Capital One 2010 Annual Report Download - page 158

Download and view the complete annual report

Please find page 158 of the 2010 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED STATEMENTS

138

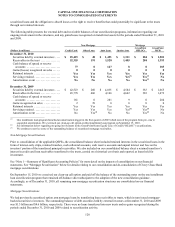

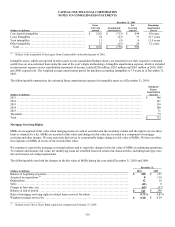

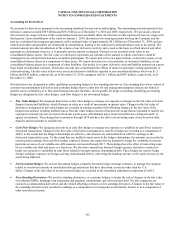

As discussed in “Note 2—Acquisitions and Restructuring Activities,” we completed the acquisition of Chevy Chase Bank in February

2009. The acquisition added $159 million in land, $248 million in buildings and improvements, $69 million of furniture and

equipment, $42 million of computer software and $11 million of construction in process at December 31, 2009, which are reflected in

the table above.

Lease Commitments

Certain premises and equipment are leased under agreements that expire at various dates through 2056, without taking into

consideration available renewal options. Many of these leases provide for payment by the lessee of property taxes, insurance

premiums, cost of maintenance and other costs. In some cases, rentals are subject to increases in relation to a cost of living index.

Total rent expenses from continuing operations amounted to approximately $191 million, $183 million, and $164 million for the years

ended December 31, 2010, 2009 and 2008, respectively.

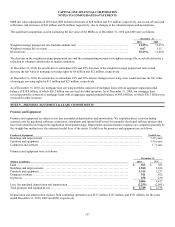

Future minimum rental commitments as of December 31, 2010, for all non-cancelable operating leases with initial or remaining terms

of one year or more are as follows:

(Dollars in millions)

Estimated

Future

Minimum

Rental

Commitments

2011 .................................................................................................... $ 159

2012 .................................................................................................... 152

2013 .................................................................................................... 145

2014 .................................................................................................... 135

2015 .................................................................................................... 122

Thereafter ............................................................................................... 785

Total .................................................................................................... $ 1,498

Minimum sublease rental income of $28 million due in future years under non-cancelable leases has not been included in the table

above as a reduction to minimum lease payments.

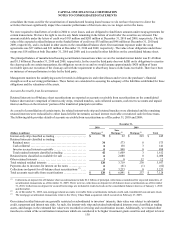

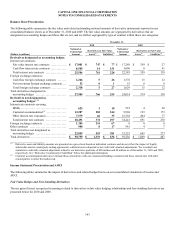

NOTE 10—DEPOSITS AND BORROWINGS

Customer Deposits

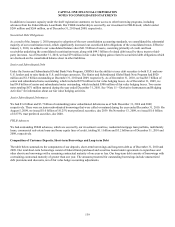

Our customer deposits, which have become our largest source of funding for our operations and asset growth, consist of non-interest

bearing and interest-bearing deposits, including demand deposits, money market deposits, negotiable order of withdrawal (“NOW”)

accounts, savings accounts and certificates of deposit.

As of December 31, 2010, we had $107.2 billion in interest-bearing deposits of which $6.5 billion represents large denomination

certificates of $100,000 or more. As of December 31, 2009, we had $102.4 billion in interest-bearing deposits, of which $8.8 billion

represents large denomination certificates of $100,000 or more.

On July 26, 2009, we sold our U.K. deposits business. The amount of deposits sold totaled approximately $1.2 billion, and we

recorded a minimal loss on the sale.

Borrowings

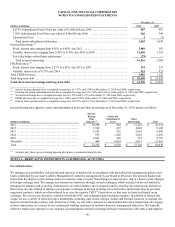

We also access the capital markets to meet our funding needs through loan securitization transactions and the issuance of senior and

subordinated debt. As of December 31, 2010, we had an effective shelf registration statement filed with the U.S. Securities &

Exchange Commission (“SEC”) under which, from time to time, we may offer and sell an indeterminate aggregate amount of senior or

subordinated debt securities, preferred stock, depository shares representing preferred stock, common stock, purchase contracts,

warrants, units, trust preferred securities, junior subordinated debentures, guarantees of trust preferred securities and certain back-up

obligations. There is no limit under this shelf registration statement to the amount or number of such securities that we may offer and

sell. Under SEC rules, the shelf registration statement, which we filed in May 2009, expires three years after filing. We did not issue

any securities under the shelf registration statement during 2010.