Capital One 2010 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2010 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED STATEMENTS

97

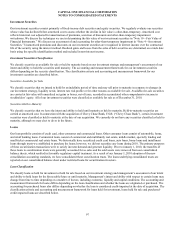

Investment Securities

Our investment securities consist primarily of fixed-income debt securities and equity securities. We regularly evaluate our securities

whose value has declined below amortized cost to assess whether the decline in fair value is other-than-temporary. Amortized cost

reflects historical cost adjusted for amortization of premiums, accretion of discounts and other-than-temporary impairment

writedowns. We discuss the techniques we use in determining the fair value of our investment securities in “Note 19—Fair Value of

Financial Instruments.” We discuss our assessment of and accounting for other-than-temporary impairment in “Note 4—Investment

Securities.” Unamortized premiums and discounts on our investment securities are recognized in interest income over the contractual

life of the security using the interest method. Realized gains and losses from the sales of debt securities are determined on a trade date

basis using the specific identification method and included in non-interest income.

Investment Securities Classification

We classify securities as available for sale or held to maturity based on our investment strategy and management’s assessment of our

intent and ability to hold the securities until maturity. The accounting and measurement framework for our investment securities

differs depending on the security classification. The classification criteria and accounting and measurement framework for our

investment securities are described below.

Securities Available for Sale

We classify securities that we intend to hold for an indefinite period of time and may sell prior to maturity in response to changes in

our investment strategy, liquidity needs, interest rate risk profile or for other reasons as available for sale. Available-for-sale securities

are carried at fair value with unrealized net gains or losses, net of taxes, recorded in accumulated other comprehensive income in

stockholders’ equity. All of our investment securities were classified as available for sale as of December 31, 2010.

Securities Held to Maturity

We classify securities that we have the intent and ability to hold until maturity as held to maturity. Held-to-maturity securities are

carried at amortized cost. In connection with the acquisition of Chevy Chase Bank, F.S.B. (“Chevy Chase Bank”), certain investment

securities were classified as held to maturity at the date of our acquisition. We currently do not have any securities classified as held to

maturity, although we may elect to do so in the future.

Loans

Our loan portfolio consists of credit card, other consumer and commercial loans. Other consumer loans consist of automobile, home,

and retail banking loans. Commercial loans consist of commercial and multifamily real estate, middle market, specialty lending and

small-ticket commercial real estate loans. We historically have securitized credit card loans, auto loans, home loans and installment

loans through trusts we established to purchase the loans; however, we did not securitize any loans during 2010. The primary purposes

of these securitization transactions were to satisfy investor demand and generate liquidity. Prior to January 1, 2010, the transfers of

these loans to securitization trusts were generally accounted for as sales and the sold assets were removed from our consolidated

balance sheets, which resulted in favorable regulatory capital treatment. As a result of our January 1, 2010 adoption of the new

consolidation accounting standards, we have consolidated these securitization trusts. The loans underlying consolidated trusts are

reported on our consolidated balance sheet under restricted loans for securitization investors.

Loan Classification

We classify loans as held for investment or held for sale based on our investment strategy and management’s assessment of our intent

and ability to hold loans for the foreseeable future or until maturity. Management’s intent and ability with respect to certain loans may

change from time to time depending on a number of factors, including economic, liquidity and capital conditions. The accounting and

measurement framework for loans differs depending on the loan classification and whether the loans are originated or purchased. The

accounting for purchased loans also differs depending on whether the loan is considered credit-impaired at the date of acquisition. The

classification criteria and accounting and measurement framework for loans held for investment, loans held for sale and purchased-

credit impaired loans are described below.