Citibank 2011 Annual Report Download - page 237

Download and view the complete annual report

Please find page 237 of the 2011 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.215

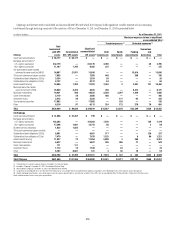

22. SECURITIZATIONS AND VARIABLE INTEREST

ENTITIES

Uses of SPEs

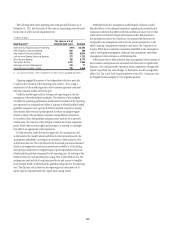

A special purpose entity (SPE) is an entity designed to fulfill a specific limited

need of the company that organized it. The principal uses of SPEs are to

obtain liquidity and favorable capital treatment by securitizing certain of

Citigroup’s financial assets, to assist clients in securitizing their financial

assets and to create investment products for clients. SPEs may be organized

in many legal forms including trusts, partnerships or corporations. In a

securitization, the company transferring assets to an SPE converts all (or a

portion) of those assets into cash before they would have been realized in

the normal course of business through the SPE’s issuance of debt and equity

instruments, certificates, commercial paper and other notes of indebtedness,

which are recorded on the balance sheet of the SPE and not reflected in the

transferring company’s balance sheet, assuming applicable accounting

requirements are satisfied.

Investors usually have recourse to the assets in the SPE and often benefit

from other credit enhancements, such as a collateral account or over-

collateralization in the form of excess assets in the SPE, a line of credit, or from

a liquidity facility, such as a liquidity put option or asset purchase agreement.

The SPE can typically obtain a more favorable credit rating from rating

agencies than the transferor could obtain for its own debt issuances, resulting in

less expensive financing costs than unsecured debt. The SPE may also enter into

derivative contracts in order to convert the yield or currency of the underlying

assets to match the needs of the SPE investors or to limit or change the credit

risk of the SPE. Citigroup may be the provider of certain credit enhancements as

well as the counterparty to any related derivative contracts.

Most of Citigroup’s SPEs are now VIEs, as described below.

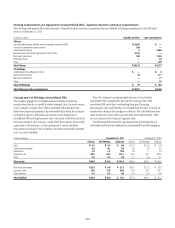

Variable Interest Entities

VIEs are entities that have either a total equity investment that is insufficient

to permit the entity to finance its activities without additional subordinated

financial support, or whose equity investors lack the characteristics of a

controlling financial interest (i.e., ability to make significant decisions

through voting rights, and right to receive the expected residual returns of

the entity or obligation to absorb the expected losses of the entity). Investors

that finance the VIE through debt or equity interests or other counterparties

that provide other forms of support, such as guarantees, subordinated fee

arrangements, or certain types of derivative contracts, are variable interest

holders in the entity.

The variable interest holder, if any, that has a controlling financial interest

in a VIE is deemed to be the primary beneficiary and must consolidate the

VIE. Citigroup would be deemed to have a controlling financial interest and

be the primary beneficiary if it has both of the following characteristics:

power to direct activities of a VIE that most significantly impact the

entity’s economic performance; and

obligation to absorb losses of the entity that could potentially be

significant to the VIE or right to receive benefits from the entity that could

potentially be significant to the VIE.

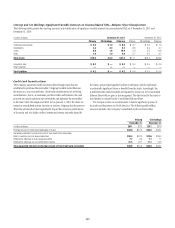

The Company must evaluate its involvement in each VIE and understand

the purpose and design of the entity, the role the Company had in the entity’s

design, and its involvement in the VIE’s ongoing activities. The Company

then must evaluate which activities most significantly impact the economic

performance of the VIE and who has the power to direct such activities.

For those VIEs where the Company determines that it has the power

to direct the activities that most significantly impact the VIE’s economic

performance, the Company then must evaluate its economic interests, if any,

and determine whether it could absorb losses or receive benefits that could

potentially be significant to the VIE. When evaluating whether the Company

has an obligation to absorb losses that could potentially be significant, it

considers the maximum exposure to such loss without consideration of

probability. Such obligations could be in various forms, including but not

limited to, debt and equity investments, guarantees, liquidity agreements,

and certain derivative contracts.

In various other transactions, the Company may act as a derivative

counterparty (for example, interest rate swap, cross-currency swap, or

purchaser of credit protection under a credit default swap or total return swap

where the Company pays the total return on certain assets to the SPE); may

act as underwriter or placement agent; may provide administrative, trustee or

other services; or may make a market in debt securities or other instruments

issued by VIEs. The Company generally considers such involvement, by itself,

not to be variable interests and thus not an indicator of power or potentially

significant benefits or losses.