Citibank 2011 Annual Report Download - page 198

Download and view the complete annual report

Please find page 198 of the 2011 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

176

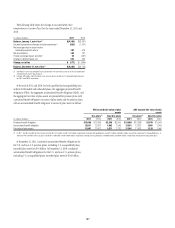

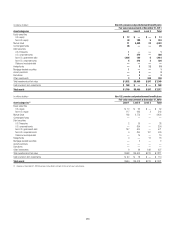

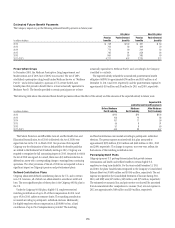

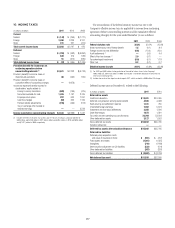

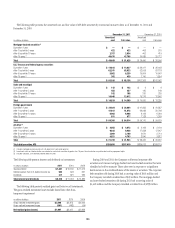

Estimated Future Benefit Payments

The Company expects to pay the following estimated benefit payments in future years:

U.S. plans Non-U.S. plans

In millions of dollars

Pension

benefits

Postretirement

benefits

Pension

benefits

Postretirement

benefits

æ

n

actuarially equivalent to Medicare Part D and, accordingly, the Company

is entitled to a subsidy.

The expected subsidy reduced the accumulated postretirement benefit

obligation (APBO) by approximately $96 million and $139 million as of

December 31, 2011 and 2010, respectively, and the postretirement expense by

approximately $10 million and $9 million for 2011 and 2010, respectively.

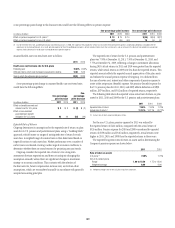

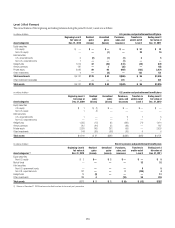

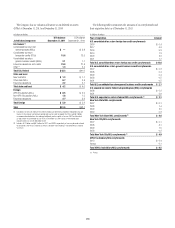

The following table shows the estimated future benefit payments without the effect of the subsidy and the amounts of the expected subsidy in future years:

Expected U.S.

postretirement benefit payments

In millions of dollars

Before Medicare

Part D subsidy

Medicare

Part D subsidy

After Medicare

Part D subsidy

æ æ

n

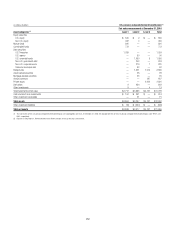

and fixed contributions are invested according to participants’ individual

elections. The pretax expense associated with this plan amounted to

approximately $383 million, $301 million and $442 million in 2011, 2010

and 2009, respectively. The change in expense, year-over-year, reflects the

fluctuations of the matching contribution rate.

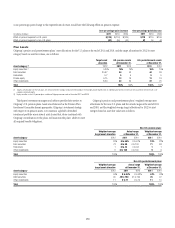

Postemployment Plans

Citigroup sponsors U.S. postemployment plans that provide income

continuation and health and welfare benefits to certain eligible U.S.

employees on long term disability. For the years ended December 31, 2011

and 2010, the plans’ funded status recognized in the Company’s Consolidated

Balance Sheet was $(469) million and $(436) million, respectively. The net

expense recognized in the Consolidated Statement of Income during 2011,

2010, and 2009 were $67 million, $69 million, and $57 million, respectively.

The estimated net actuarial loss and prior service cost that will be amortized

from Accumulated other comprehensive income (loss) into net expense in

2012 are approximately $169 million and $19 million, respectively.

Prescription Drugs

In December 2003, the Medicare Prescription Drug Improvement and

Modernization Act of 2003 (Act of 2003) was enacted. The Act of 2003

established a prescription drug benefit under Medicare known as “Medicare

Part D,” and a federal subsidy to sponsors of U.S. retiree health-care

benefit plans that provide a benefit that is at least actuarially equivalent to

Medicare Part D. The benefits provided to certain participants are at least

The Patient Protection and Affordable Care Act and the Health Care and

Education Reconciliation Act of 2010 (collectively, the Act of 2010) were

signed into law in the U.S. in March 2010. One provision that impacted

Citigroup was the elimination of the tax deductibility for benefits paid that

are related to the Medicare Part D subsidy, starting in 2013. Citigroup was

required to recognize the full accounting impact in 2010, the period in which

the Act of 2010 was signed. As a result, there was a $45 million reduction in

deferred tax assets with a corresponding charge to earnings from continuing

operations. The other provisions of the Act of 2010 are not expected to have a

significant impact on Citigroup’s pension and postretirement plans.

Defined Contribution Plans

Citigroup administers defined contribution plans in the U.S. and in certain

non-U.S. locations, all of which are administered in accordance with local

laws. The most significant plan of these plans is the Citigroup 401(k) plan in

the U.S.

Under the Citigroup 401(k) plan, eligible U.S. employees received

matching contributions of up to 6% of their compensation for 2011 and

up to 4% for 2010, subject to statutory limits. The matching contribution

is invested according to participants’ individual elections. Additionally,

for eligible employees whose compensation is $100,000 or less, a fixed

contribution of up to 2% of compensation is provided. The matching