Capital One 2010 Annual Report Download - page 219

Download and view the complete annual report

Please find page 219 of the 2010 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Page 4

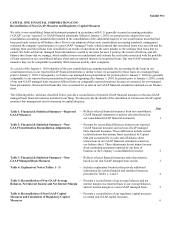

CAPITAL ONE FINANCIAL CORPORATION (COF)

Table 4: Explanatory Notes (Tables 1 - 3)

Notes

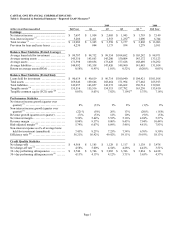

(1) Based on continuing operations.

(2) Effective February 27, 2009, the Company acquired Chevy Chase Bank, FSP for $476 million, which included a cash payment of $445 million

and the issuance of 2.6 million common shares valued at $31 million. The acquisition of Chevy Chase Bank included $10 billion in loans and

$13.6 billion in deposits.

(3) Includes the impact from the change in fair value of retained interests, including interest-only strips, totaling $(146) million for the year 2009,

$55 million in Q4 2009, $38 million in Q3 2009, $(115) million in Q2 2009 and $(124) million in Q1 2009, and $(260) million in 2008.

(4) In Q2 2009, the Company elected to convert and sell 404,508 shares of MasterCard class B common stock, which resulted in the recognition of

a gain of $66 million that was recorded in non-interest income.

(5) Billed finance charges and fees not recognized in revenue totaled $2.1 billion for the year 2009, $490 million in Q4 2009, $517 million in Q3

2009, $572 million in Q2 2009, $544 million in Q1 2009, and $1.9 billion in 2008.

(6) Includes the impact of the issuance of 56,000,000 common shares at $27.75 per share on May 14, 2009.

(7) Prior period amounts have been reclassified to conform to the current period presentation and adjusted to reflect purchase accounting

refinements related to the acquisition of Chevy Chase Bank, FSB (“CCB”).

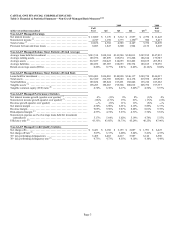

(8) The denominator used in calculating the allowance as a % of loans held for investment, the net charge-off rate and the 30+ day performing

delinquency rate include loans acquired as part of the CCB acquisition. These metrics, calculated excluding CCB loans, are presented below.

2009

(dollars in millions) (unaudited) Full Year Q4 Q3 Q2 Q1

CCB period end acquired loan portfolio ........ $ 7,251 $ 7,251 $ 7,885 $ 8,644 $ 8,859

CCB average acquired loan portfolio .......... $ 7,996 $ 7,512 $ 8,029 $ 8,499 $ 3,073

Allowance as a % of loans held for investment,

excluding CCB ............................ 4.95% 4.95% 5.08% 4.86% 4.84%

N

et charge-off rate (Reported), excluding CCB . 4.98% 5.44% 4.94% 4.65% 4.54%

N

et charge-off rate (Managed), excluding CCB . 6.21% 6.70% 6.36% 5.98% 5.53%

30+ day performing delinquency rate (Reported),

excluding CCB ............................ 4.49% 4.49% 4.48% 4.06% 3.99%

30+ day performing delinquency rate (Managed),

excluding CCB ............................ 4.99% 4.99% 4.82% 4.36% 4.36%

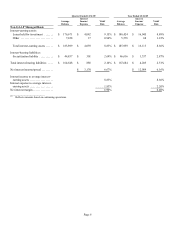

(9) The managed loan portfolio does not include automobile or home loans that have been sold in whole loan sale transactions where the Company

has retained servicing rights.

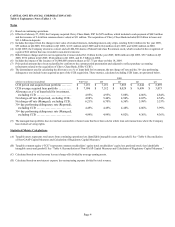

Statistical/Metric Calculations

(A) Tangible assets represents total assets from continuing operations less identifiable intangible assets and goodwill. See “Table 6: Reconciliation

of Non-GAAP Capital Measures and Calculation of Regulatory Capital Measures.”

(B) Tangible common equity (“TCE”) represents common stockholders’ equity (total stockholders’ equity less preferred stock) less identifiable

intangible assets and goodwill. See “Table 6: Reconciliation of Non-GAAP Capital Measures and Calculation of Regulatory Capital Measures.”

(C) Calculated based on total revenue less net charge-offs divided by average earning assets.

(D) Calculated based on non-interest expense less restructuring expense divided by total revenue.