Capital One 2010 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2010 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.32

our external cost of equity, adjusted for risks inherent in each reporting unit. We corroborated the key inputs used in our discounted

cash flow analysis with market data, where available, to validate that our assumptions were within a reasonable range of observable

market data.

Based on the results of step one of our 2010 goodwill impairment test, we determined that the carrying amount of each of our

reporting units, including goodwill, exceeded the fair value. Accordingly, the goodwill of our reporting units was considered not

impaired, and the second step of impairment testing was not required. However, assuming all other factors were held constant, a 34%

decline in the fair value of the Domestic Card reporting unit, a 14% decline in the fair value of the International Card reporting unit, a

37% decline in the fair value of the Auto Finance reporting unit, a 30% decline in the fair value of the Commercial Banking reporting

unit and a 21% decline in the fair value of the other Consumer Banking reporting unit would have caused the carrying amount for

those reporting units to be in excess of fair value which would require the second step to be performed.

As part of the annual goodwill impairment test, we assessed our market capitalization based on the average market price relative to the

aggregate fair value of our reporting units and determined that any excess fair value in our reporting units at that time could be

attributed to a reasonable control premium compared to historical control premiums seen in the industry. During 2009, the lack of

liquidity in the financial markets and the continued economic deterioration led to a decline in market capitalization resulting in

significantly higher control premiums than what had been seen historically. Throughout 2010, our capitalization rate increased

resulting in a decline in our implied control premium. We will continue to regularly monitor our market capitalization in 2011, overall

economic conditions and other events or circumstances that may result in an impairment of goodwill in the future.

Intangible assets with definite useful lives are amortized over their estimated lives and evaluated for potential impairment whenever

events or changes in circumstances suggest that an asset’s or asset group’s carrying value may not be fully recoverable. An

impairment loss, generally calculated as the difference between the estimated fair value and the carrying value of an asset or asset

group, is recognized if the sum of the estimated undiscounted cash flows relating to the asset or asset group is less than the

corresponding carrying value. We did not recognize impairment on our other intangible assets in 2010, 2009 or 2008.

We provide additional information on the nature of and accounting for goodwill and intangible assets, including the process and

methodology used to conduct goodwill impairment testing, in “Note 8—Goodwill and Other Intangible Assets.”

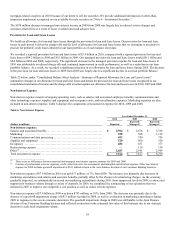

Representation and Warranty Reserve

In connection with their sales of mortgage loans, certain subsidiaries entered into agreements containing varying representations and

warranties about, among other things, the ownership of the loan, the validity of the lien securing the loan, the loan’s compliance with

any applicable loan criteria established by the purchaser, including underwriting guidelines and the ongoing existence of mortgage

insurance, and the loan’s compliance with applicable federal, state and local laws. We may be required to repurchase the mortgage

loan, indemnify the investor or insurer, or reimburse the investor for credit losses incurred on the loan in the event of a material breach

of contractual representations or warranties.

We have established representation and warranty reserves for losses that we consider to be both probable and reasonably estimable

associated with the mortgage loans sold by each subsidiary, including both litigation and non-litigation liabilities. The reserve-setting

process relies heavily on estimates, which are inherently uncertain, and requires the application of judgment. In establishing the

representation and warranty reserves, we consider a variety of factors, depending on the category of purchaser and rely on historical

data. We evaluate these estimates on a quarterly basis.

During the first and second quarters of 2010, we made significant refinements to our process for estimating our representation and

warranty reserve, due primarily to increased counterparty activity and our ability to extend the timeframe over which we estimate our

repurchase liability for mortgage loans sold by our subsidiaries to GSEs and those mortgage loans placed into Active Insured

Securitizations for the full life of the mortgage loans. Prior to the second quarter of 2010, we generally estimated the amount of

probable repurchase requests to be received over the next 12 months. As a result of these refinements, we recorded a substantial

increase in our representation and warranty repurchase reserve in the first and second quarters of 2010. Approximately $407 million of

the $636 million of provision for representation and warranty reserves recorded in 2010 resulted from our extension of repurchase

liability estimates to the life of the loan effective in the second quarter of 2010. The remaining $229 million related primarily to

changing counterparty activity in the form of updated estimates around active and probable litigation, most of which occurred in the

first quarter of 2010.

Our aggregate representation and warranty mortgage repurchase reserves, which we report as a component of other liabilities in our

consolidated balance sheets, totaled $816 million as of December 31, 2010, compared with $238 million as of December 31,

2009. The adequacy of the reserves and the ultimate amount of losses incurred by us or one of our subsidiaries will depend on, among

other things, actual future mortgage loan performance, the actual level of future repurchase and indemnification requests, the actual

success rates of claimants, developments in litigation, actual recoveries on the collateral and macroeconomic conditions (including