Capital One 2010 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2010 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

59

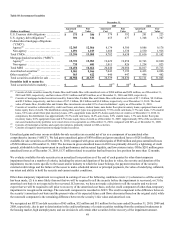

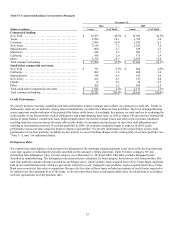

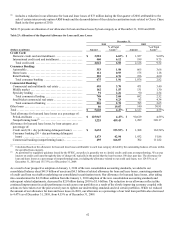

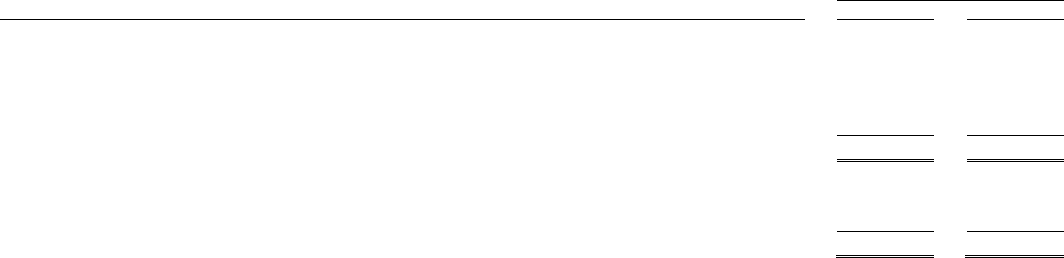

Table 21: Loan Modifications and Restructurings(1)

December 31,

(Dollars in millions) 2010 2009

Modified and restructured loans:

Credit card(2) .............................................................................

.

$ 912 $ 678

Home loans ..............................................................................

.

57 10

Commercial retail and multifamily real estate ...............................................

.

153 41

Other retail ...............................................................................

.

23 4

Total .....................................................................................

.

$ 1,145 $ 733

Status of modified and restructured loans:

Performing ...............................................................................

.

$ 1,049 $ 713

Nonperforming ...........................................................................

.

96 20

Total .....................................................................................

.

$ 1,145 $ 733

________________________

(1) Reflects modifications and restructuring of loans in our total loan portfolio, which we previously referred to as our “managed” loan portfolio.

The total loan portfolio includes loans recorded on our balance sheet and loans held in our securitization trusts. Certain prior period amounts

have been reclassified to conform to the current period presentation.

(2) Amount reported reflects the total outstanding customer balance.

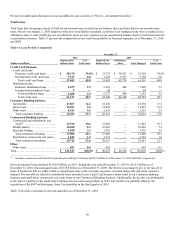

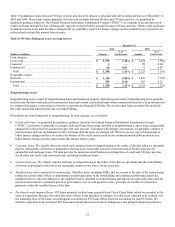

The outstanding balance of loan modifications made to assist borrowers experiencing financial difficulties increased to $1.1 billion as

of December 31, 2010, from $733 million as December 31, 2009. Of these modifications, approximately $96 million, or 8%, were

classified as nonperforming as of December 31, 2010, compared with $20 million, or 3%, as of December 31, 2009.

Credit card loan modifications have accounted for the substantial majority of our loan modifications, representing $912 million, or

80%, of the outstanding balance of total modified loans as of December 31, 2010, and $678 million, or 92%, of the outstanding

balance of total modified loans as of December 31, 2009. The vast majority of our credit card loan modifications involve a reduction

in the interest rate on the account and placing the customer on a fixed payment plan not exceeding 60 months. In all cases, we cancel

the customer’s available line of credit on the credit card. If the cardholder does not comply with the modified payment terms, then the

credit card loan agreement will revert back to its original payment terms, with the amount of any loan outstanding reflected in the

appropriate delinquency “bucket.” The loan amount may then be charged-off in accordance with our standard charge-off policy.

We typically measure the re-performance rate of modified credit card loans over a 5-year period. Five years after starting a credit card

modification, approximately 84% of the balances of modified loans are paid off in full and approximately 16% are charged-off. Based

on our experience to date, we believe that credit losses are lower for credit card loans that have been modified than those of similar

accounts that were not modified. We therefore plan to ramp up our short-term credit card loan modification programs and continue our

long-term programs.

Mortgage loan modifications represented $57 million, or 5%, of the outstanding balance of total modified loans as of December 31,

2010, compared with $10 million, or 1%, of the outstanding balance of total modified loans as of December 31, 2009. Approximately

76% of our modified mortgage loans include reduction in the contractual interest rate, approximately 17% include a term extension

and approximately 5% include a principal reduction. The majority of our modified mortgage loans involve a combination of an

interest rate reduction, term extension or principal reduction. Because many of the mortgage loan modification programs have been

recently launched and we have had a limited number of modifications under these programs, we do not have sufficient history to fully

assess the long-term performance of modified mortgage loans. Of the modified mortgage loans outstanding as of December 31, 2010,

approximately 27% were 90 days or more delinquent.

Commercial loan modifications represented $153 million, or 13%, of the outstanding balance of total modified loans as of December

31, 2010, compared with $41 million, or 6%, of the outstanding balance of total modified loans as of December 31, 2009. The vast

majority of modified commercial loans include a reduction in interest rate or a term extension. Because we have had only a limited

number of commercial loan modifications and the structure of each loan varies, the ultimate success of our commercial loan

modifications is uncertain. Of the modified commercial loans outstanding as of December 31, 2010, approximately 22% were 90 days

or more delinquent.

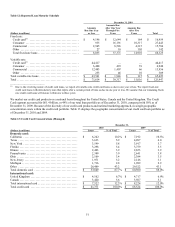

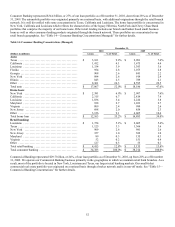

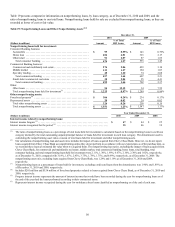

Impaired Loans

A loan is considered impaired when, based on current information and events, it is probable that we will be unable to collect all

amounts due from the borrower in accordance with the original contractual terms of the loan. Loans defined as individually impaired,

based on applicable accounting guidance, include larger balance commercial nonperforming loans and TDR loans. We do not report

nonperforming consumer loans that have not been modified in a TDR as individually impaired, as we collectively evaluate these