Citibank 2011 Annual Report Download - page 243

Download and view the complete annual report

Please find page 243 of the 2011 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

221

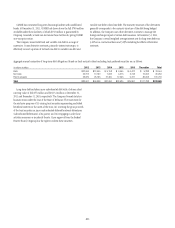

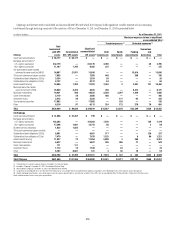

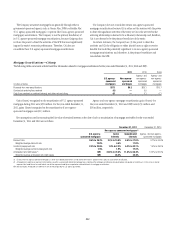

Credit Card Securitizations—Citicorp

The following table summarizes selected cash flow information related to

Citicorp’s credit card securitizations for the years ended December 31, 2011,

2010 and 2009:

In billions of dollars 2011

0ROCEEDSæFROMæNEWæSECURITIZATIONS $—

0AYæDOWNæOFæMATURINGæNOTES (12.8) .!

0ROCEEDSæFROMæCOLLECTIONSæREINVESTEDææ

INæNEWæRECEIVABLES N/A .!

#ONTRACTUALæSERVICINGæFEESæRECEIVED N/A .!

#ASHæFLOWSæRECEIVEDæONæRETAINEDææ

INTERESTSæANDæOTHERæNETæCASHæFLOWS N/A .!

Credit Card Securitizations—Citi Holdings

The following table summarizes selected cash flow information related to Citi

Holdings’ credit card securitizations for the years ended December 31, 2011,

2010 and 2009:

In billions of dollars 2011

0ROCEEDSæFROMæNEWæSECURITIZATIONS $ 3.9

0AYæDOWNæOFæMATURINGæNOTES (7.7) .!

0ROCEEDSæFROMæCOLLECTIONSæREINVESTEDææ

INæNEWæRECEIVABLES N/A .!

#ONTRACTUALæSERVICINGæFEESæRECEIVED N/A .!

#ASHæFLOWSæRECEIVEDæONæRETAINEDææ

INTERESTSæANDæOTHERæNETæCASHæFLOWS N/A .!

Managed Loans

After securitization of credit card receivables, the Company continues to

maintain credit card customer account relationships and provides servicing

for receivables transferred to the trusts. As a result, the Company considers

the securitized credit card receivables to be part of the business it manages.

As Citigroup consolidates the credit card trusts, all managed securitized card

receivables are on-balance sheet.

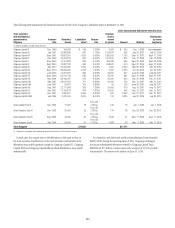

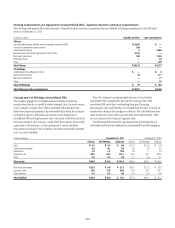

Funding, Liquidity Facilities and Subordinated Interests

Citigroup securitizes credit card receivables through two securitization

trusts—Citibank Credit Card Master Trust (Master Trust), which is part of

Citicorp, and the Citibank OMNI Master Trust (Omni Trust), which is part of

Citi Holdings as of December 31, 2011. The liabilities of the trusts are included

in the Consolidated Balance Sheet, excluding those retained by Citigroup.

Master Trust issues fixed- and floating-rate term notes. Some of the term

notes are issued to multi-seller commercial paper conduits. The weighted

average maturity of the term notes issued by the Master Trust was 3.1 years as

of December 31, 2011 and 3.4 years as of December 31, 2010.

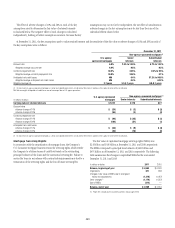

Master Trust Liabilities (at par value)

In billions of dollars

December 31,

2011

$ECEMBERæææ

4ERMæNOTESæISSUEDæTOæMULTISELLERææ

COMMERCIALæPAPERæCONDUITS $—

4ERMæNOTESæISSUEDæTOæTHIRDæPARTIES 30.4

4ERMæNOTESæRETAINEDæBYæ#ITIGROUPæAFFILIATESæ 7.7

Total Master Trust liabilities $38.1

The Omni Trust issues fixed- and floating-rate term notes, some of which

are purchased by multi-seller commercial paper conduits.

The weighted average maturity of the third-party term notes issued by

the Omni Trust was 1.5 years as of December 31, 2011 and 1.8 years as of

December 31, 2010.

Omni Trust Liabilities (at par value)

In billions of dollars

December 31,

2011

$ECEMBERææ

4ERMæNOTESæISSUEDæTOæMULTISELLERææ

COMMERCIALæPAPERæCONDUITS $ 3.4

4ERMæNOTESæISSUEDæTOæTHIRDæPARTIES 9.2

4ERMæNOTESæRETAINEDæBYæ#ITIGROUPæAFFILIATESæ 7.1

Total Omni Trust liabilities $19.7

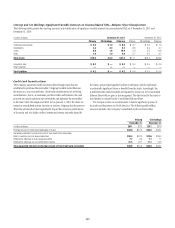

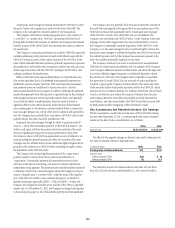

Mortgage Securitizations

The Company provides a wide range of mortgage loan products to a diverse

customer base.

Once originated, the Company often securitizes these loans through the

use of SPEs. These SPEs are funded through the issuance of Trust Certificates

backed solely by the transferred assets. These certificates have the same

average life as the transferred assets. In addition to providing a source of

liquidity and less expensive funding, securitizing these assets also reduces

the Company’s credit exposure to the borrowers. These mortgage loan

securitizations are primarily non-recourse, thereby effectively transferring

the risk of future credit losses to the purchasers of the securities issued by

the trust. However, the Company’s Consumer business generally retains

the servicing rights and in certain instances retains investment securities,

interest-only strips and residual interests in future cash flows from the trusts

and also provides servicing for a limited number of Securities and Banking

securitizations. Securities and Banking and Special Asset Pool do not retain

servicing for their mortgage securitizations.