Citibank 2011 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2011 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

90

In sum, the increase in estimated future loan documentation requests and

repurchase claims as a percentage of loan documentation requests were the

primary drivers of the $948 million increase in estimate for the repurchase

reserve during 2011. These factors were also the primary drivers of the

$305 million increase in estimate during the fourth quarter of 2011.

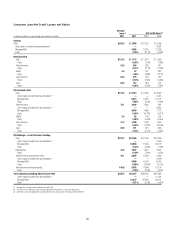

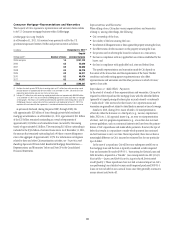

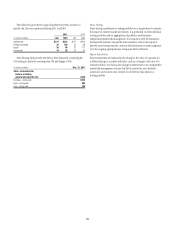

The table below sets forth the activity in the repurchase reserve for the years

ended December 31, 2011 and 2010:

In millions of dollars Dec. 31, 2011 $ECææ

"ALANCEæBEGINNINGæOFæPERIOD $ 969

!DDITIONSæFORæNEWæSALES 20

#HANGEæINæESTIMATE 948

5TILIZATIONS (749)

Balance, end of period $ 1,188

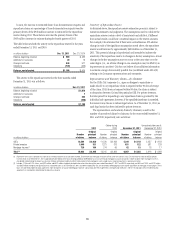

The activity in the repurchase reserve for the three months ended

December 31, 2011 was as follows:

In millions of dollars Dec. 31, 2011

"ALANCEæBEGINNINGæOFæPERIOD $ 1,076

!DDITIONSæFORæNEWæSALES 7

#HANGEæINæESTIMATE 305

5TILIZATIONS (200)

Balance, end of period $ 1,188

Sensitivity of Repurchase Reserve

As discussed above, the repurchase reserve estimation process is subject to

numerous estimates and judgments. The assumptions used to calculate the

repurchase reserve contain a level of uncertainty and risk that, if different

from actual results, could have a material impact on the reserve amounts.

For example, Citi estimates that if there were a simultaneous 10% adverse

change in each of the significant assumptions noted above, the repurchase

reserve would increase by approximately $620 million as of December 31,

2011. This potential change is hypothetical and intended to indicate the

sensitivity of the repurchase reserve to changes in the key assumptions. Actual

changes in the key assumptions may not occur at the same time or to the

same degree (i.e., an adverse change in one assumption may be offset by an

improvement in another). Citi does not believe it has sufficient information

to estimate a range of reasonably possible loss (as defined under ASC 450)

relating to its Consumer representations and warranties.

Representation and Warranty Claims—By Claimant

For the GSEs, Citi’s response (i.e., agree or disagree to repurchase or

make-whole) to any repurchase claim is required within 90 days of receipt

of the claim. If Citi does not respond within 90 days, the claim is subject

to discussions between Citi and the particular GSE. For private investors,

the time period for responding to any repurchase claim is governed by the

individual sale agreement; however, if the specified timeframe is exceeded,

the investor may choose to initiate legal action. As of December 31, 2011, no

such legal action has been initiated by private investors.

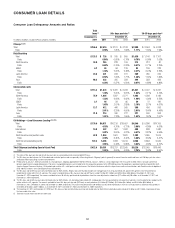

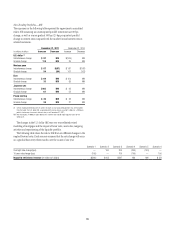

The representation and warranty claims by claimant, as well as the

number of unresolved claims by claimant, for the years ended December 31,

2011 and 2010, respectively, were as follows:

#LAIMSæDURINGæ 5NRESOLVEDæCLAIMSæASæOF

2011 December 31, 2011 $ECEMBERææ

In millions of dollars

Number

of claims

Original

principal

balance

.UMBERæ

OFæCLAIMS

/RIGINALææ

PRINCIPALææ

BALANCE

Number

of claims

Original

principal

balance

.UMBERæ

OFæCLAIMS

/RIGINALææ

PRINCIPALææ

BALANCE

'3%S 13,584 $ 2,930 5,344 $ 1,148

0RIVATEæINVESTORS 1,649 331 651 122

-ORTGAGEæINSURERSæ 729 164 62 15

Total (2) 15,962 $ 3,425 6,057 $ 1,285

æ 2EPRESENTSæTHEæINSURERSæREJECTIONæOFæAæCLAIMæFORæLOSSæREIMBURSEMENTæTHATæHASæYETæTOæBEæRESOLVEDæ4OæTHEæEXTENTæTHATæMORTGAGEæINSURANCEæWILLæNOTæCOVERæTHEæCLAIMæONæAæLOANæ#ITIæMAYæHAVEæTOæMAKEæTHEæ'3%æORæPRIVATEæ

INVESTORæWHOLEæ!SæOFæ$ECEMBERæææAPPROXIMATELYææBILLIONæOFæTHEæTOTALæSERVICINGæPORTFOLIOæOFææBILLIONæHASæINSURANCEæTHROUGHæMORTGAGEæINSURANCEæCOMPANIESæ&AILUREæTOæCOLLECTæFROMæMORTGAGEæINSURERSæISæ

CONSIDEREDæINæDETERMININGæTHEæREPURCHASEæRESERVEæ#ITIæDOESæNOTæBELIEVEæINABILITYæTOæCOLLECTæREIMBURSEMENTæFROMæMORTGAGEæINSURERSæWOULDæHAVEæAæMATERIALæIMPACTæONæITSæREPURCHASEæRESERVE

æ )NCLUDESææANDææCLAIMSæANDææMILLIONæANDææMILLIONæOFæORIGINALæPRINCIPALæBALANCEæFORæCLAIMSæDURINGæTHEæYEARSæENDEDæ$ECEMBERæææANDææRESPECTIVELYæANDææANDææANDææMILLIONæ

ANDææMILLIONæOFæORIGINALæPRINCIPALæBALANCEæFORæUNRESOLVEDæCLAIMSæASæOFæ$ECEMBERæææANDææRESPECTIVELYæTHATæAREæSERVICEDæBYæ#ITI-ORTGAGEæPURSUANTæTOæPRIORæACQUISITIONSæOFæMORTGAGEæSERVICINGæRIGHTSæ4HESEæ

LOANSæAREæCOVEREDæBYæINDEMNIFICATIONæAGREEMENTSæFROMæTHIRDæPARTIESæINæFAVORæOFæ#ITI-ORTGAGEæHOWEVERæSUBSTANTIALLYæALLæOFæTHESEæAGREEMENTSæWILLæEXPIREæPRIORæTOæ-ARCHæææ4HEæEXPIRATIONæOFæTHESEæINDEMNIFICATIONæ

AGREEMENTSæISæCONSIDEREDæINæDETERMININGæTHEæREPURCHASEæRESERVE