Capital One 2010 Annual Report Download - page 190

Download and view the complete annual report

Please find page 190 of the 2010 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED STATEMENTS

170

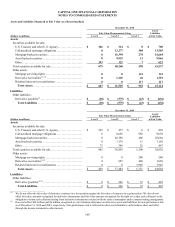

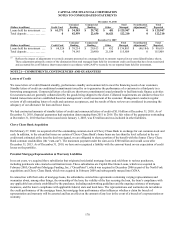

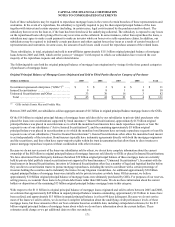

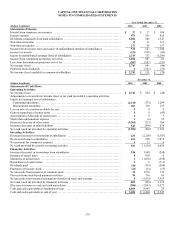

December 31, 2010

(Dollars in millions) Credit Card

Consumer

Banking

Commercial

Banking Other

Total

Managed

Securitization

Adjustments(1)

Total

Reported

Loans held for investment . . . $ 61,371 $ 34,383 $ 29,742 $ 451 $ 125,947 $ 0 $ 125,947

Total deposits ............... 0 82,959 22,630 16,621 122,210 0 122,210

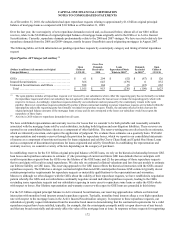

December 31, 2009

(Dollars in millions) Credit Card

Consumer

Banking

Commercial

Banking Other

Total

Managed

Securitization

Adjustments(1)

Total

Reported

Loans held for investment . . . $ 68,524 $ 38,214 $ 29,613 $ 452 $ 136,803 $ (46,184) $ 90,619

Total deposits ............... 0 74,145 20,480 21,184 115,809 0 115,809

________________________

(1) Reflects the impact of adjustments to reconcile amounts presented on a managed basis to amounts reported in our consolidated balance sheets.

These adjustments primarily consist of the elimination from total managed loans held for investment credit card loans that have been securitized

and accounted for as off-balance sheet transactions in accordance with GAAP to reconcile to our reported loans held for investment.

NOTE 21—COMMITMENTS, CONTINGENCIES AND GUARANTEES

Letters of Credit

We issue letters of credit (financial standby, performance standby and commercial) to meet the financing needs of our customers.

Standby letters of credit are conditional commitments issued by us to guarantee the performance of a customer to a third party in a

borrowing arrangement. Commercial letters of credit are short-term commitments issued primarily to facilitate trade finance activities

for customers and are generally collateralized by the goods being shipped to the client. Collateral requirements are similar to those for

funded transactions and are established based on management’s credit assessment of the customer. Management conducts regular

reviews of all outstanding letters of credit and customer acceptances, and the results of these reviews are considered in assessing the

adequacy of our allowance for loan and lease losses.

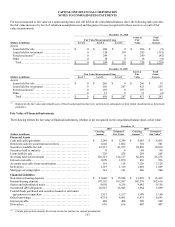

We had contractual amounts of standby letters of credit and commercial letters of credit of $1.8 billion at December 31, 2010. As of

December 31, 2010, financial guarantees had expiration dates ranging from 2011 to 2016. The fair value of the guarantees outstanding

at December 31, 2010 that have been issued since January 1, 2003, was $3 million and was included in other liabilities.

Chevy Chase Bank Acquisition

On February 27, 2009, we acquired all of the outstanding common stock of Chevy Chase Bank in exchange for our common stock and

cash. In addition, to the extent that losses on certain of Chevy Chase Bank’s home loans are less than the level reflected in the net

credit mark estimated at the time the deal was signed, we are obligated to share a portion of the benefit with the former Chevy Chase

Bank common stockholders (the “earn-out”). The maximum payment under the earn-out is $300 million and would occur after

December 31, 2013. As of December 31, 2010, we have not recognized a liability with the earn-out based on our expectation of credit

losses on the portfolio.

Potential Mortgage Representation & Warranty Liabilities

In recent years, we acquired three subsidiaries that originated residential mortgage loans and sold them to various purchasers,

including purchasers who created securitization trusts. These subsidiaries are Capital One Home Loans, which was acquired in

February 2005; GreenPoint Mortgage Funding, Inc. (“GreenPoint”), which was acquired in December 2006 as part of the North Fork

acquisition; and Chevy Chase Bank, which was acquired in February 2009 and subsequently merged into CONA.

In connection with their sales of mortgage loans, the subsidiaries entered into agreements containing varying representations and

warranties about, among other things, the ownership of the loan, the validity of the lien securing the loan, the loan’s compliance with

any applicable loan criteria established by the purchaser, including underwriting guidelines and the ongoing existence of mortgage

insurance, and the loan’s compliance with applicable federal, state and local laws. The representations and warranties do not address

the credit performance of the mortgage loans, but mortgage loan performance often influences whether a claim for breach of

representation and warranty will be asserted and has an effect on the amount of any loss in the event of a breach of a representation or

warranty.