Citibank 2011 Annual Report Download - page 293

Download and view the complete annual report

Please find page 293 of the 2011 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.271

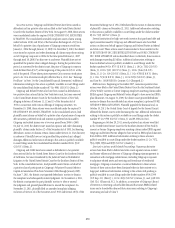

Mortgage-Backed Securities and CDO Investor Actions and Repurchase

Claims: Beginning in July 2010, several investors, including Cambridge

Place Investment Management, The Charles Schwab Corporation, the Federal

Home Loan Bank of Chicago, the Federal Home Loan Bank of Boston,

Allstate Insurance Company and affiliated entities, Union Central Life

Insurance Co. and affiliated entities, the Federal Housing Finance Agency,

the Western & Southern Life Insurance Company and affiliated entities,

Moneygram Payment Systems, Inc., and Loreley Financing (Jersey) No. 3

Ltd. and affiliated entities, have filed lawsuits against Citigroup and Related

Parties alleging actionable misstatements or omissions in connection with

the issuance and underwriting of MBS and CDOs. These actions are in early

stages. As a general matter, plaintiffs in these actions are seeking rescission

of their investments or other damages. Additional information relating to

these actions is publicly available in court filings under the docket numbers

10-2741-BLS1 (Mass. Super. Ct.) (Lauriat, J.), 11-0555-BLS1 (Mass. Super.

Ct.) (Lauriat, J.), CGC-10-501610 (Cal. Super. Ct.) (Kramer, J.), 10 CH

45033 (Ill. Super. Ct.) (Allen, J.), LC091499 (Cal. Super. Ct.) (Mohr, J.),

11 Civ. 10952 (D. Mass.) (O’Toole, J.), 11 Civ. 1927 (S.D.N.Y.) (Sullivan,

J.), 11 Civ. 2890 (S.D.N.Y.) (Daniels, J.), 11 Civ. 6188 (S.D.N.Y.) (Cote, J.),

11 Civ. 6196 (S.D.N.Y.) (Cote, J.), 11 Civ. 6916 (S.D.N.Y.) (Cote, J.), 11 Civ.

7010 (S.D.N.Y.) (Cote, J.), A 1105042 (Ohio Ct. Common Pleas) (Myers, J.),

No. 27-CB-11-21348 (Minn. Dist. Ct.) (Howard, J.) and 650212/12 (N.Y. Sup.

Ct.). Other purchasers of MBS or CDOs sold or underwritten by Citigroup

affiliates have threatened to file lawsuits asserting similar claims, some

of which Citigroup has agreed to toll pending further discussions with

these investors.

In addition, various parties to MBS securitizations, among others,

have asserted that certain Citigroup affiliates breached representations

and warranties made in connection with mortgage loans placed into

securitization trusts. Citigroup also has experienced an increase in the level

of inquiries relating to these securitizations, particularly requests for loan

files from trustees of securitization trusts and others. In December 2011,

Citigroup received a letter from the law firm Gibbs & Bruns LLP, which

purports to represent a group of investment advisers and holders of MBS

issued or underwritten by Citigroup. The letter asserts that Gibbs & Bruns

LLP’s clients collectively hold 25% or more of the voting rights in 35 MBS

trusts issued and/or underwritten by Citigroup affiliates, and that these

trusts have an aggregate outstanding balance in excess of $9 billion. The

letter alleges that certain mortgages in these trusts were sold or deposited

into the trusts based on misrepresentations by the mortgage originators,

sellers and/or depositors and that Citigroup improperly serviced mortgage

loans in those trusts. The letter further threatens to instruct trustees of the

trusts to assert claims against Citigroup based on these allegations. Gibbs &

Bruns LLP subsequently informed Citigroup that its clients hold the requisite

interest in 70 trusts in total, with an alleged total unpaid principal balance

of $24 billion, for which Gibbs & Bruns LLP asserts that Citigroup affiliates

have repurchase obligations. Citigroup is also a trustee of securitization trusts

for MBS issued by unaffiliated issuers that have received similar letters from

Gibbs & Bruns, LLP.

Given the continued and increased focus on mortgage-related matters,

as well as the increasing level of litigation and regulatory activity relating to

mortgage loans and mortgage-backed securities, the level of inquiries and

assertions respecting securitizations may further increase. These inquiries

and assertions could lead to actual claims for breaches of representations and

warranties, or to litigation relating to such breaches or other matters.

Underwriting Matters: Certain Citigroup affiliates have been named

as defendants arising out of their activities as underwriters of securities

in actions brought by investors in securities of issuers adversely affected

by the credit crisis, including AIG, Fannie Mae, Freddie Mac, Ambac and

Lehman, among others. These matters are in various stages of litigation. As

a general matter, issuers indemnify underwriters in connection with such

claims. In certain of these matters, however, Citigroup affiliates are not being

indemnified or may in the future cease to be indemnified because of the

financial condition of the issuer.

On September 28, 2011, the United States District Court for the Southern

District of New York approved a stipulation of settlement with the underwriter

defendants in IN RE AMBAC FINANCIAL GROUP, INC. SECURITIES

LITIGATION and judgment was entered. A member of the settlement class has

appealed the judgment to the United States Court of Appeals for the Second

Circuit. On December 22, 2011, the underwriter defendants moved to dismiss

the appeal. Additional information relating to this action is publicly available

in court filings under the docket numbers 08 Civ. 0411 (S.D.N.Y.) (Buchwald,

J.) and 11-4643 (2d Cir.).

Counterparty and Investor Actions

Citigroup and Related Parties have been named as defendants in actions

brought in various state and federal courts, as well as in arbitrations, by

counterparties and investors that claim to have suffered losses as a result

of the credit crisis. These actions include an arbitration brought by Abu

Dhabi Investment Authority (ADIA) alleging statutory and common law

claims in connection with its $7.5 billion investment in Citigroup. ADIA

sought rescission of the investment agreement or, in the alternative, more

than $4 billion in damages. A hearing took place in May 2011. Following

post-hearing proceedings, on October 14, 2011, the arbitration panel issued

a final award and statement of reasons finding in favor of Citigroup on all

claims asserted by ADIA. On January 11, 2012, ADIA filed a petition to vacate

the award in New York state court. On January 13, 2012, Citigroup removed

the petition to the United States District Court for the Southern District of New

York. Additional information regarding this matter is publicly available in

court filings under the docket number 12 Civ. 283 (S.D.N.Y.) (Daniels, J.).

In August 2011, two Saudi nationals and related entities commenced a

FINRA arbitration against Citigroup Global Markets, Inc. (CGMI) alleging

$380 million in losses resulting from certain options trades referencing a

portfolio of hedge funds and certain credit facilities collateralized by a private

equity portfolio. CGMI did not serve as the counterparty or credit facility

provider in these transactions. In September 2011, CGMI commenced an

action in the United States District Court for the Southern District of New

York seeking to enjoin the arbitration. Simultaneously with that filing, the

Citigroup entities that served as the counterparty or credit facility provider

to the transactions commenced actions in London and Switzerland for

declaratory judgments of no liability.