Capital One 2010 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2010 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

34

expiration periods. To the extent we do not consider it more likely than not that a deferred tax asset will be recovered, a valuation

allowance is established. If changes in circumstances lead us to change our judgment about our ability to realize deferred tax assets in

future years, we would adjust our valuation allowances in the period that the change in circumstances occurs and record a

corresponding increase or charge to income.

We provide additional information on income taxes in “Consolidated Results of Operations Financial Performance” and in “Note 18—

Income Taxes.”

RECENT ACCOUNTING PRONOUNCEMENTS

New accounting pronouncements or changes in existing accounting pronouncements may have a significant effect on our results of

operations, financial condition, stockholders’ equity, capital ratios or business operations. As discussed above, effective January 1,

2010, we adopted two new accounting standards that had a significant impact on the manner in which we account for our

securitization transactions, our consolidated financial statements and our capital ratios. These new accounting standards eliminated the

concept of qualified special purpose entities (“QSPEs”), revised the accounting for transfers of financial assets and changed the

consolidation criteria for variable interest entities (“VIEs”). Under the new accounting guidance, the determination to consolidate a

VIE is based on a qualitative assessment of which party to the VIE has “power” combined with potentially significant benefits or

losses, instead of the previous quantitative risks and rewards model. Consolidation is required when an entity has the power to direct

matters which significantly impact the economic performance of the VIE, together with either the obligation to absorb losses or the

rights to receive benefits that could be significant to the VIE. The prospective adoption of this new accounting guidance resulted in

our consolidating substantially all our existing securitization trusts that had previously been off-balance sheet and eliminated sales

treatment for new transfers of loans to securitization trusts.

We provide additional information on the impact of these new accounting standards above in “Impact from Adoption of New

Consolidation Accounting Standards” and in “Note 1—Summary of Significant Accounting Policies.” We also identify and discuss

the impact of other significant recently issued accounting pronouncements, including those not yet adopted, in “Note 1—Summary of

Significant Accounting Policies.”

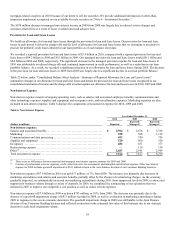

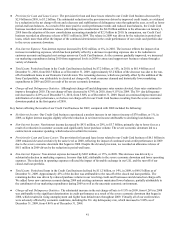

OFF-BALANCE SHEET ARRANGEMENTS AND VARIABLE INTEREST ENTITIES

In the ordinary course of business, we are involved in various types of transactions with limited liability companies, partnerships or

trusts that often involve special purpose entities (“SPEs”) and VIEs. Some of these arrangements are not recorded on our consolidated

balance sheets or may be recorded in amounts different from the full contract or notional amount of the transaction, depending on the

nature or structure of, and accounting required to be applied to, the arrangement. These arrangements may expose us to potential

losses in excess of the amounts recorded in the consolidated balance sheets. Our involvement in these arrangements can take many

forms, including securitization and servicing activities, the purchase or sale of mortgage-backed or other asset-backed securities in

connection with our home loan portfolio, and loans to VIEs that hold debt, equity, real estate or other assets. Under previous

accounting guidance, we were not required to consolidate the majority of our securitization trusts because they were QSPEs.

Accordingly, we considered these trusts to be off-balance sheet arrangements.

In June 2009, the FASB issued two new accounting standards that eliminated the concept of QSPEs, revised the accounting for

transfers of financial assets and changed the consolidation criteria for VIEs. As discussed above in “Impact from Adoption of New

Consolidation Accounting Standards,” we prospectively adopted these new standards on January 1, 2010, which resulted in the

consolidation of our credit card securitization trusts, one installment loan trust, certain option-ARM loan trusts originated by Chevy

Chase Bank for which we provide servicing and certain affordable housing entities. All of our remaining securitization trusts were

consolidated or liquidated as of December 31, 2010.

Our continuing involvement in unconsolidated VIEs primarily consists of certain mortgage loan trusts and community reinvestment

and development entities. The carrying amount of assets and liabilities of these unconsolidated VIEs was $2.0 billion and $344

million, respectively, as of December 31, 2010, and our maximum exposure to loss was $2.2 billion. We provide a discussion of our

activities related to these VIEs in “Note 7—Variable Interest Entities and Securitizations.”

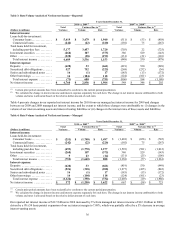

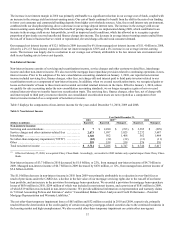

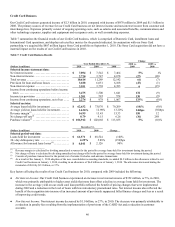

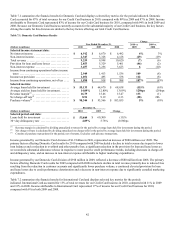

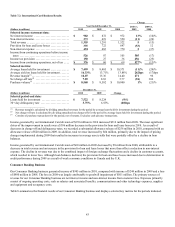

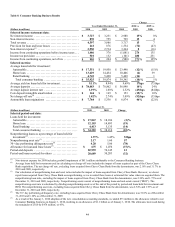

CONSOLIDATED RESULTS OF OPERATIONS FINANCIAL PERFORMANCE

As indicated above under “Impact from Adoption of New Consolidation Accounting Standards,” our reported results subsequent to

January 1, 2010 are not presented on a basis consistent with our reported results prior to January 1, 2010 as a result of our adoption of

the new consolidation accounting standards. Our reported results subsequent to January 1, 2010 are more comparable to our managed

results because we assumed for our managed based reporting that our securitized loans had not been sold and that the earnings from

securitized loans were classified in our results of operations in the same manner as the earnings on loans that we owned. Accordingly,