Capital One 2010 Annual Report Download - page 175

Download and view the complete annual report

Please find page 175 of the 2010 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED STATEMENTS

155

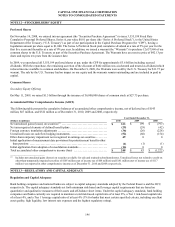

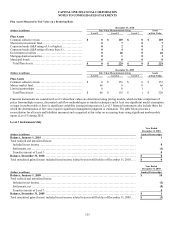

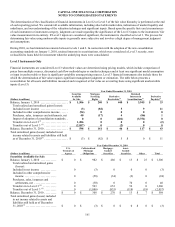

Plan Assets Measured at Fair Value on a Recurring Basis

December 31, 2010

(Dollars in millions) Fair Value Measurements Using Assets

Level 1 Level 2 Level 3 at Fair Value

Plan Assets

Common collective trusts .................................

.

$ 0 $ 169 $ 0 $ 169

Short-term investment fund ................................

.

0 7 0 7

Corporate bonds (S&P rating of A or higher) ................

.

0 2 0 2

Corporate bonds (S&P rating of lower than A) ..............

.

0 4 0 4

Government securities ....................................

.

0 46 0 46

Mortgage-backed securities ................................

.

0 1 0 1

Municipal bonds ..........................................

.

0 0 0 0

Total Plan Assets .......................................

.

$ 0 $ 229 $ 0 $ 229

December 31, 2009

(Dollars in millions) Fair Value Measurements Using Assets

Level 1 Level 2 Level 3 at Fair Value

Plan Assets

Common collective trusts .................................

.

$ 0 $ 153 $ 0 $ 153

Money market fund .......................................

.

66 0 0 66

Limited partnerships ......................................

.

0 0 1 1

Total Plan Assets .......................................

.

$ 66 $ 153 $ 1 $ 220

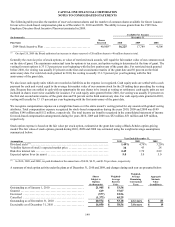

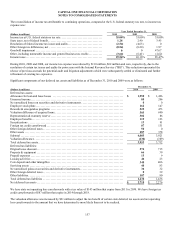

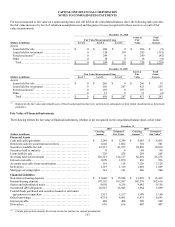

Financial instruments are considered Level 3 when their values are determined using pricing models, which include comparison of

prices from multiple sources, discounted cash flow methodologies or similar techniques and at least one significant model assumption

or input is unobservable or there is significant variability among pricing sources. Level 3 financial instruments also include those for

which the determination of fair value requires significant management judgment or estimation. The table below presents a

reconciliation for all assets and liabilities measured and recognized at fair value on a recurring basis using significant unobservable

inputs (Level 3) during 2010.

Level 3 Instruments Only

Year Ended

December 31, 2010

(Dollars in millions) Limited Partnerships

Balance, January 1, 2010 ............................................................................ $ 1

Total realized and unrealized losses:

Included in net income .............................................................................. 0

Settlements, net .................................................................................... (1)

Transfers in(out) of Level 3 ......................................................................... 0

Balance, December 31, 2010 ......................................................................... $ 0

Total unrealized gains (losses) included in net income related to assets still held as of December 31, 2010 .... $ 0

Year Ended

December 31, 2009

(Dollars in millions) Limited Partnerships

Balance, January 1, 2009 ............................................................................ $ 10

Total realized and unrealized losses:

Included in net income .............................................................................. (1)

Settlements, net .................................................................................... (8)

Transfers in(out) of Level 3 ......................................................................... 0

Balance, December 31, 2009 ......................................................................... $ 1

Total unrealized gains (losses) included in net income related to assets still held as of December 31, 2009 .... $ (1)