Citibank 2011 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2011 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.7

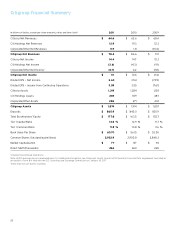

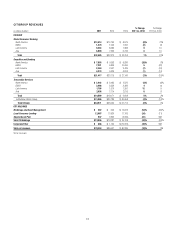

Expenses

Citigroup expenses were $50.9 billion in 2011, up $3.6 billion, or 8%,

compared to 2010. Over two-thirds of this increase resulted from higher legal

and related costs (approximately $1.5 billion) and higher repositioning

charges (approximately $200 million, including severance) as compared to

2010, as well as the impact of FX translation (approximately $800 million).

Excluding these items, expenses were up $1.0 billion, or 2%, compared to the

prior year.

Investment spending was $3.9 billion higher in 2011, of which

roughly half was funded with efficiency savings, primarily in operations

and technology, labor reengineering and business support functions

(e.g., call centers and collections) of $1.9 billion. The $3.9 billion

increase in investment spending in 2011 included higher investments

in Global Consumer Banking ($1.6 billion, including incremental

cards marketing campaigns and new branch openings), Securities

and Banking (approximately $800 million, including new hires and

technology investments) and Transaction Services (approximately $600

million, including new mandates and platform enhancements), as well as

additional firm-wide initiatives and investments to comply with regulatory

requirements. All other expense increases, including higher volume-

related costs in Citicorp, were more than offset by a decline in Citi Holdings

expenses. While Citi will continue some level of incremental investment

spending in its businesses going forward, Citi currently believes these

increases in investments will be self-funded through ongoing reengineering

and efficiency savings. Accordingly, Citi believes that the increased level of

investment spending incurred during the latter part of 2010 and 2011 was

largely completed by year end 2011.

Citicorp expenses were $39.6 billion in 2011, up $3.5 billion, or 10%,

compared to 2010. Over one-third of this increase resulted from higher legal

and related costs and higher repositioning charges (including severance) as

compared to 2010, as well as the impact of FX translation. The remainder

of the increase was primarily driven by investment spending (as described

above), partially offset by ongoing productivity savings and other expense

reductions.

Citi Holdings expenses were $8.8 billion in 2011, down $824 million,

or 9%, principally due to the continued decline in assets, partially offset by

higher legal and related costs.

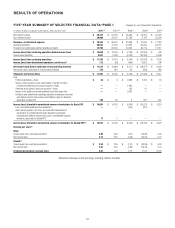

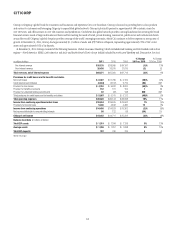

Credit Costs

Credit trends for Citigroup continued to improve in 2011, particularly for

Citi’s North America Citi-branded and retail partner cards businesses, as well

as its North America mortgage portfolios in Citi Holdings, although the pace

of improvement in these businesses slowed. Citi’s total provisions for credit

losses and for benefits and claims of $12.8 billion declined $13.2 billion, or

51%, from 2010. Net credit losses of $20.0 billion in 2011 were down $10.8

billion, or 35%, reflecting improvement in both Consumer and Corporate

credit trends. Consumer net credit losses declined $10.0 billion, or 35%, to

$18.4 billion, driven by continued improvement in credit in North America

Citi-branded cards and retail partner cards and North America real estate

lending in Citi Holdings. Corporate net credit losses decreased $810 million,

or 33%, to $1.6 billion, as credit quality continued to improve in the

Corporate portfolio.

The net release of allowance for loan losses and unfunded lending

commitments was $8.2 billion in 2011, compared to a net release of

$5.8 billion in 2010. Of the $8.2 billion net reserve release in 2011, $5.9

billion related to Consumer and was mainly driven by North America Citi-

branded cards and retail partner cards. The $2.3 billion net Corporate reserve

release reflected continued improvement in Corporate credit trends, partially

offset by loan growth.

More than half of the net credit reserve release in 2011, or $4.8 billion,

was attributable to Citi Holdings. The $3.5 billion net credit release in

Citicorp increased from $2.2 billion in the prior year, as a higher net release

in Citi-branded cards in North America was partially offset by lower net

releases in international Regional Consumer Banking and the Corporate

portfolio, each driven by loan growth.