Capital One 2010 Annual Report Download - page 150

Download and view the complete annual report

Please find page 150 of the 2010 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED STATEMENTS

130

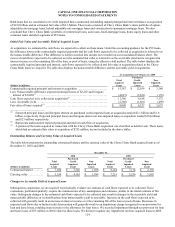

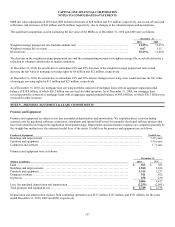

consolidate the trusts used for the securitization of manufactured housing loans because we do not have the power to direct the

activities that most significantly impact the economic performance of the trusts since we no longer service the loans.

We were required to fund letters of credit in 2004 to cover losses, and are obligated to fund future amounts under swap agreements for

certain transactions. We have the right to receive any funds remaining in the letters of credit after the securities are released. The

amount available under the letters of credit was $183 million and $205 million at December 31, 2010 and 2009, respectively. The fair

value of the expected residual balances on the funded letters of credit was $35 million and $46 million at December 31, 2010 and

2009, respectively, and is included in other assets on the consolidated balance sheet. Our maximum exposure under the swap

agreements was $27 million and $33 million at December 31, 2010 and 2009, respectively. The value of our obligations under these

swaps was $18 million at both December 31, 2010 and 2009, and is recorded in other liabilities on the consolidated balance sheet.

The principal balance of manufactured housing securitization transactions where we are the residual interest holder was $1.4 billion

and $1.5 billion at December 31, 2010 and 2009, respectively. In the event the third party does not fulfill on its obligations to exercise

the clean-up calls on certain transactions, the obligation reverts to us and we would assume approximately $420 million of loans

receivable upon our execution of the clean-up call with the requirement to absorb any losses on the loans receivable. There have been

no instances of non-performance to date by the third party.

Management monitors the underlying assets for trends in delinquencies and related losses and reviews the purchaser’s financial

strength as well as servicing performance. These factors are considered in assessing the adequacy of the liabilities established for these

obligations and the valuations of the assets.

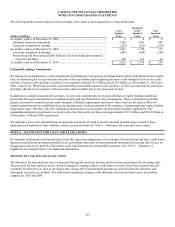

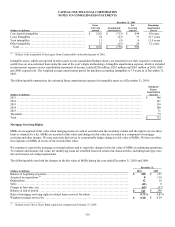

Accounts Receivable from Securitizations

Retained interests in off-balance sheet securitizations are reported as accounts receivable from securitizations on the consolidated

balance sheet and are comprised of interest-only strips, retained tranches, cash collateral accounts, cash reserve accounts and unpaid

interest and fees on the investors’ portion of the transferred principal receivables.

As a result of consolidation of certain trusts, the related interest-only strip and retained tranches were eliminated and the remaining

retained interests were reclassified to either loans held for investment, accrued interest receivable or restricted cash for these trusts.

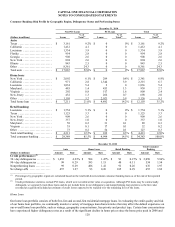

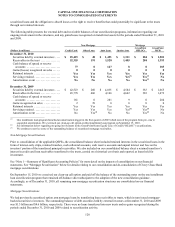

The following table provides details of accounts receivable from securitizations as of December 31, 2010 and 2009:

December 31,

2010 2009

(Dollars in millions) Mortgage (3) Non-

Mortgage (2) Mortgage (3) Total

Interest-only strip classified as trading ........................

.

$ 75 $ 22 $ 223 $ 245

Retained interests classified as trading:

Retained notes ............................................

.

34 573 0 573

Cash collateral ............................................

.

8 138 3 141

Investor accrued interest receivable .........................

.

0 898 0 898

Total retained interests classified as trading .................

.

42 1,609 3 1,612

Retained notes classified as available for sale ..................

.

0 2,088 0 2,088

Other retained interests ......................................

.

3 0 12 12

Total retained residual interests ..............................

.

120 3,719 238 3,957

Payments due to investors for interest on the notes .............

.

0 (61 ) (1) (62)

Collections on deposit for off-balance sheet securitizations (1) ...

.

0 3,233 0 3,233

Total accounts receivable from securitizations .................

.

$ 120 $ 6,891 $ 237 $ 7,128

________________________

(1) Collections on deposit for off-balance sheet securitizations include $2.2 billion of principal collections accumulated for expected maturities of

securitization transactions as of December 31, 2009. There were no collections on deposit for off-balance sheet securitizations as of December

31, 2010. Collections on deposit for secured borrowings are included in restricted cash on the consolidated balance sheet as of January 1, 2010

and thereafter.

(2) As of December 31, 2009, non-mortgage related accounts receivable from securitizations includes credit card, installment loan and auto trusts.

(3) The mortgage securitization transactions relate to the Chevy Chase Bank acquisition which occurred on February 27, 2009.

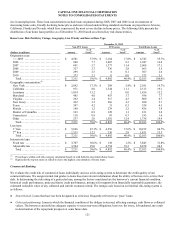

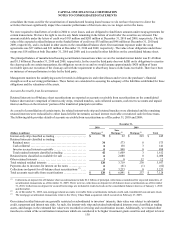

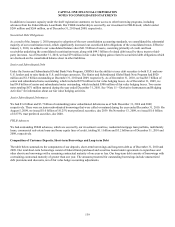

Our retained residual interests are generally restricted or subordinated to investors’ interests, their value was subject to substantial

credit, repayment and interest rate risks. As such, the interest-only strip and retained subordinated interests were classified as trading

assets, and changes in the estimated fair value were recorded in servicing and securitization income. Additionally, we retained other

tranches in certain of the securitization transactions which are considered to be higher investment grade securities and subject to lower