Citibank 2011 Annual Report Download - page 265

Download and view the complete annual report

Please find page 265 of the 2011 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.243

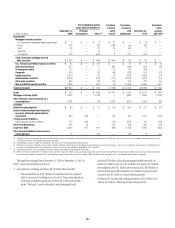

Trading account assets and liabilities—derivatives

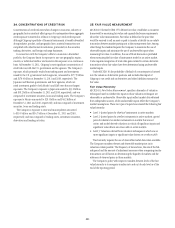

Exchange-traded derivatives are generally fair valued using quoted market

(i.e., exchange) prices and so are classified as Level 1 of the fair value

hierarchy.

The majority of derivatives entered into by the Company are executed

over the counter and so are valued using internal valuation techniques as no

quoted market prices exist for such instruments. The valuation techniques

and inputs depend on the type of derivative and the nature of the underlying

instrument. The principal techniques used to value these instruments are

discounted cash flows, Black-Scholes and Monte Carlo simulation. The fair

values of derivative contracts reflect cash the Company has paid or received

(for example, option premiums paid and received).

The key inputs depend upon the type of derivative and the nature of

the underlying instrument and include interest rate yield curves, foreign-

exchange rates, the spot price of the underlying volatility and correlation.

The item is placed in either Level 2 or Level 3 depending on the observability

of the significant inputs to the model. Correlation and items with longer

tenors are generally less observable.

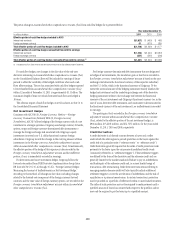

In the fourth quarter of 2011, the Company began incorporating

overnight indexed swap (“OIS”) curves as fair value measurement inputs for

the valuation of certain collateralized interest-rate related derivatives. The

OIS curves reflect the interest rates paid on cash collateral provided against

the fair value of these derivatives. The Company believes using relevant OIS

curves as inputs to determine fair value measurements provides a more

representative reflection of the fair value of these collateralized interest-rate

related derivatives. Previously, the Company used the relevant benchmark

curve for the currency of the derivative (e.g., the London Interbank Offered

Rate for U.S. dollar derivatives) as the discount rate for these collateralized

interest-rate related derivatives. The Company recognized a pretax gain of

approximately $167 million upon the change in this fair value measurement

input. For further information on derivative instruments and hedging

activities, see Note 23.

Subprime-related direct exposures in CDOS

The valuation of high-grade and mezzanine asset-backed security (ABS)

CDO positions uses trader prices based on the underlying assets of each high-

grade and mezzanine ABS CDO. The high-grade and mezzanine positions

are now largely hedged through the ABX and bond short positions, which

are trader priced. This results in closer symmetry in the way these long and

short positions are valued by the Company. Citigroup uses trader marks

to value this portion of the portfolio and will do so as long as it remains

largely hedged.

For most of the lending and structuring direct subprime exposures,

fair value is determined utilizing observable transactions where available,

other market data for similar assets in markets that are not active and other

internal valuation techniques.

Investments

The investments category includes available-for-sale debt and marketable

equity securities, whose fair value is determined using the same procedures

described for trading securities above or, in some cases, using vendor prices

as the primary source.

Also included in investments are nonpublic investments in private equity

and real estate entities held by the S&B business. Determining the fair

value of nonpublic securities involves a significant degree of management

resources and judgment as no quoted prices exist and such securities are

generally very thinly traded. In addition, there may be transfer restrictions

on private equity securities. The Company uses an established process for

determining the fair value of such securities, using commonly accepted

valuation techniques, including the use of earnings multiples based on

comparable public securities, industry-specific non-earnings-based multiples

and discounted cash flow models. In determining the fair value of nonpublic

securities, the Company also considers events such as a proposed sale of

the investee company, initial public offerings, equity issuances or other

observable transactions. As discussed in Note 15 to the Consolidated Financial

Statements, the Company uses NAV to value certain of these entities.

Private equity securities are generally classified as Level 3 of the fair value

hierarchy.

Short-term borrowings and long-term debt

Where fair value accounting has been elected, the fair values of non-

structured liabilities are determined by discounting expected cash flows using

the appropriate discount rate for the applicable maturity. Such instruments

are generally classified as Level 2 of the fair value hierarchy as all inputs are

readily observable.

The Company determines the fair values of structured liabilities (where

performance is linked to structured interest rates, inflation or currency risks)

and hybrid financial instruments (performance linked to risks other than

interest rates, inflation or currency risks) using the appropriate derivative

valuation methodology (described above) given the nature of the embedded

risk profile. Such instruments are classified as Level 2 or Level 3 depending

on the observability of significant inputs to the model.