Citibank 2011 Annual Report Download - page 218

Download and view the complete annual report

Please find page 218 of the 2011 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

196

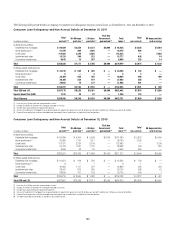

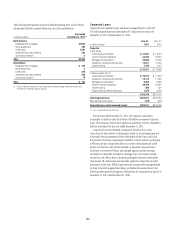

Consumer Credit Scores (FICO)

In the U.S., independent credit agencies rate an individual’s risk for

assuming debt based on the individual’s credit history and assign every

consumer a credit score. These scores are often called “FICO scores” because

most credit bureau scores used in the U.S. are produced from software

developed by Fair Isaac Corporation. Scores range from a high of 900 (which

indicates high credit quality) to 300. These scores are continually updated

by the agencies based upon an individual’s credit actions (e.g., taking out a

loan or missed or late payments).

The following table provides details on the FICO scores attributable

to Citi’s U.S. Consumer loan portfolio as of December 31, 2011 and

December 31, 2010 (commercial market loans are not included in the table

since they are business-based and FICO scores are not a primary driver in

their credit evaluation). FICO scores are updated monthly for substantially

all of the portfolio or, otherwise, on a quarterly basis.

During the first quarter of 2011, the cards businesses (Citi-branded and

retail partner cards) in the U.S. began using a more updated FICO model

version to score customer accounts for substantially all of their loans. The

change was made to incorporate a more recent version of FICO in order to

improve the predictive strength of the score and to enhance Citi’s ability

to manage risk. In the first quarter, this change resulted in an increase in

the percentage of balances with FICO scores equal to or greater than 660

and conversely lowered the percentage of balances with FICO scores lower

than 620.

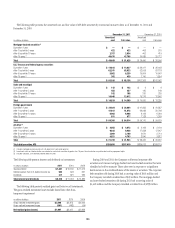

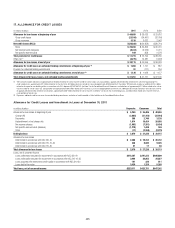

FICO score distribution in U.S. portfolio (1)(2) December 31, 2011

In millions of dollars

Less than

620

≥ 620 but less

than 660

Equal to or

greater

than 660

2ESIDENTIALæFIRSTæMORTGAGES $20,370 $ 8,815 $ 52,839

(OMEæEQUITYæLOANS 6,385 3,596 31,389

#REDITæCARDS 9,621 10,905 93,234

)NSTALLMENTæANDæOTHER 3,789 2,858 6,704

Total $40,165 $26,174 $184,166

æ %XCLUDESæLOANSæGUARANTEEDæBYæ53æGOVERNMENTæAGENCIESæLOANSæSUBJECTæTOæ,43#SæWITHæ53æ

GOVERNMENTSPONSOREDæAGENCIESæANDæLOANSæRECORDEDæATæFAIRæVALUE

æ %XCLUDESæBALANCESæWHEREæ&)#/æWASæNOTæAVAILABLEæ3UCHæAMOUNTSæAREæNOTæMATERIAL

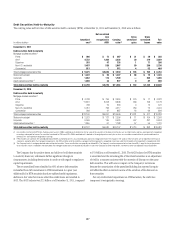

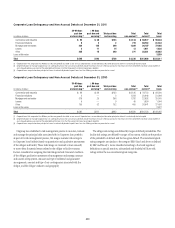

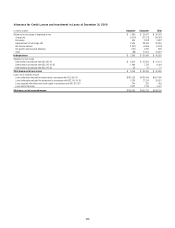

FICO score distribution in U.S. portfolio (1)(2) $ECEMBERææ

In millions of dollars

Less than

620

≥ 620 but less

than 660

Equal to or

greater

than 660

2ESIDENTIALæFIRSTæMORTGAGES

(OMEæEQUITYæLOANS

#REDITæCARDS

)NSTALLMENTæANDæOTHER

Total

æ %XCLUDESæLOANSæGUARANTEEDæBYæ53æGOVERNMENTæAGENCIESæLOANSæSUBJECTæTOæ,43#SæWITHæ53æ

GOVERNMENTSPONSOREDæAGENCIESæANDæLOANSæRECORDEDæATæFAIRæVALUE

æ %XCLUDESæBALANCESæWHEREæ&)#/æWASæNOTæAVAILABLEæ3UCHæAMOUNTSæAREæNOTæMATERIAL

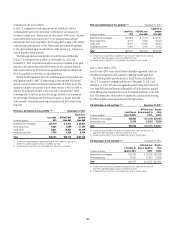

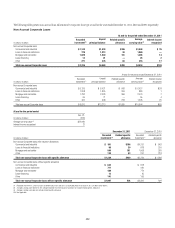

Loan to Value Ratios (LTV)

Loan to value (LTV) ratios (loan balance divided by appraised value) are

calculated at origination and updated by applying market price data.

The following tables provide details on the LTV ratios attributable to

Citi’s U.S. Consumer mortgage portfolios as of December 31, 2011 and

December 31, 2010. LTV ratios are updated monthly using the most recent

Core Logic HPI data available for substantially all of the portfolio applied

at the Metropolitan Statistical Area level, if available; otherwise, at the state

level. The remainder of the portfolio is updated in a similar manner using

the Office of Federal Housing Enterprise Oversight indices.

LTV distribution in U.S. portfolio (1)(2) December 31, 2011

In millions of dollars

Less than or

equal to 80%

> 80% but less

than or equal to

100%

Greater

than

100%

2ESIDENTIALæFIRSTæMORTGAGES $36,422 $ 21,146 $24,425

(OMEæEQUITYæLOANS 12,724 10,232 18,226

Total $49,146 $ 31,378 $42,651

æ %XCLUDESæLOANSæGUARANTEEDæBYæ53æGOVERNMENTæAGENCIESæLOANSæSUBJECTæTOæ,43#SæWITHæ53æ

GOVERNMENTSPONSOREDæAGENCIESæANDæLOANSæRECORDEDæATæFAIRæVALUE

æ %XCLUDESæBALANCESæWHEREæ,46æWASæNOTæAVAILABLEæ3UCHæAMOUNTSæAREæNOTæMATERIAL

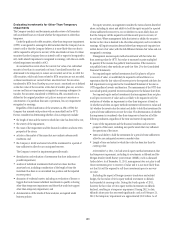

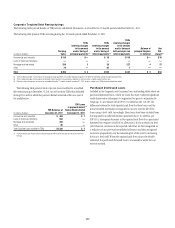

LTV distribution in U.S. portfolio (1)(2) $ECEMBERææ

In millions of dollars

Less than or

equal to 80%

> 80% but less

than or equal to

100%

Greater

than

100%

2ESIDENTIALæFIRSTæMORTGAGES

(OMEæEQUITYæLOANS

Total

æ %XCLUDESæLOANSæGUARANTEEDæBYæ53æGOVERNMENTæAGENCIESæLOANSæSUBJECTæTOæ,43#SæWITHæ53æ

GOVERNMENTSPONSOREDæAGENCIESæANDæLOANSæRECORDEDæATæFAIRæVALUE

æ %XCLUDESæBALANCESæWHEREæ,46æWASæNOTæAVAILABLEæ3UCHæAMOUNTSæAREæNOTæMATERIAL