Capital One 2010 Annual Report Download - page 182

Download and view the complete annual report

Please find page 182 of the 2010 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED STATEMENTS

162

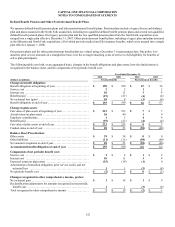

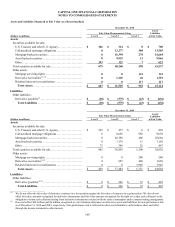

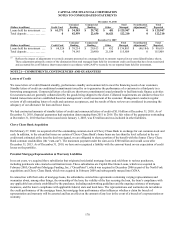

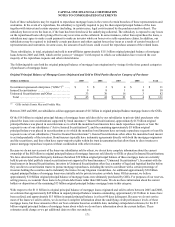

Year Ended December 31, 2009

(Dollars in millions)

Securities

Available

for Sale

Mortgage

Servicing

Rights Derivative

Receivables(2)

Retained

Interests in

Securitizations(3) Derivative

Payables(2)

Balance, January 1, 2009 ..................... $ 2,380 $ 151 $ 60 $ 1,470 $ 61

Total realized and unrealized gains (losses):

Included in net income ..................... 0 (6)(1) (214) (131) (28)

Included in other comprehensive income ..... (168) 0 0 114 0

Purchases, sales, issuances and settlements,

net ...................................... (115) 95 38 2,492 4

Transfers in/(out) of Level 3 ................ (591) 0 556 0 (4)

Balance, December 31, 2009 .................. $ 1,506 $ 240 $ 440 $ 3,945 $ 33

Total unrealized gains (losses) included in net

income related to assets and liabilities still

held as of December 31, 2009(5) ............. $ 0 $ (6) $ (214) $ 71 $ (28)

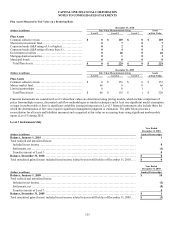

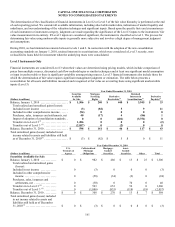

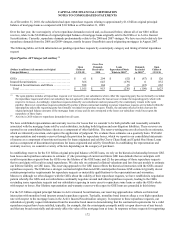

Year Ended December 31, 2009

(Dollars in millions)

U.S.

Treasury &

Agency

Collateralized

Mortgage

Obligations

Mortgage-

backed

Securities

Asset-

backed

Securities Other Total

Securities Available for Sale

Balance, January 1, 2009 ........

.

$ 0 $ 1,580 $ 773 $ 0 $ 27 $ 2,380

Total realized and unrealized

gains (losses):

Included in net income ........

.

0 0 0 0 0 0

Included in other comprehensive

income .....................

.

0 (175) 7 0 0 (168)

Purchases, sales, issuances and

settlements, net .............

.

0 (235) 48 74 (2) (115)

Transfers in/out of Level 3 (4) . ..

.

0 (188) (342) (61) 0 (591)

Balance, December 31, 2009 .....

.

$ 0 $ 982 $ 486 $ 13 $ 25 $ 1,506

Total unrealized gains (losses)

included in net income related to

assets and liabilities still held as

of December 31, 2009(5) .......

.

$ 0 $ 0 $ 0 $ 0 $ 0 $ 0

________________________

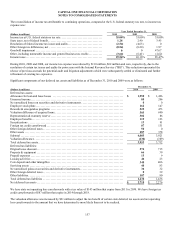

(1) Gains (losses) related to Level 3 mortgage servicing rights are reported in mortgage servicing and other income, which is a component of non-

interest income.

(2) An end of quarter convention is used to measure derivative activity, resulting in end of quarter values being reflected as purchases, issuances

and settlements for derivatives having a zero fair value at inception. Gains (losses) related to Level 3 derivative receivables and derivative

payables are reported in other non-interest income, which is a component of non-interest income.

(3) An end of quarter convention is used to reflect activity in retained interests in securitizations, resulting in all transactions and assumption

changes being reflected as if they occurred on the last day of the quarter. Gains (losses) related to Level 3 retained interests in securitizations are

reported in servicing and securitizations income, which is a component of non-interest income.

(4) The transfer out of Level 3 for the year ended December 31, 2010 was primarily driven by greater consistency amongst multiple pricing sources.

The transfer into Level 3 were primarily driven by less consistency amongst vendor pricing on individual securities for non-agency MBS.

(5) The amount presented for unrealized gains (loss) for assets still held as of the reporting date primarily represents impairments for available-for-

sale securities and accretion on certain fixed maturity securities, and are reported in total other-than-temporary losses as a component of non-

interest income.

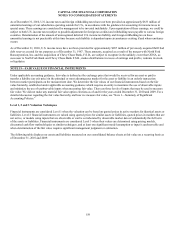

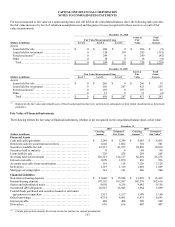

Assets and Liabilities Measured at Fair Value on a Nonrecurring Basis

We are required to measure and recognize certain other financial assets at fair value on a nonrecurring basis in the consolidated

balance sheet. These financial assets are not measured at fair value on an ongoing basis but are subject to fair value adjustments in

certain circumstances (for example, when we evaluate impairment). Fair value adjustments for loans held for sale, foreclosed assets,

and other assets are recorded in other non-interest expense, and fair value adjustments for loans held for investment are recorded in

provision for loan and lease losses in the consolidated statement of income.