Citibank 2011 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2011 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

27

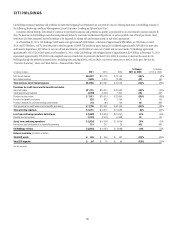

2011 vs. 2010

S&B’s results of operations for 2011 were significantly impacted by the

macroeconomic concerns during the year, including the overall pace of U.S.

economic recovery, the U.S. debt ceiling debate and subsequent downgrade of

U.S. sovereign credit, the ongoing sovereign debt crisis in Europe and general

continued concerns about the health of the global economy and financial

markets. These concerns led to heightened volatility as well as overall

declines in liquidity and market activity during the second half of the year as

clients reduced their activity and risk.

Net income of $4.9 billion decreased 24%. Excluding CVA/DVA (see table

below), net income decreased 43% as declines in fixed income and equity

markets revenues and investment banking revenues, along with higher

expenses, more than offset increases in lending and private bank revenues.

Revenues of $21.4 billion decreased 7% from the prior year. CVA/DVA

increased by $2.1 billion from the prior year, driven by the widening of Citi’s

credit spreads in 2011. Excluding CVA/DVA, S&B revenues decreased 16%,

reflecting lower results in fixed income markets, equity markets and investment

banking, partially offset by increased revenues in lending and the private bank.

Fixed income markets revenues, which constituted over 50% of S&B

revenues in 2011, decreased 24% excluding CVA/DVA. This was driven by

lower results in securitized and credit products, reflecting the challenging

market environment and reduced customer risk appetite and, to a lesser

extent, rates and currencies.

Equity markets revenues decreased 35% excluding CVA/DVA, driven by

declining revenues in equity proprietary trading (which Citi also refers to as

equity principal strategies) as positions in the business were wound down,

a decline in equity derivatives revenues and, to a lesser extent, a decline in

cash equities. The wind down of Citi’s equity proprietary trading was

completed at the end of 2011.

Investment banking revenues declined 14%, as the macroeconomic

concerns and market uncertainty drove lower volumes in debt and equity

issuance.

Lending revenues increased 87%, mainly due to the absence of losses on

credit default swap hedges in the prior year (see the table below). Excluding

the impact of these hedging gains and losses, lending revenues increased

3%, primarily due to growth in the Corporate loan portfolio. Private bank

revenues increased 6% excluding CVA/DVA, primarily due to higher loan and

deposit balances and improved customer pricing, partially offset by declines

in investment and capital markets-related products given the negative

market sentiment.

Expenses increased 2%, primarily due to investment spending, which

largely occurred in the first half of the year, relating to new hires and

technology investments. The increase in expenses was also driven by higher

repositioning charges and the negative impact of FX translation (which

contributed approximately 2% to the expense growth), partially offset by

productivity saves and reduced incentive compensation due to business

results. The increase in the level of investment spending in S&B was largely

completed at the end of 2011.

Provisions increased by $140 million, primarily due to builds in the

allowance for unfunded lending commitments as a result of portfolio growth

and higher net credit losses.

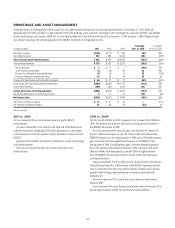

2010 vs. 2009

Net income of $6.4 billion decreased 30%. Excluding CVA/DVA, net income

decreased 36%, as an increase in lending was more than offset by declines

in fixed income and equity trading activities, investment banking fees and

higher expenses.

Revenues of $23.1 billion decreased 15% from the prior year, as

performance in the first half of 2009 was particularly strong due to higher

fixed income markets activity and client activity levels in investment

banking. In addition, 2010 CVA/DVA increased $1.6 billion from the prior

year, mainly due to a larger narrowing of Citi’s spreads in 2009 compared

2010. Excluding CVA/DVA, revenues decreased 19%, reflecting lower results

in fixed income markets, equity markets and investment banking, partially

offset by increased revenues in lending.

Fixed income markets revenues decreased 32% excluding CVA/DVA, primarily

reflecting lower results in rates and currencies, credit products and securitized

products due to the overall weaker market environment during 2010.

Equity markets revenues decreased 31% excluding CVA/DVA, driven

by lower trading revenues linked to the derivatives business and equity

proprietary trading.

Investment banking revenues declined 20%, reflecting lower levels of

market activity in debt and equity underwriting.

Lending revenues increased by $3.4 billion, mainly driven by a reduction

in losses on credit default swap hedges.

Expenses increased 12%, or $1.6 billion, year over year. Excluding the

2010 U.K. bonus tax impact and litigation reserve releases in the first half

of 2010 and 2009, expenses increased 8%, or $1.1 billion, mainly as a result

of higher compensation, transaction costs and the negative impact of FX

translation (which contributed approximately 1% to the expense growth).

Provisions decreased by $1.8 billion, to negative $24 million, mainly

due to credit reserve releases and lower net credit losses as the result of an

improvement in the credit environment during 2010.

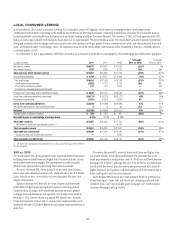

In millions of dollars 2011

S&B CVA/DVA

&IXEDæ)NCOMEæ-ARKETS $1,368

%QUITYæ-ARKETS 355

0RIVATEæ"ANK 9

Total S&B CVA/DVA $1,732

Total S&B Lending Hedge gain (loss) $ 73