Capital One 2010 Annual Report Download - page 172

Download and view the complete annual report

Please find page 172 of the 2010 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED STATEMENTS

152

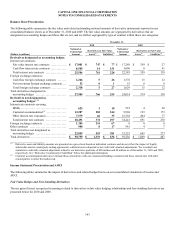

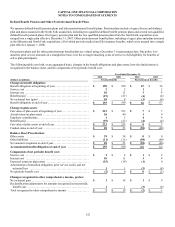

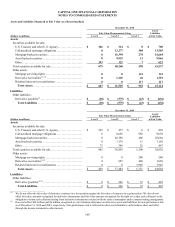

Defined Benefit Pension and Other Postretirement Benefit Plans

We sponsor defined benefit pension plans and other postretirement benefit plans. Pension plans include a legacy frozen cash balance

plan and plans assumed in the North Fork acquisition, including two qualified defined benefit pension plans and several non-qualified

defined benefit pension plans. Our legacy pension plan and the two qualified pension plans from the North Fork acquisition were

merged into a single plan effective December 31, 2007. Other postretirement benefit plans, including a legacy plan and plans assumed

in the Hibernia and North Fork acquisitions, all of which provide medical and life insurance benefits, which were merged into a single

plan effective January 1, 2008.

Our pension plans and the other postretirement benefit plans are valued using a December 31 measurement date. Our policy is to

amortize prior service amounts on a straight-line basis over the average remaining years of service to full eligibility for benefits of

active plan participants.

The following table sets forth, on an aggregated basis, changes in the benefit obligations and plan assets, how the funded status is

recognized in the balance sheet, and the components of net periodic benefit cost:

Year Ended December 31,

2010 2009 2010 2009

(Dollars in millions) Pension Benefits Postretirement Benefits

Change in benefit obligation:

Benefit obligation at beginning of year ..........................

.

$ 190 $ 190 $ 67 $ 74

Service cost ..................................................

.

2 2 1 2

Interest cost ..................................................

.

10 11 3 4

Benefits paid .................................................

.

(19) (21) (4) (4)

N

et actuarial loss (gain) .......................................

.

10 8 (1) (9)

Benefit obligation at end of year ................................

.

$ 193 $ 190 $ 66 $ 67

Change in plan assets:

Fair value of plan assets at beginning of year ....................

.

$ 213 $ 193 $ 7 $ 7

Actual return on plan assets ....................................

.

26 40 1 0

Employer contributions ........................................

.

1 1 4 4

Benefits paid .................................................

.

(19) (21) (4) (4)

Fair value of plan assets at end of year ..........................

.

$ 221 $ 213 $ 8 $ 7

Funded status at end of year ....................................

.

$ 28 $ 23 $ (58) $ (60)

Balance Sheet Presentation:

Other assets ..................................................

.

$ 39 $ 34 $ 0 $ 0

Other liabilities ...............................................

.

(11) (11) (58) (60)

N

et amount recognized at end of year ...........................

.

$ 28 $ 23 $ (58) $ (60)

Accumulated benefit obligation at end of year ................

.

$ 193 $ 190 n/a n/a

Components of net periodic benefit cost:

Service cost ..................................................

.

$ 2 $ 2 $ 1 $ 2

Interest cost ..................................................

.

10 11 3 4

Expected return on plan assets .................................

.

(15) (14) (1) 0

Amortization of transition obligation, prior service credit, and net

actuarial loss ...............................................

.

1 1 (3) (8)

N

et periodic benefit cost .......................................

.

$ (2) $ 0 $ 0 $ (2)

Changes recognized in other comprehensive income, pretax:

N

et actuarial gain .............................................

.

$ 1 $ 18 $ 1 $ 9

Reclassification adjustments for amounts recognized in net periodic

benefit cost .................................................

.

1 1 (3) (8)

Total recognized in other comprehensive income ................

.

$ 2 $ 19 $ (2) $ 1