Capital One 2010 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2010 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

72

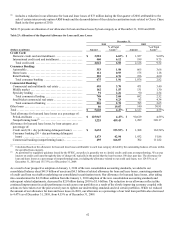

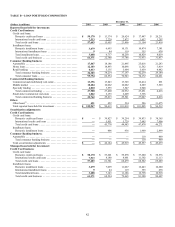

Table 28: Liquidity Reserves

December 31,

(Dollars in millions) 2010 2009

Cash and cash equivalents ................................................................ $ 5,249 $ 8,685

Securities available for sale(1) ............................................................. 41,537 38,830

Less: Pledged available for sale securities ................................................ (9,963) (11,883)

Unencumbered available-for-sale securities ................................................ 31,574 26,947

Undrawn committed securitization borrowing facilities ..................................... 207 2,913

Total liquidity reserves ................................................................... $ 37,030 $ 38,545

________________________

(1) The weighted average life of our available-for-sale securities was approximately 5.1 and 4.9 years as of December 31, 2010 and 2009,

respectively.

Funding

Our funding objective is to establish an appropriate maturity profile using a cost-effective mix of both short-term and long-term funds.

We use a variety of funding sources, including deposits, loan securitizations, debt and equity securities, securitization borrowing

facilities and FHLB advances.

Deposits

Our deposits provide a stable and relatively low cost of funds and have become our largest source of funding. We have expanded our

opportunities for deposit growth through direct and indirect marketing channels, our existing branch network and branch expansion.

These channels offer a broad set of deposit products that include demand deposits, money market deposits, negotiable order of

withdrawal (“NOW”) accounts, savings accounts and certificates of deposit. Table 29 presents the composition of our deposits by type

as of December 31, 2010 and 2009. Total deposits increased by $6.4 billion, or 5.5%, in 2010, to $122.2 billion as of December 31,

2010.

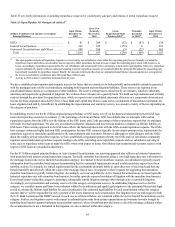

Table 29: Deposits

December 31,

(Dollars in millions) 2010 2009

N

on-interest bearing ...................................................................... $ 15,048 $ 13,439

N

OW accounts .......................................................................... 13,536 12,077

Money market deposit accounts ........................................................... 44,485 38,094

Savings accounts ......................................................................... 26,077 17,019

Other consumer time deposits ............................................................. 15,753 25,456

Total core deposits ..................................................................... 114,899 106,085

Public fund certificates of deposit $100,000 or more ........................................ 177 579

Certificates of deposit $100,000 or more ................................................... 6,300 8,248

Foreign time deposits ..................................................................... 834 897

Total deposits .......................................................................... $ 122,210 $ 115,809

Of our total deposits, approximately $834 million and $897 million were held in foreign banking offices as of December 31, 2010 and

2009, respectively. Large domestic denomination certificates of deposits of $100,000 or more represented $6.5 billion and $8.8 billion

of our total deposits as of December 31, 2010 and 2009, respectively. Our funding and liquidity strategy takes into consideration the

scheduled maturities of large denomination time deposits. Of the $6.5 billion in large domestic denomination certificates of deposit as

of December 31, 2010, $0.7 billion is scheduled to mature within the next three months; $2.3 billion is scheduled to mature between

three and 12 months and $3.5 billion is scheduled to mature over 12 months. Based on past activity, we expect to retain a portion of

these deposits as they mature.

We have brokered deposits, which we obtained through the use of third-party intermediaries that are included above in Table 28 in

money market deposit accounts and other consumer time deposits. The Federal Deposit Insurance Corporation Improvement Act of

1991 limits the use of brokered deposits to “well-capitalized” insured depository institutions and, with a waiver from the Federal

Deposit Insurance Corporation, to “adequately capitalized” institutions. COBNA and CONA were “well-capitalized,” as defined under

the federal banking regulatory guidelines, as of December 31, 2010, and therefore permitted to maintain brokered deposits. Our

brokered deposits totaled $14.8 billion, or 12% of total deposits, as of December 31, 2010. Brokered deposits totaled $18.8 billion, or

16% of total deposits, as of December 31, 2009. Based on our historical access to the brokered deposit market, we expect to replace

maturing brokered deposits with new brokered deposits or direct deposits and branch deposits.