Capital One 2010 Annual Report Download - page 165

Download and view the complete annual report

Please find page 165 of the 2010 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.CAPITAL ONE FINANCIAL CORPORATION

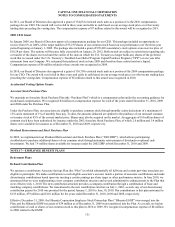

NOTES TO CONSOLIDATED STATEMENTS

145

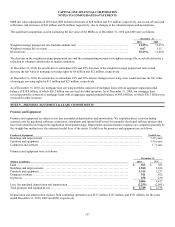

We expect to reclassify net after-tax gains of $2 million recorded in AOCI as of December 31, 2010, related to derivatives designated

as cash flow hedges to earnings over the next 12 months, which we expect to offset against the cash flows associated with the hedged

forecasted transactions. The maximum length of time over which forecasted transactions were hedged was 7 years as of December 31,

2010. The amount we expect to reclassify into earnings may change as a result of changes in market conditions and ongoing actions

taken as part of our overall risk management strategy.

Credit Default Swaps

We have credit exposure on credit default swap agreements that we entered into to manage our risk of loss on certain manufactured

housing securitizations issued by GreenPoint Credit LLC in 2000. Our maximum credit exposure related to these swap agreements

totaled $27 million and $33 million as of December 31, 2010 and 2009, respectively. These agreements are recorded in our

consolidated balance sheets as a component of other liabilities. The value of our obligations under these swaps was $18 million as of

December 31, 2010 and 2009. See “Note 7—Variable Interest Entities and Securitizations” for additional information about our

manufactured housing securitization transactions.

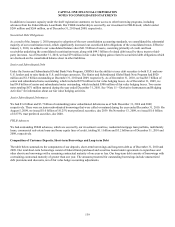

Credit Risk-Related Contingency Features

Certain of our derivative contracts include provisions requiring that our debt maintain a credit rating of investment grade or above by

each of the major credit rating agencies. In the event of a downgrade of our debt credit rating below investment grade, some of our

derivative counterparties would have the right to terminate the derivative contract and close-out the existing positions. Other

derivative contracts include provisions that would, in the event of a downgrade of our debt credit rating below investment grade, allow

our derivative counterparties to demand immediate and ongoing full overnight collateralization on derivative instruments in a net

liability position. Certain of our derivative contracts may allow, in the event of a downgrade of our debt credit rating of any kind, our

derivative counterparties to demand additional collateralization on such derivative instruments in a net liability position. The fair value

of derivative instruments with credit-risk-related contingent features in a net liability position was $66 million and $117 million as of

December 31, 2010 and 2009, respectively. We were required to post collateral, consisting of a combination of cash and securities,

totaling $229 million and $254 million as of December 31, 2010 and 2009, respectively. If our debt credit rating had fallen below

investment grade, we would have been required to post additional collateral of $39 million and $28 million as of December 31, 2010

and 2009, respectively.

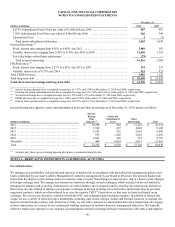

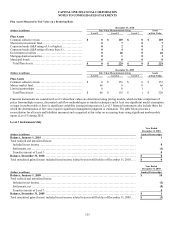

Derivative Counterparty Credit Risk

Derivative instruments contain an element of credit risk that arises from the potential failure of a counterparty to perform according to

the contractual terms of the contract. Our exposure to derivative counterparty credit risk at any point in time is represented by the fair

value of derivatives in a gain position, or derivative assets, assuming no recoveries of underlying collateral. To mitigate the risk of

counterparty default, we maintain collateral agreements with certain derivative counterparties. These agreements typically require both

parties to maintain collateral in the event the fair values of derivative financial instruments exceed established thresholds. We received

cash collateral from derivatives counterparties totaling $668 million and $338 million as of December 31, 2010 and 2009,

respectively. We posted cash collateral in accounts maintained by derivatives counterparties totaling $229 million and $254 million as

of December 31, 2010 and 2009, respectively.

We record counterparty credit risk valuation adjustments on our derivative assets to properly reflect the credit quality of the

counterparty. We consider collateral and legally enforceable master netting agreements that mitigate our credit exposure to each

counterparty in determining the counterparty credit risk valuation adjustment, which may be adjusted in future periods due to changes

in the fair value of the derivative contract, collateral and creditworthiness of the counterparty. The cumulative counterparty credit risk

valuation adjustment recorded on our consolidated balance sheets as a reduction in the derivative asset balance was $22 million and $5

million as of December 31, 2010 and 2009, respectively. We also adjust the fair value of our derivative liabilities to reflect the impact

of our credit quality. We calculate this adjustment by comparing the spreads on our credit default swaps to the discount benchmark

curve. The cumulative credit risk valuation adjustment related to our credit quality recorded on our consolidated balance sheets as

reduction in the derivative liability balance was $2 million and $1 million as of December 31, 2010 and 2009, respectively.