Capital One 2010 Annual Report Download - page 183

Download and view the complete annual report

Please find page 183 of the 2010 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED STATEMENTS

163

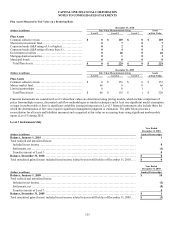

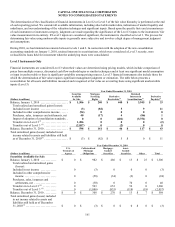

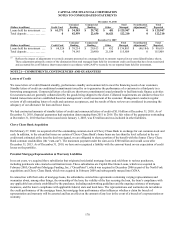

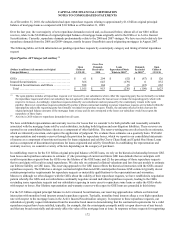

For assets measured at fair value on a nonrecurring basis and still held on the consolidated balance sheet, the following table provides

the fair value measures by level of valuation assumptions used and the gains or losses recognized for these assets as a result of fair

value measurements.

December 31, 2010

Fair Value Measurements Using

Assets at

Fair

Value

Total

Gains/

(Losses)

(Dollars in millions) Level 1 Level 2 Level 3

Assets

Loans held for sale ...........................

.

$ 0 $ 206 $ 0 $ 206 $ (9)

Loans held for investment ....................

.

0 126 159 285 (151)

Foreclosed assets(1) ...........................

.

0 249 0 249 (42)

Other .......................................

.

0 18 0 18 (8)

Total ......................................

.

$ 0 $ 599 $ 159 $ 758 $ (210)

December 31, 2009

Fair Value Measurements Using

Assets at

Fair

Value

Total

Gains/

(Losses)

(Dollars in millions) Level 1 Level 2 Level 3

Assets

Loans held for sale ...........................

.

$ 0 $ 266 $ 0 $ 266 $ 16

Loans held for investment ....................

.

0 156 267 423 255

Foreclosed assets(1) ...........................

.

0 197 0 197 26

Other .......................................

.

0 31 0 31 (4)

Total ......................................

.

$ 0 $ 650 $ 267 $ 917 $ 293

________________________

(1) Represents the fair value and related losses of foreclosed properties that were written down subsequent to their initial classification as foreclosed

properties.

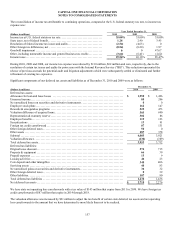

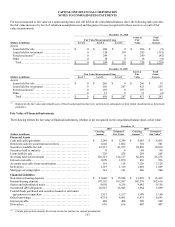

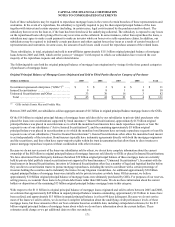

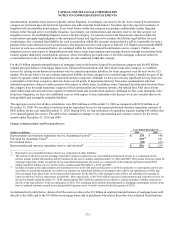

Fair Value of Financial Instruments

The following reflects the fair value of financial instruments, whether or not recognized on the consolidated balance sheet, at fair value.

December 31,

2010 2009

(Dollars in millions)

Carrying

Amount

Estimated

Fair Value

Carrying

Amount (1)

Estimated

Fair Value(1)

Financial Assets

Cash and cash equivalents .....................................

.

$ 5,249 $ 5,249 $ 8,685 $ 8,685

Restricted cash for securitization investors ......................

.

1,602 1,602 501 501

Securities available for sale ....................................

.

41,537 41,537 38,830 38,830

Securities held to maturity .....................................

.

0 0 80 80

Loans held for sale ............................................

.

228 228 268 268

N

et loans held for investment ..................................

.

120,319 124,117 86,492 86,158

Interest receivable .............................................

.

1,070 1,070 936 936

Accounts receivable from securitization .........................

.

118 118 7,128 7,128

Derivatives ...................................................

.

1,319 1,319 1,069 1,069

Mortgage servicing rights ......................................

.

141 141 240 240

Financial Liabilities

N

on-interest bearing deposits ..................................

.

$ 15,048 $ 15,048 $ 13,439 $ 13,439

Interest-bearing deposits .......................................

.

107,162 107,587 102,370 102,616

Senior and subordinated notes ..................................

.

8,650 9,236 9,045 9,156

Securitized debt obligations ....................................

.

26,915 26,943 3,954 3,890

Federal funds purchased and securities loaned or sold under

agreements to repurchase ....................................

.

1,517 1,517 1,140 1,140

Other borrowings .............................................

.

4,714 4,901 6,875 6,693

Interest payable ...............................................

.

488 488 509 509

Derivatives ...................................................

.

636 636 407 407

________________________

(1) Certain prior period amounts have been revised to conform to current presentation.