Capital One 2010 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2010 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

29

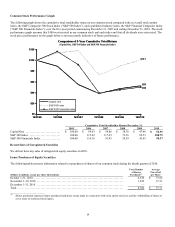

Consumer Banking Business

In our Consumer Banking business, we expect that Auto Finance origination volumes and returns will remain strong in 2011. We

expect our Retail Banking business will continue to deliver strong growth in low-cost deposits and valuable customer relationships.

Commercial Banking Business

In our Commercial Banking business, nonperforming asset rates and criticized loans continue to improve modestly, and, as such, we

believe that the worst of the Commercial Banking business credit deterioration cycle is behind us. We believe, however, that the

charge-off rate for our Commercial Banking business will continue to fluctuate over the next several quarters. We expect to grow our

Commercial Banking loan portfolio in 2011. Based on strong deposit growth and new commercial customer relationships in 2010, we

expect to generate future loan and revenue growth by expanding the relationships with our customers in 2011 and beyond.

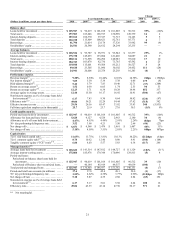

CRITICAL ACCOUNTING POLICIES AND ESTIMATES

The preparation of financial statements in accordance with U.S. GAAP requires management to make a number of judgments,

estimates and assumptions that affect the reported amount of assets, liabilities, income and expenses in the consolidated financial

statements. Understanding our accounting policies and the extent to which we use management judgment and estimates in applying

these policies is integral to understanding our financial statements. We provide a summary of our significant accounting policies in

“Note 1—Summary of Significant Accounting Policies.”

We have identified the following accounting policies as critical because they require significant judgments and assumptions about

highly complex and inherently uncertain matters and the use of reasonably different estimates and assumptions could have a material

impact on our reported results of operations or financial condition. These critical accounting policies govern:

● Fair value

● Allowance for loan and lease losses

● Asset impairment

● Representation and warranty reserve

● Revenue recognition

● Derivative and hedge accounting

● Income taxes

We evaluate our critical accounting estimates and judgments on an ongoing basis and update them as necessary based on changing

conditions. Management has reviewed and approved these critical accounting policies and has discussed these policies with the Audit

and Risk Committee of the Board of Directors.

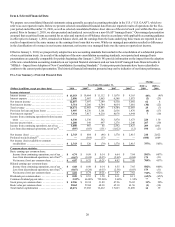

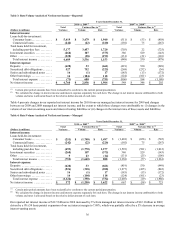

Fair Value

Fair value is defined as the price that would be received for an asset or paid to transfer a liability in an orderly transaction between

market participants on the measurement date (also referred to as an exit price). The fair value accounting guidance provides a three-

level fair value hierarchy for classifying financial instruments. This hierarchy is based on whether the inputs to the valuation

techniques used to measure fair value are observable or unobservable. Fair value measurement of a financial asset or liability is

assigned to a level based on the lowest level of any input that is significant to the fair value measurement in its entirety. The three

levels of the fair value hierarchy are described below:

Level 1: Quoted prices (unadjusted) in active markets for identical assets or liabilities.

Level 2: Observable market-based inputs, other than quoted prices in active markets for identical assets or liabilities.

Level 3: Unobservable inputs.

The degree of management judgment involved in determining the fair value of a financial instrument is dependent upon the

availability of quoted prices in active markets or observable market parameters. When quoted prices and observable data in active

markets are not fully available, management judgment is necessary to estimate fair value. Changes in market conditions, such as

reduced liquidity in the capital markets or changes in secondary market activities, may reduce the availability and reliability of quoted

prices or observable data used to determine fair value.

We have developed policies and procedures to determine when markets for our financial assets and liabilities are inactive if the level

and volume of activity has declined significantly relative to normal conditions. If markets are determined to be inactive, it may be