Capital One 2010 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2010 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED STATEMENTS

114

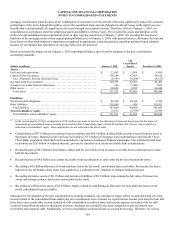

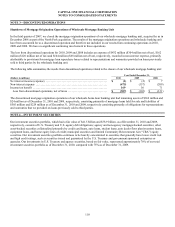

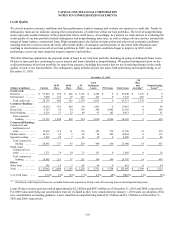

Because borrowers may have the right to call or prepay certain obligations, the expected maturities of our securities are likely to differ

from the scheduled contractual maturities presented above. The table below summarizes, by major security type, the expected

maturities and the weighted average yields of our investment securities as of December 31, 2010. Actual calls or prepayment rates

may differ from our estimates, which may cause the actual maturities of our investment securities to differ from the expected

maturities presented below.

December 31, 2010

Due in 1 Year

or Less

Due > 1 Year

through

5 Years

Due > 5 Years

through

10 Years Due > 10 Years Total

(Dollars in millions) Amount

Average

Yield(1) Amount

Average

Yield(1) Amount

Average

Yield(1) Amount

Average

Yield(1) Amount

Average

Yield(1)

Fair value of securities

available for sale:

U.S. Treasury debt obligations ... $ 260 1.55% $ 126 4.27% $ 0 0% $ 0 0% $ 386 2.39%

U.S. Agency debt obligations(2) .. 172 4.62 142 4.56 0 0 0 0 314 4.59

CMOs:

Agency(3) .................... 600 5.53 6,108 4.59 5,830 4.25 28 4.35 12,566 4.47

Non-agency .................. 148 5.85 741 5.59 125 5.31 5 6.58 1,019 5.60

Total CMOs .................... 748 5.60 6,849 4.71 5,955 4.27 33 4.65 13,585 4.57

MBS:

Agency(3) .................... 54 5.06 3,722 5.02 11,067 4.41 1,140 4.24 15,983 4.54

Non-agency .................. 0 0 385 5.88 296 6.03 0 0 681 5.95

Total MBS ..................... 54 5.06 4,107 5.11 11,363 4.46 1,140 4.24 16,664 4.60

Asset-backed securities ......... 2,131 2.89 7,478 2.64 357 3.66 0 0 9,966 2.73

Other(4) ........................ 326 1.78 89 4.12 6 4.51 201 4.55 622 2.21

Total securities available for sale $ 3,691 3.35% $18,791 3.96% $17,681 4.38% $1,374 4.28% $41,537 4.09%

Amortized cost of securities

available for sale ............. $ 3,666 $18,463 $17,511 $1,348 $40,988

________________________

(1) The weighted-average yield is computed using the expected maturity of each security weighted based on the amortized cost of each security.

(2) Consists of debt securities issued by Fannie Mae and Freddie Mac.

(3) Consists of mortgage-related securities issued by Fannie Mae, Freddie Mac and Ginnie Mae.

(4) Yields of tax-exempt securities are calculated on a fully taxable-equivalent (FTE) basis.

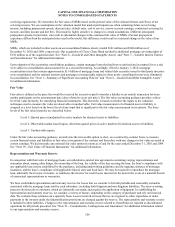

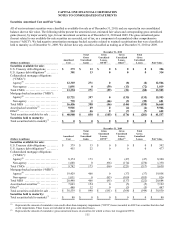

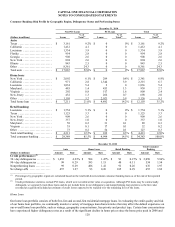

Credit Ratings

Approximately 92% and 90% of our total investment securities portfolio was rated AAA or its equivalent as of December 31, 2010

and 2009, respectively, while approximately 4% and 5%, respectively, were below investment grade as of December 31, 2010 and

2009. All of our agency securities were rated AAA as of December 31, 2010 and 2009. The table below presents information on the

credit ratings of our non-agency CMOs, non-agency MBS and asset-backed securities, which account for the substantial majority of

the unrealized losses related to our investment securities portfolio as of December 31, 2010 and 2009.

December 31,

2010 2009

% o

f

Investment

Securities

Portfolio(1) AAA

Other

Investment

Grade

Below

Investment

Grade or

Not Rated

%o

f

Investment

Securities

Portfolio(1) AAA

Other

Investment

Grade

Below

Investment

Grade or

Not Rated

N

on-agency CMOs ......... 3% 1% 11% 88% 4% 2% 24% 74%

N

on-agency MBS .......... 2 0 6 94 3 4 7 89

Asset-backed securities ..... 24 90 10 0 18 84 16 0

________________________

(1) Calculated based on the amortized cost of the major security type presented divided by the amortized cost of our total investment securities

portfolio as of the end of each period.