Capital One 2010 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2010 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

24

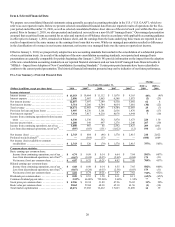

IMPACT FROM ADOPTION OF NEW CONSOLIDATION ACCOUNTING STANDARDS

Impact on Reported Financial Information

Effective January 1, 2010, we prospectively adopted two new accounting standards that had a significant impact on our accounting for

entities previously considered to be off-balance sheet arrangements. The adoption of these new accounting standards resulted in the

consolidation of our credit card securitization trusts, one of our installment loan trusts and certain option-adjustable rate mortgages

(“option-ARM”) loan trusts originated by Chevy Chase Bank. Prior to January 1, 2010, transfers of our credit card receivables,

installment loans and certain option-adjustable rate mortgage loans to our securitization trusts were accounted for as sales and treated

as off-balance sheet. At the adoption of these new accounting standards on January 1, 2010, we added to our reported consolidated

balance sheet $41.9 billion of assets, consisting primarily of credit card loan receivables underlying the consolidated securitization

trusts, along with $44.3 billion of related debt issued by these trusts to third-party investors. We also recorded an after-tax charge to

retained earnings on January 1, 2010 of $2.9 billion, reflecting the net cumulative effect of adopting these new accounting standards.

This charge primarily related to the addition of $4.3 billion to our allowance for loan and lease losses for the newly consolidated loans

and the recording of $1.6 billion in related deferred tax assets. The initial recording of these amounts on our reported balance sheet as

of January 1, 2010 had no impact on our reported income. We provide additional information on the impact on our financial

statements from the adoption of these new accounting standards in “Note 1—Summary of Significant Accounting Policies” and “Note

7—Variable Interest Entities and Securitizations.” We discuss the impact on our capital ratios below in “Liquidity and Capital

Management — Capital.”

Although the adoption of these new accounting standards does not change the economic risk to our business, specifically our exposure

to liquidity, credit and interest rate risks, the prospective adoption of these rules has a significant impact on our capital ratios and the

presentation of our reported consolidated financial statements, including changes in the classification of specific consolidated

statements of income line items. The most significant changes to our reported consolidated financial statements are outlined below:

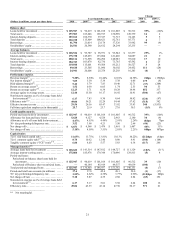

Financial Statement Accounting and Presentation Changes

Balance Sheet ............... • Significant increase in restricted cash, securitized loans and securitized debt resulting from

the consolidation of securitization trusts.

• Significant increase in the allowance for loan and lease losses resulting from the establishment

of a loan loss reserve for the loans underlying the consolidated securitization trusts.

• Significant reduction in accounts receivable from securitizations resulting from the

reversal of retained interests held in securitization trusts that have been consolidated.

Statement of Income ......... • Significant increase in interest income and interest expense attributable to the securitized

loans and debt underlying the consolidated securitization trusts.

• Changes in the amount recorded for the provision for loan and lease losses, resulting from

the establishment of an allowance for loan and lease losses for the loans underlying the

consolidated securitization trusts.

• Amounts previously recorded as servicing and securitization income are now classified in

our results of operations in the same manner as the earnings on loans not held in

securitization trusts.

Statement of Cash Flows ..... • Significant change in the amounts of cash flows from investing and financing activities.

Beginning with the first quarter of 2010, our reported consolidated statements of income no longer reflect securitization and servicing

income related to newly consolidated loans. Instead, we report interest income, net charge-offs and certain other income associated

with securitized loan receivables and interest expense associated with the debt securities issued from the trust to third party investors

in the same consolidated statements of income categories as loan receivables and corporate debt. Additionally, we no longer record

initial gains on new securitization activity since the majority of our securitized loans will no longer receive sale accounting treatment.

Because our securitization transactions are being accounted for under the new consolidation accounting rules as secured borrowings

rather than asset sales, the cash flows from these transactions are presented as cash flows from financing activities rather than as cash

flows from operating or investing activities. Notwithstanding this change in accounting, our securitization transactions are structured

to legally isolate the receivables from our company, and we do not expect to be able to access the assets of our securitization trusts.

We do, however, continue to have the rights associated with our retained interests in the assets of these trusts.