Capital One 2010 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2010 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

79

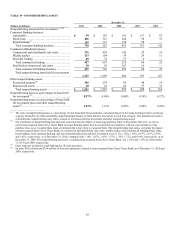

Table 37: Interest Rate Sensitivity Analysis

December 31,

2010 2009

Impact to projected base-line net interest income:

+ 200 basis points(1) ...................................................................... (0.7)% (0.4)%

- 50 basis points(1) ........................................................................ (0.2) (0.1)

Impact to economic value of equity:

+ 200 basis points(2) ...................................................................... (3.8)% (3.2)%

- 50 basis points(2) ........................................................................ 0.1 0.3

________________________

(1) These sensitivities include our net interest income and mortgage servicing rights valuation change (net of hedges). For net interest income, the

rate scenarios are based on a hypothetical gradual increase in interest rates of 200 basis points and a hypothetical gradual decrease of 50 basis

points to forward rates over the next 9 months. For the mortgage servicing rights valuation change (net of hedges), the rate scenarios are based

on a hypothetical instantaneous parallel rate shock of plus 200 basis points and minus 50 basis points to spot rates.

(2) Based on a hypothetical instantaneous parallel shift in the level of interest rates of plus 200 basis points and minus 50 basis points to spot rates.

The interest rate risk models that we use in deriving these measures incorporate contractual information, internally-developed

assumptions and proprietary modeling methodologies, which project borrower and deposit behavior patterns in certain interest rate

environments. Other market inputs, such as interest rates, market prices and interest rate volatility, are also critical components of our

interest rate risk measures. We regularly evaluate, update and enhance these assumptions, models and analytical tools as we believe

appropriate to reflect our best assessment of the market environment and the expected behavior patterns of our existing assets and

liabilities.

There are inherent limitations in any methodology used to estimate the exposure to changes in market interest rates. The above

sensitivity analyses contemplate only certain movements in interest rates and are performed at a particular point in time based on the

existing balance sheet, and do not incorporate other factors that may have a significant effect, most notably future business activities

and strategic actions that management may take to manage interest rate risk. Actual earnings and economic value of equity could

differ from the above sensitivity analyses.

Foreign Exchange Risk

We are exposed to changes in foreign exchange rates, which may impact the earnings of our foreign operations. Our asset/liability

management policy requires that we use derivatives to hedge material foreign currency denominated transactions to limit our earnings

exposure to foreign exchange risk. The estimated reduction in our 12-month earnings due to adverse foreign exchange rate movements

corresponding to a 95% probability was less than 2% as of December 31, 2010 and 2009. The precision of this estimate is limited due

to the inherent uncertainty of the underlying forecast assumptions.

Derivative Instruments

Derivatives are one of the primary tools we use in managing interest rate and foreign exchange risk. We execute our derivative

contracts in both over-the-counter and exchange-traded derivative markets. Although the majority of our derivatives are interest rate

swaps, we also use a variety of other derivative instruments, including caps, floors, options, futures and forward contracts, to manage

our interest rate and foreign currency risk. The outstanding notional amount of our derivative contracts totaled $50.8 billion as of

December 31, 2010, compared with $59.2 billion as of December 31, 2009. See “Note 11—Derivative Instruments and Hedging

Activities” for additional information on our derivatives activity.