Capital One 2010 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2010 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

35

the section below provides a comparative discussion of our reported consolidated results of operations for 2010 and our managed

results for 2009 and 2008. Our net income on a managed basis in 2009 and 2008 is the same as our reported net income; however,

there are differences in the classification of certain amounts in our managed income statement, which we identify in our discussion.

See “Exhibit 99.1” for a reconciliation of our non-GAAP managed based information for periods prior to January 1, 2010 to the most

comparable reported U.S. GAAP information.

Net Interest Income

Net interest income represents the difference between the interest income and applicable fees earned on our interest-earning assets,

which includes loans held for investment and investment securities, and the interest expense on our interest-bearing liabilities, which

includes interest-bearing deposits, senior and subordinated notes, securitized debt and other borrowings. We include in interest income

any past due fees on loans that we deem are collectible. Our net interest margin represents the difference between the yield on our

interest-earning assets and the cost of our interest bearing liabilities, including the impact of non-interest bearing funding. Prior to the

adoption of the new consolidation accounting standards on January 1, 2010, our reported net interest income did not include interest

income from loans in our off-balance sheet securitization trusts or the interest expense on third-party debt issued by these

securitization trusts. Beginning January 1, 2010, servicing fees, finance charges, other fees, net charge-offs and interest paid to third

party investors related to consolidated securitization trusts are included in net interest income.

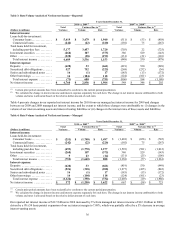

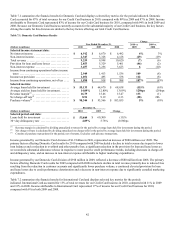

Table 2 below displays the major sources of our interest income and interest expense for 2010, 2009 and 2008. We present for each

major category of our interest-earning assets and interest-bearing liabilities, the average outstanding balances, the interest earned or

paid and the average yield or cost during the period in Table A under “Supplemental Statistical Tables.” We expect net interest income

and our net interest margin to fluctuate based on changes in interest rates and changes in the amount and composition of our interest-

earning assets and interest-bearing liabilities.

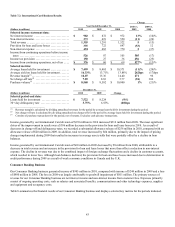

Table 2: Net Interest Income

Year Ended December 31,

2010 2009 (1) 2008

(Dollars in millions) Reported Managed Reported Managed Reported Managed

Interest income:

Loans held-for-investment:

Consumer loans(2) ..................... $ 12,656 $ 12,664 $ 7,237 $ 12,915 $ 7,748 $ 14,316

Commercial loans ..................... 1,278 1,278 1,520 1,520 1,712 1,712

Total loans held for investment, including

past-due fees ......................... 13,934 13,942 8,757 14,435 9,460 16,028

Investment securities .................... 1,342 1,342 1,610 1,610 1,224 1,224

Other .................................. 77 77 297 68 428 199

Total interest income .................. 15,353 15,361 10,664 16,113 11,112 17,451

Interest expense:

Deposits ............................... 1,465 1,465 2,093 2,093 2,512 2,512

Securitized debt obligations .............. 809 813 282 1,339 550 2,616

Senior and subordinated notes ............ 276 276 260 260 445 445

Other borrowings ....................... 346 346 332 332 456 456

Total interest expense ................. 2,896 2,900 2,967 4,024 3,963 6,029

N

et interest income ..................... $ 12,457 $ 12,461 $ 7,697 $ 12,089 $ 7,149 $ 11,422

________________________

(1) Effective February 27, 2009, we acquired Chevy Chase Bank. Accordingly, our results for 2009 include only a partial impact from Chevy Chase

Bank.

(2) Interest income on credit card, auto, home and retail banking loans is reflected in consumer loans. Interest income generated from small business

credit cards also is included in consumer loans.

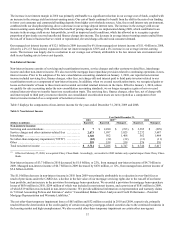

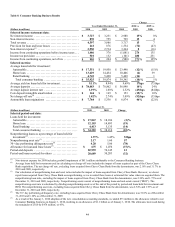

Table 3 presents changes in our reported net interest income between periods and the extent to which those changes were attributable

to: (i) changes in the volume of our interest-earning assets and interest-bearing liabilities or (ii) changes in the interest rates of these

assets and liabilities.