Capital One 2010 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2010 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

58

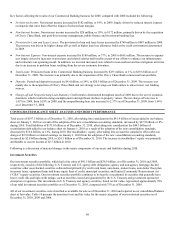

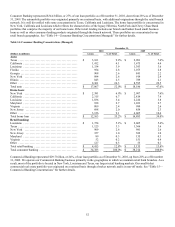

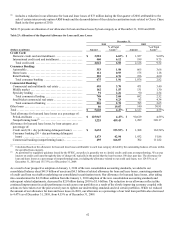

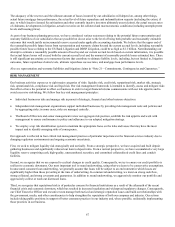

Table 20: Net Charge-Offs(1)

Year Ended December 31,

(Dollars in millions) 2010 2009 2008

Managed: Amount Rate(2) Amount Rate(2) Amount Rate(2)

Credit card .........................

.

$ 5,505 8.79% $ 6,688 9.15% $ 4,956 6.26%

Consumer banking(3)(4) ...............

.

655 1.82 1,094 2.74 1,218 3.09

Commercial banking(3)(4) .............

.

390 1.32 434 1.45 83 0.29

Other ..............................

.

107 21.18 205(5) 37.11 168 30.87

Total company(4) ....................

.

$ 6,657 5.18% $ 8,421 5.87% $ 6,425 4.35%

Average loans held for investment(6) ...

.

$ 128,622 $ 143,514 $ 147,812

Reported:

Total company charge-offs ...........

.

6,651 5.18% 4,568 4.58% 3,478 3.51%

Average loans heid for investments(6) ..

.

128,526 99,787 98,971

________________________

(1) Net charge-offs reflect charge-offs, net of recoveries, related to our total loan portfolio, which we previously referred to as our “managed” loan

portfolio. The total loan portfolio includes loans recorded on our balance sheet and loans held in our securitization trusts.

(2) Calculated for each loan category by dividing annualized net charge-offs for the period divided by average loans held for investment during the

period.

(3) Excludes losses on the purchased credit-impaired loans acquired from Chevy Chase Bank unless they do not perform in accordance with our

expectations as of the purchase date.

(4) The average loans held for investment used in calculating net charge-off rates includes the impact of loans acquired as part of the Chevy Chase

Bank acquisition. Our total net charge-off rate, excluding the impact of acquired Chevy Chase Bank loans, was 5.44% and 6.09% for the years

ended December 31, 2010 and 2009, respectively.

(5) During the first quarter of 2009, loans acquired from Chevy Chase Bank were included in the “Other” category.

(6) The average balances of the acquired Chevy Chase Bank loan portfolio, which are included in the total average loans held for investment used in

calculating the net charge-off rates, were $6.3 billion and $6.8 billion for the years ended December 31, 2010 and 2009, respectively.

The overall decrease in net charge-offs in 2010 from 2009 reflects the ongoing improvement in credit performance since the end of

2009, as well as declining loan balances. The overall increase in net charge-offs in 2009 from 2008 was predominately due to the

continued economic downturn, which persisted in 2009.

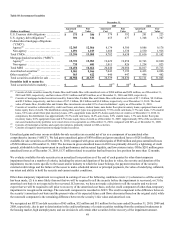

Loan Modifications and Restructurings

As part of our customer retention efforts, we may modify loans for certain borrowers who have demonstrated performance under the

previous terms. As part of our loss mitigation efforts, we may make loan modifications to a borrower experiencing financial difficulty

that are intended to minimize our economic loss and avoid the need for foreclosure or repossession of collateral. We may provide

short-term (three to twelve months) or long-term (greater than twelve months) modifications to improve the long-term collectability of

the loan. Our most common types of modifications include a reduction in the borrower’s initial monthly or quarterly principal and

interest payment through an extension of the loan term, a reduction in the interest rate, or a combination of both. These modifications

may result in our receiving the full amount due, or certain installments due, under the loan over a period of time that is longer than the

period of time originally provided for under the terms of the loan. In some cases, we may curtail the amount of principal owed by the

borrower. Loan modifications in which an economic concession has been granted to a borrower experiencing financial difficulty are

accounted for and reported as troubled debt restructurings (“TDRs”).

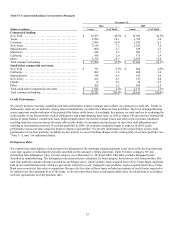

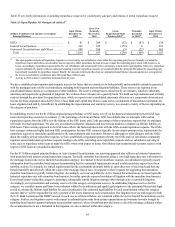

Table 21 presents the unpaid principal balance as of December 31, 2010 and 2009 of loan modifications made as part of our loss

mitigation efforts, all of which are considered to be TDRs. Table 21 excludes acquired loans from Chevy Chase Bank that were

restructured prior to acquisition, which we track and report separately below under “Purchased Credit - Impaired Loans.”