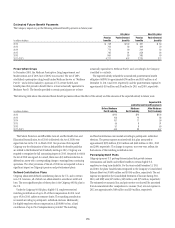

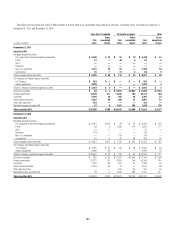

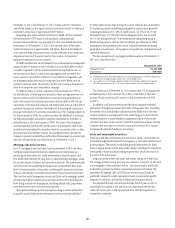

11. EARNINGS PER SHARE

The following is a reconciliation of the income and share data used in the basic and diluted earnings per share (EPS) computations for the years ended

December 31:

In millions, except per-share amounts 2011 (1) æ æ

Income (loss) from continuing operations before attribution of noncontrolling interests $ 11,103 æ

,ESSæ.ONCONTROLLINGæINTERESTSæFROMæCONTINUINGæOPERATIONS 148

Net income (loss) from continuing operations (for EPS purposes) $ 10,955 æ

)NCOMEæLOSSæFROMæDISCONTINUEDæOPERATIONSæNETæOFæTAXES 112

,ESSæ.ONCONTROLLINGæINTERESTSæFROMæDISCONTINUINGæOPERATIONS —

Citigroup’s net income (loss) $ 11,067 æ

,ESSæ)MPACTæOFæTHEæPUBLICæANDæPRIVATEæPREFERREDæSTOCKæEXCHANGEæOFFERS —

,ESSæ0REFERREDæDIVIDENDS 26

,ESSæ)MPACTæOFæTHEæCONVERSIONæPRICEæRESETæRELATEDæTOæTHEææBILLIONæ

CONVERTIBLEæPREFERREDæSTOCKæPRIVATEæISSUANCE —

,ESSæ0REFERREDæSTOCKæ3ERIESæ(æDISCOUNTæACCRETION —

Net income (loss) available to common shareholders $ 11,041 æ

,ESSæ$IVIDENDSæANDæUNDISTRIBUTEDæEARNINGSæALLOCATEDæTOæEMPLOYEEæRESTRICTEDæANDæ

DEFERREDæSHARESæTHATæCONTAINæNONFORFEITABLEæRIGHTSæTOæDIVIDENDSæAPPLICABLEæTOæBASICæ%03 186

Net income (loss) allocated to common shareholders for basic EPS (2) $ 10,855

!DDæ)NTERESTæEXPENSEæNETæOFæTAXæONæCONVERTIBLEæSECURITIESæANDæ

ADJUSTMENTæOFæUNDISTRIBUTEDæEARNINGSæALLOCATEDæTOæEMPLOYEEæ

RESTRICTEDæANDæDEFERREDæSHARESæTHATæCONTAINæNONFORFEITABLEæRIGHTSæ

TOæDIVIDENDSæAPPLICABLEæTOæDILUTEDæ%03 17

Net income (loss) allocated to common shareholders for diluted EPS (2) $ 10,872 æ

Weighted-average common shares outstanding applicable to basic EPS 2,909.8

%FFECTæOFæDILUTIVEæSECURITIES

#ONVERTIBLEæSECURITIES 0.1

/THERæEMPLOYEEæPLANS 0.5

/PTIONS 0.8

4$%#S 87.6

Adjusted weighted-average common shares outstanding applicable to diluted EPS (3) 2,998.8

Basic earnings per share

)NCOMEæLOSSæFROMæCONTINUINGæOPERATIONS $ 3.69 æ

$ISCONTINUEDæOPERATIONS 0.04

Net income (loss) $ 3.73 æ æ

Diluted earnings per share (2)(3)

)NCOMEæLOSSæFROMæCONTINUINGæOPERATIONS $ 3.59

$ISCONTINUEDæOPERATIONS 0.04

Net income (loss) $ 3.63 æ æ

æ !LLæPERSHAREæAMOUNTSæANDæ#ITIGROUPæSHARESæOUTSTANDINGæFORæALLæPERIODSæREFLECTæ#ITIGROUPSæFORæREVERSEæSTOCKæSPLITæWHICHæWASæEFFECTIVEæ-AYææ

æ $UEæTOæTHEæNETæLOSSæAVAILABLEæTOæCOMMONæSHAREHOLDERSæINææLOSSæAVAILABLEæTOæCOMMONæSTOCKHOLDERSæFORæBASICæ%03æWASæUSEDæTOæCALCULATEæDILUTEDæ%03æ)NCLUDINGæTHEæEFFECTæOFæDILUTIVEæSECURITIESæWOULDæRESULTæINæANTIDILUTION

æ $UEæTOæTHEæNETæLOSSæAVAILABLEæTOæCOMMONæSHAREHOLDERSæINææBASICæSHARESæWEREæUSEDæTOæCALCULATEæDILUTEDæ%03æ!DDINGæDILUTIVEæSECURITIESæTOæTHEæDENOMINATORæWOULDæRESULTæINæANTIDILUTION

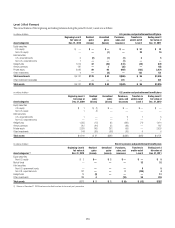

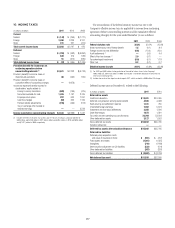

During 2011, 2010 and 2009, weighted-average options to purchase

24.1 million, 38.6 million and 16.6 million shares of common stock,

respectively, were outstanding but not included in the computation of

earnings per share because the weighted-average exercise prices of $123.47,

$102.89 and $315.65, respectively, were greater than the average market price

of the Company’s common stock.

Warrants issued to the U.S. Treasury as part of TARP and the loss-sharing

agreement (all of which were subsequently sold to the public in January

2011), with exercise prices of $178.50 and $106.10 for approximately

21.0 million and 25.5 million shares of common stock, respectively, were

not included in the computation of earnings per share in 2010 and 2009,

because they were anti-dilutive.

Equity awards granted under the Management Committee Long-Term

Incentive Plan (MC LTIP) were not included in the 2009 computation of

earnings per share because the performance targets under the terms of the

awards were not met and, as a result, the awards expired in the first quarter

of 2010.

The final tranche of equity units held by the Abu Dhabi Investment

Authority (ADIA) converted into 5.9 million shares of Citigroup common

stock during the third quarter of 2011. Equity units of approximately

11.8 million shares and 23.5 million shares of Citigroup common stock held

by ADIA were not included in the computation of earnings per share in 2010

and 2009, respectively, because the exercise price of $318.30 was greater than

the average market price of the Company’s common stock.