Capital One 2010 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2010 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

6

Commercial Banking held its own through

the worst of the commercial credit cycle

Despite the distress in commercial real estate and mid-market

commercial lending markets, our Commercial Banking business

posted net income of $160 million in 2010. Revenue increased

12% as a result of improving loan margins, growth in our

deposit book, and higher non-interest income. Credit performance

remains relatively strong, with the charge-off rate in the 1%

range. Non-performing assets were down $248 million at

year-end from their peak in the first quarter of 2010.

Deposits grew by $2.2 billion, to $22.6 billion, while deposit

interest expense improved 19 basis points, to just 0.61%.

With the worst of the commercial credit cycle behind us,

we expect to grow low-risk commercial loans in 2011.

Increased emphasis on treasury management services and

stronger relationships with our commercial customers

drove the growth in non-interest income in 2010 and is

expected to generate more revenue growth opportunities

in 2011. We’re delivering strong commercial deposit

growth at attractive spreads, and deposit growth brings

new customers and strengthens existing relationships.

We can generate future loan and revenue growth by

expanding these relationships.

Our balance sheet is a

major source of strength

Throughout the recession, our analytical rigor and vigilance kept our balance sheet strong, reduced our risk,

and helped us identify and seize opportunities as they arose in the rapidly changing economic landscape.

In 2010 we added $8.8 billion in retail deposits, which are a stable, low-cost source of funding. At year-end,

our loan-to-deposit ratio had fallen to 1.03. We also have a $41.5 billion portfolio of high-quality securities,

which is a storehouse of readily available liquidity and a source of significant earnings.

We ended the year in a strong capital position. Our tangible common equity (TCE) ratio was 6.9%, and

our Tier 1 common ratio was 8.8%. We are one of the few banks that did not have to significantly dilute

shareholders with costly equity raises to address the challenges of the Great Recession.

To learn more visit capitalonebank.com

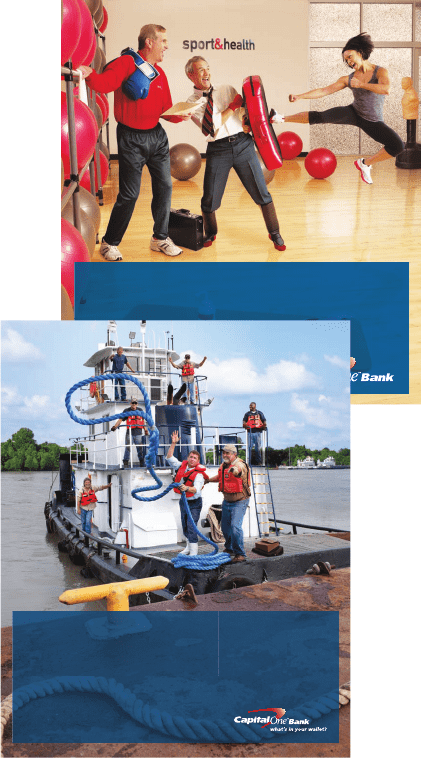

We’re rolling up our sleeves

to help D.C. businesses grow.

When D.C.’s largest locally owned health club was looking to expand, they turned to the area’s largest locally owned bank

for help. With Capital One Bank®, Sport & Health plans to open new clubs every year. Their Capital One commercial banker,

Rich Amador, is working hard to provide the financing and cash flow tools they need to grow their business and create

jobs in the Washington, D.C. area.

Capital One

Commercial Banker

Rich Amador

Sport & Health

Business Owner

Jonathan Adler

®

To learn more, stop by a branch, call 1-888-755-BANK,

or visit capitalonebank.com/smallbusiness.

It takes more than great banking to grow a business like Z. Dave’s towboat operation. It takes a banker

like Dean, who’s ready to roll up his sleeves and learn the ropes of your small business, helping out with

everything from cash fl ow tools to cargo, from payloads to payroll.

Get onboard with the hardest

working bankers in business.

Deloach Marine

Services Owner

Z. Dave Delo ach

Capital One

Business Banker

Dean Beeson

Our Commercial and Small Business bankers

have the expertise and are willing to go the extra

mile to help make our customers successful.