Capital One 2010 Annual Report Download - page 164

Download and view the complete annual report

Please find page 164 of the 2010 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

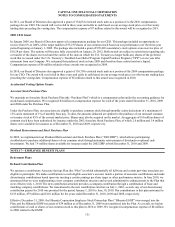

CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED STATEMENTS

144

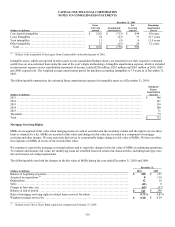

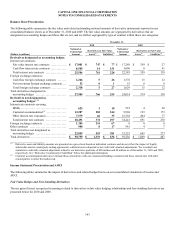

Year Ended December 31,

(Dollars in millions) 2010 2009

Derivatives designated as accounting hedges:

Fair value interest rate contracts:

Gain (loss) recognized in earnings on derivatives(1) ..........................................

.

$ 343 $ (266)

Gain (loss) recognized in earnings on hedged items(1) ........................................

.

(293) 313

Net fair value hedge ineffectiveness gain ..................................................

.

50 47

Derivatives not designated as accounting hedges:

Interest rate contracts covering:

MSRs(2) ..................................................................................

.

(21) (27)

Customer accommodation(1) ...............................................................

.

25 2

Other interest rate exposures(1) .............................................................

.

5 15

Total interest rate contracts ..............................................................

.

9 (10)

Foreign exchange contracts(1) ................................................................

.

4 0

Other contracts(2) ............................................................................

.

38 (9)

Total gain (loss) on derivatives not designated as accounting hedges .........................

.

51 (19)

N

et derivatives gain recognized in earnings ...................................................

.

$ 101 $ 28

________________________

(1) Amounts are recorded in our consolidated statements of income in other non-interest income.

(2) Other contracts include items such as To Be Announced (“TBA”) forward contracts and futures contracts. Of the $38 million of income

recognized in 2010, $43 million was included in our consolidated statements of income in servicing and securitizations income offset by $5

million of expense included in non-interest income. Of the $9 million of expense recognized in 2009, $4 million was included in servicing and

securitizations income and $5 million was included in non-interest income.

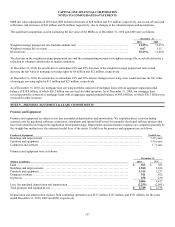

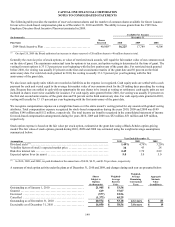

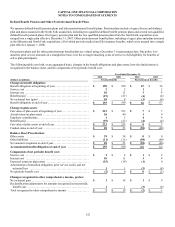

Cash Flow and Net Investment Hedges

The table below shows the net gains (losses) related to derivatives designated as cash flow hedges and net investment hedges for 2010

and 2009.

Year Ended December 31,

(Dollars in millions) 2010 2009

Gain (loss) recorded in AOCI:(1)

Cash flow hedges:

Interest rate contracts ......................................................................

.

$ 83 $ 175

Foreign exchange contracts ................................................................

.

(1) 11

Subtotal ................................................................................

.

82 186

Net investment hedges:

Foreign exchange contracts ................................................................

.

0 (7)

N

et derivatives gain recognized in AOCI ......................................................

.

$ 82 $ 179

Gain (loss) recorded in earnings:

Cash flow hedges:

Gain (loss) reclassified from AOCI into earnings:

Interest rate contracts(2) ....................................................................

.

$ (74) $ (89)

Foreign exchange contracts(3) ...............................................................

.

0 (3)

Subtotal ................................................................................

.

(74) (92)

Gain (loss) recognized in earnings due to ineffectiveness:

Interest rate contracts(3) ....................................................................

.

1 (1)

Foreign exchange contracts (3) ..............................................................

.

0 0

Subtotal ..............................................................................

.

1 (1)

Net investment hedges:

Gain (loss) reclassified from AOCI into earnings:(1)

Foreign exchange contracts ................................................................

.

0 0

N

et derivatives loss recognized in earnings ....................................................

.

$ (73) $ (93)

________________________

(1) Amounts represent the effective portion.

(2) Amounts reclassified are recorded in our consolidated statements of income in interest income or interest expense.

(3) Amounts reclassified are recorded in our consolidated statements of income in other non-interest income.